In the latest announcement, PYN Elite Fund from Finland reported completing the sale of 95,200 shares of SCS from Saigon Cargo Service on March 11th.

After the transaction, the foreign fund reduced its ownership in SCS from over 4.7 million shares (5.004% stake) to over 4.6 million shares (4.9% stake) and is no longer a major shareholder in Saigon Cargo Service.

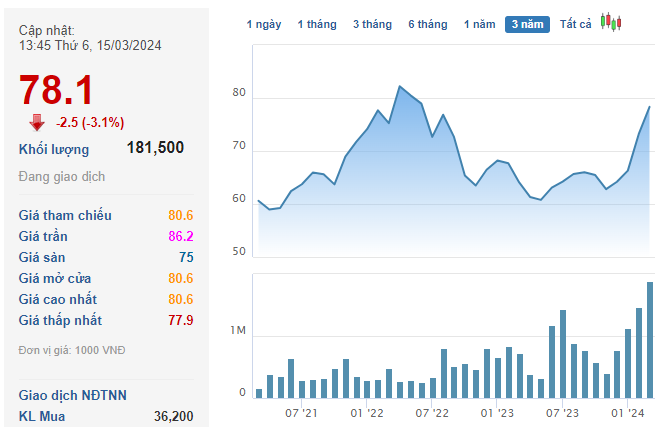

This selling action by the Finnish foreign fund is recorded in the context of SCS’s relatively strong performance in recent months. Since the beginning of 2024, the SCS stock price has increased nearly 14%, approaching the near 3-year peak (June 2021).

Based on the closing price of SCS shares on March 11th at 79,500 VND/share, PYN Elite Fund potentially earned about 8 billion VND after the transaction.

In terms of business performance, Saigon Cargo Service is known as the cargo terminal operator at Tan Son Nhat International Airport. The company operates in a monopolistic market with only one competitor, TCS – a subsidiary of Vietnam Airlines.

Currently, SCS holds a 15% market share nationwide and a 45% market share at Tan Son Nhat. Moreover, among all terminals at Tan Son Nhat, SCS is the only terminal with the capacity to expand (up to 75% of the current capacity).

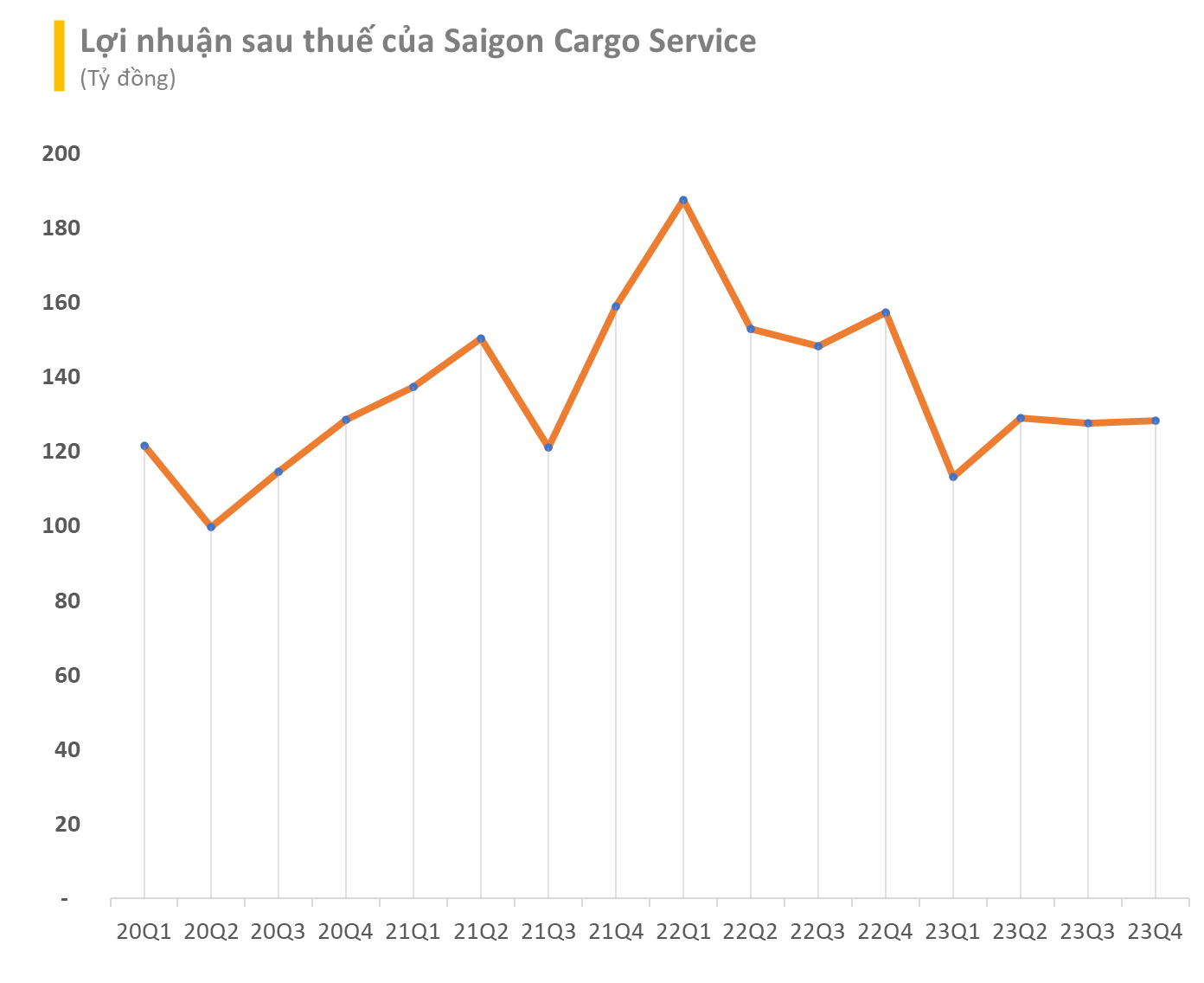

This airline enterprise is also notable for its impressive profit margin. In 2023 alone, its net revenue decreased by 17% to 705 billion VND, along with increased cost of goods sold causing a decrease in profit margin from 82% to 76%. However, this is still the highest profit margin ratio in the stock market, equivalent to earning 1 VND profit for every 8 VND of revenue. The net profit for the whole year 2023 decreased by 18% to 569 billion VND, achieving 92% of the annual profit target.