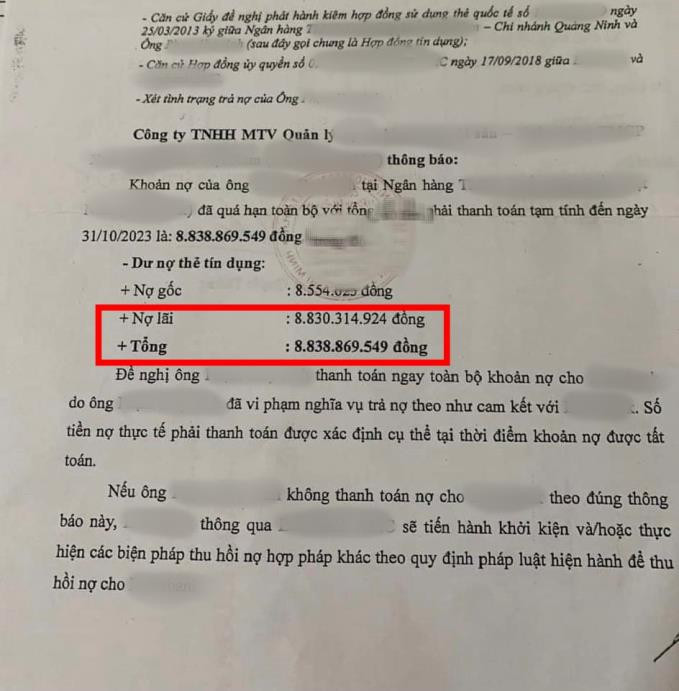

As per information shared on social media, a man named P.H.A. has been using a credit card from a commercial bank since 25/3/2018 and has accumulated a debt of 8,554,625 VND.

As of 30/10/2023, the bank has sent a notification of overdue payment for the entire loan amount of this individual, with a total amount to be paid of 8,838,869,549 VND, of which 8,830,314,924 VND is the interest.

Notification of “debt collection” from the bank to the customer has shocked many people due to the large amount of overdue interest payment.

Immediately after the information about the man’s story was shared on social media, many people were shocked by the amount of interest he had to pay.

Most of the opinions questioned how the interest amount that the man had to pay was calculated to reach such a large figure. In addition, many opinions also stated that as the man had agreed to sign the loan agreement, the bank must have regulations regarding loan interest calculation, so it would be difficult to have any mistakes in this case.

Although the accuracy of this debt collection notification is still unknown, this story has made many people “startled” about their current credit card spending habits.

However, you need to be careful in controlling your expenses and getting into debt when using a credit card.

The advantage of a credit card is that users can buy first and pay later, so owners can easily swipe their cards or make online purchases when they don’t have cash. However, there are many cases where users forget to pay off the credit card balance.

If you don’t pay off the amount borrowed within the specified time, you will be charged late payment interest on the total amount you spent during that period. Therefore, you need to balance your spending needs and your ability to repay to avoid being in a situation where you are unable to pay and have to bear high penalty interest.

Not to mention, currently, the use and payment of credit cards by customers have been collected and credit-rated at the National Credit Information Center of Vietnam. Accordingly, there are 5 types of credit debt as follows: Group 1: Standard debt; group 2: Debt requiring attention; group 3: Debt below standard; group 4: Doubtful debt; group 5: Potential capital loss debt (Bad debt).

This is an important criterion for evaluating the creditworthiness of customers who can borrow money from banks. Therefore, it is not good if you have a history of opening too many credit cards and regularly late payment for card expenses.