In the latest announcement, the Ho Chi Minh City Stock Exchange (HoSE) has announced the lifting of the trading suspension on the stock HPX of Hai Phat Investment Corporation.

HoSE stated that based on Hai Phat’s information disclosure situation, the company has not violated the information disclosure regulations for 6 consecutive months since HoSE’s decision to suspend trading. Along with that, on March 8, 2024, Hai Phat published the audited financial statements for 2023 (separate and consolidated) as required. Therefore, HoSE will proceed to remove HPX shares from the trading suspension and resume trading full-time according to regulations.

Prior to this, HoSE decided to put over 304 million HPX shares under trading suspension from September 18, 2023. The reason was due to Hai Phat continuing to violate the information disclosure regulations after being included in the restricted trading category, falling under the case of securities being suspended from trading.

In early March 2024, Hai Phat reported that it had resolved the situation of suspended trading in its securities and requested the resumption of HPX trading. Hai Phat stated that due to its business focus on real estate, it was heavily affected by the Covid-19 pandemic and the downturn of the real estate market.

The suspension of HPX shares has caused many difficulties in business operations, such as accessing capital from credit institutions, financial institutions for project implementation, facing significant pressure from shareholders, investors, difficulties in debt restructuring, valuation of secured assets for loans, bond issuances, etc.

The company reported that it has completed all obligations, ensuring conditions for the resumption of trading of its shares. The State Securities Commission, the Vietnam Stock Exchange, and HoSE have reviewed and approved the decision to resume trading of HPX shares.

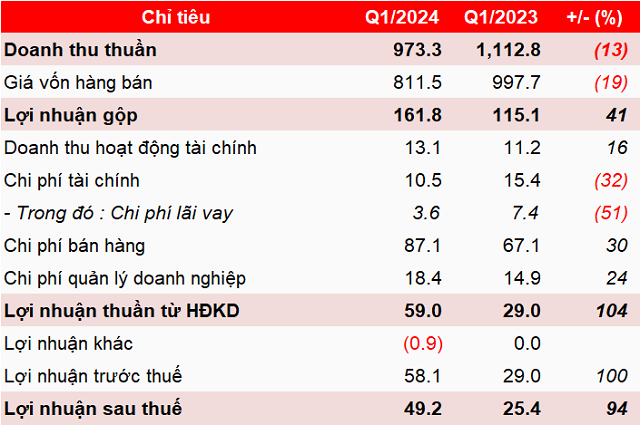

In terms of business performance, as of 2023, HPX’s net revenue reached VND 1,699.6 billion, an increase of 4% compared to the previous year, the highest in the past 4 years. Gross profit reached VND 288 billion, a decrease of 41%.

For the plan in 2024, Hai Phat has set a revenue target of VND 2,800 billion, a 65% increase, and a post-tax profit of VND 105 billion, a 22% decrease compared to the performance in 2023. The expected dividend payout ratio is 5%.

In terms of business orientation for investment, buying, and mergers and acquisitions (M&A) activities, Hai Phat will focus on completing the resolution of existing projects facing difficulties and legal issues for early implementation; continue seeking partners to transfer some projects that are not part of the company’s plans and objectives; research and seek investment opportunities in new projects with clean land funds, reasonable capital costs in provinces and cities for business operation by the end of 2024 and the following years.

In addition, the company will focus on balancing cash flow, arranging capital to implement projects in 2024; balance sources to pay taxes, repay principal and interest on bond packages, and credit facilities at maturity. This includes negotiating with bondholders to extend bond packages, credit facilities; restructuring ownership ratios in subsidiary companies, affiliate companies, and timely disclosure of financial reports as required.

HPX shares were suspended at VND 5,460 per share before the trading suspension.