Stock

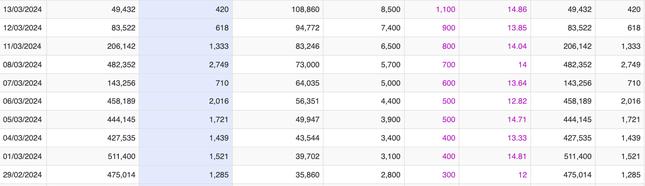

VRC of VRC Real Estate and Investment Joint Stock Company just had a series of limit-up sessions from March 6th to March 13th. As a result, the Ho Chi Minh City Stock Exchange (HoSE) has requested the company to explain this development.

In the explanation document, VRC stated that this is an objective development depending on the supply and demand of the stock market. The trading decisions of investors on VRC shares are beyond the company’s control. VRC’s business activities are still going on as usual, without any abnormal fluctuations, and the company does not have any impact on VRC’s stock trading prices.

Prior to the recent sharp rise in VRC’s stock, in January, Mr. Phan Van Tuong, a member of VRC’s Board of Directors, registered to sell 2.5 million shares. However, due to the market price being outside the expected trading range, Mr. Tuong was not able to sell any shares and still holds 9.32 million shares, equivalent to 18.65%.

VRC, formerly known as Vung Tau – Con Dao Special Zone Construction Enterprise, was established in August 1980. It is one of the earliest construction companies to be founded in Ba Ria – Vung Tau province. In June 2018, the company relocated its headquarters to Ho Chi Minh City.

In 2023, VRC achieved a revenue of VND 3.9 billion and a net profit of just over VND 197 million after tax, as it no longer recognized extraordinary financial revenue and other extraordinary income as in 2022.

ICF stock has had 10 consecutive limit-up sessions.

ICF shares of Incomfish Investment Corporation have also just had a series of 10 consecutive limit-up sessions, from VND 2,400 to VND 7,400 per share. In the explanation to the Hanoi Stock Exchange (HNX) about this development, ICF stated that the company is still operating normally without any changes. The company does not know the reason for the increase in stock price.

In 2006, IFC listed its stock on the HNX and then transferred to the HoSE with a reference price of VND 30,200 per share on December 18th, 2007. However, after 12 years of listing on the HoSE, in May 2019, IFC’s shares were delisted on the HoSE due to prolonged losses. Afterwards, this stock started trading on the UPCoM with a reference price of VND 900 per unit.

Incomfish returned to profitability in 2023 with a profit of VND 287 million after 7 consecutive years of losses (2016 – 2022). As of the end of 2023, the company accumulated losses of VND 88.7 billion.

Previously, a similar explanation was given by Truong Long Automotive and Technical Joint Stock Company (HTL) for the case of its stock price. HTL’s stock had 6 consecutive limit-up sessions from January 31st to February 7th, 2024, from VND 12,200 to VND 18,150 per share, equivalent to 49%.

HTL explained that the increase/decrease in stock price completely depends on the supply and demand of the stock market, as well as the taste and demand of investors. The trading decisions of investors on HTL shares are beyond the company’s control. Business activities are proceeding as usual without any abnormal fluctuations, and the company does not have any information or impact that is affecting the trading price on the market. In 2023, HTL achieved a net revenue of over VND 660 billion, with a net profit of about VND 10 billion after tax.

HTL, formerly known as Truong Long Trading and Services Limited Company, was established in 1998. In 2007, the company conducted equitization and switched to operate as a joint stock company, with its main activities in the business of trucks, repair, warranty, maintenance, supply of spare parts; vehicle inspection and commission for vehicle insurance.