According to a report from JPMorgan, Bitcoin has officially surpassed Gold in investor portfolio allocation. Analysts at the bank found that Bitcoin allocation is now more than 3.7 times that of Gold.

JPMorgan also shared how the approval and operation of the Bitcoin spot ETF has contributed to this increase in portfolio allocation.

Furthermore, according to analysts, the inflow of BTC funds from these funds indicates that the Bitcoin ETF market has the potential to reach a massive $62 billion compared to Gold. Bitcoin started its price surge in 2024, reaching an all-time high of $73,000. With the strong rise of BTC, the entire cryptocurrency market has also seen a surge in trading volume and value, indicating investors’ interest in the digital asset market.

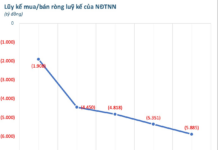

In February, the cryptocurrency market saw an overall market cap increase of over 40% compared to the previous month, reaching $2.2 trillion. Grayscale and BlackRock’s Bitcoin ETF funds led the BTC trading and yielded over $2 billion for multiple consecutive days.

Additionally, JPMorgan’s analysis revealed that both Bitcoin and Gold investments performed well in February 2024. Both individual and institutional investors have been buying both Gold and Bitcoin this year.

The analysis led by Nikolaos Panigirtzoglou stated, “Institutional and individual investors have been flipping from Gold back to Bitcoin since the start of the year.”

At the time of writing, Bitcoin has decreased by 3%, trading at $68,117. In the past week, its price trend has gradually returned to the ground. However, in the overall picture, BTC is still performing the best it has in years.