BOS Securities is a securities company under the “FLC” group, and it has been heavily influenced by the recent arrest of Trinh Van Quyet, former Chairman of the Board of Directors of FLC. On March 19, the company is expected to hold its second annual general meeting of shareholders in 2024, after the first one on February 27 could not be held due to a lack of shareholder attendance.

Expectations are high for the early resumption of stock trading activities.

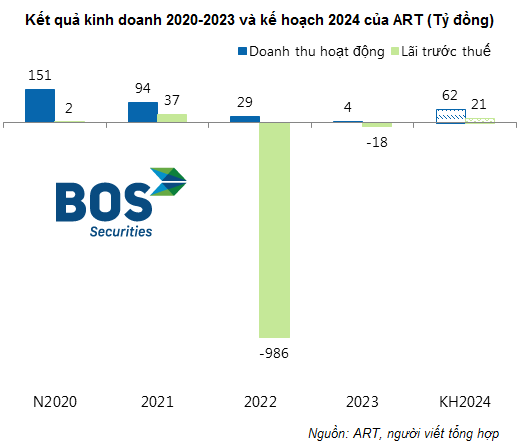

Looking back at 2023, the ART leadership evaluated the business environment to be unfavorable, along with fluctuations in the workforce, which continued to make the company’s operations difficult. Operating revenue reached only 3.5 billion dong and pre-tax loss was 18 billion dong – much lower than the loss of 986 billion dong in 2022.

In late August 2023, ART was suspended from buying stocks on the listed securities market, the registered trading market, and the derivatives securities market for violating reporting obligations, disclosure of information, and failing to address the violations.

In November, the company essentially resolved violations related to reporting and disclosing information in accordance with regulations. At the same time, ART also voluntarily ceased its operations of providing offsetting services, derivative securities trading settlement payments; reduced advisory services, underwriting, and issuing securities to ensure a safe ratio of available capital.

In 2024, it is expected to be the turning point for the company’s development in the following years after the restructuring phase. The ART leadership expects the relevant authorities to soon resume afternoon trading to help stabilize the company’s business operations, improve revenue, and profit in the coming years.

Based on that, the company plans to achieve revenues of nearly 62 billion dong and pre-tax profit of 21 billion dong in 2024. The business activities include securities brokerage, underlying securities, and margin lending.

Plan to privately issue 50 million shares at a price of not less than 10,000 dong/share

In order to implement the 2024 plan, ART has developed specific solutions. The most prominent one is the plan to increase charter capital by an additional 500 billion dong through the form of private placement of shares.

Specifically, the company will propose to shareholders a plan to issue 50 million shares privately to a maximum of 20 professional securities investors and/or strategic investors to increase charter capital. If the issuance is successful, the company’s charter capital will increase from over 969 billion dong to over 1,469 billion dong.

The privately issued shares will be restricted from transfer for 1 year for professional securities investors and 3 years for strategic investors from the date of completion of the capital raising round.

The offering price will be authorized by the Board of Directors but will not be lower than 10,000 dong/share. Before the trading suspension, ART was trading at 1,300 dong/share. Therefore, participating investors will buy at a price almost 8 times higher than the market price.

The expected implementation time is in the third and fourth quarters of 2024, after receiving approval from the State Securities Commission. The entire amount raised from the capital raising round will be used to enhance capital for margin lending activities.