Specifically, DNSE targets a total revenue of 1,390 billion VND for 2024 (including operating revenue, financial revenue, and other revenue) for the most optimistic scenario (scenario 3), representing an 88% increase compared to the previous year. In the other two scenarios, DNSE expects to bring in a total revenue of 1,119 billion VND (scenario 1), a 51% increase, and a less positive scenario of 868 billion VND (scenario 2), a corresponding increase of over 17%.

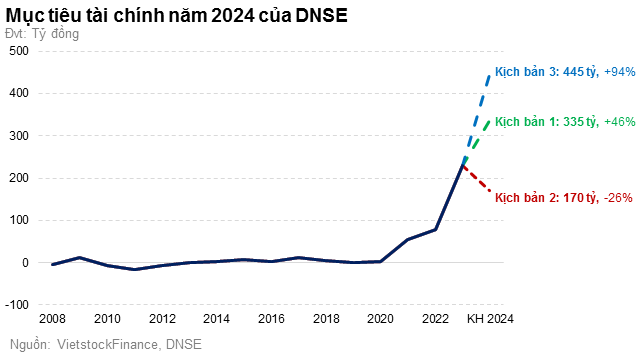

Regarding profit targets, DNSE plans to achieve a maximum after-tax profit of 445 billion VND (scenario 3), nearly double the previous year. The minimum after-tax profit target is 170 billion VND, a 26% decrease (scenario 2), and the remaining scenario (scenario 1) is 335 billion VND, a 46% increase.

In 2024, technology will continue to be the focus of DNSE’s development. In particular, the company places a major emphasis on derivative securities products. The company also aims to be one of the earliest securities companies to implement new products such as T+0 trading or apply low reserve ratios once the KRX system is implemented.

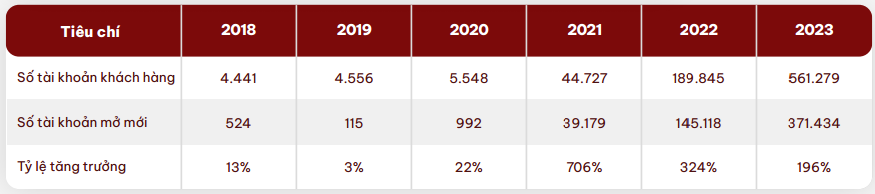

Additionally, DNSE aims to increase the total number of cumulative basic securities accounts to over 2 million accounts and aims to reach a top 10 market share in derivative securities in 2024.

As of the end of 2023, DNSE manages nearly 562,000 cumulative accounts. In 2023 alone, DNSE opened over 371,000 new accounts, equivalent to nearly 1,500 new accounts opened each day.

Source: DNSE’s 2023 financial statements

|

DNSE also recognizes that market competition will become increasingly fierce, given that securities companies are trending toward commission-free trading models.

Looking back at the 2023 business results, DNSE achieved operating revenue of 714.5 billion VND, a 58% increase compared to the previous year. Operating revenue increased primarily from gains on financial assets recognized through profit or loss (FVTPL), which increased by 743% compared to the previous year, and gains from held-to-maturity investments increased by 83 billion VND, a corresponding increase of nearly 74%.

After deducting expenses, DNSE had a after-tax profit nearly triple that of the previous year, reaching 229 billion VND.

In 2023, DNSE had total assets of 7,447 billion VND, a 16% increase compared to the previous year. Of these, current assets accounted for 6,598 billion VND, a 22% increase. In terms of capital sources, the company’s total liabilities were 4,141 billion VND, a 27% increase.