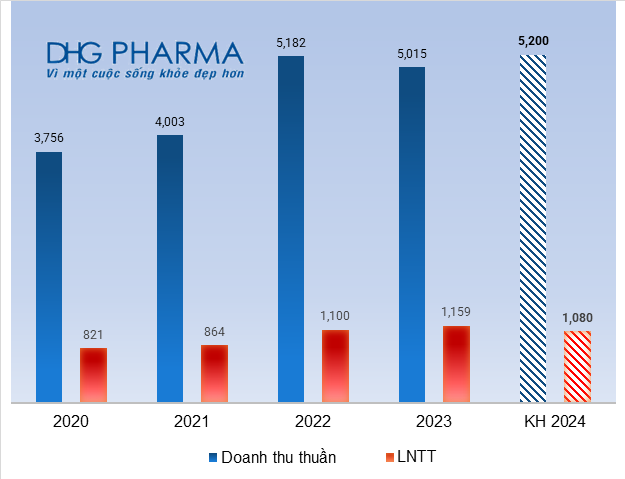

In particular, DHG aims for a revenue of VND 5.2 trillion, a slight increase of nearly 4% compared to the actual performance in 2023. However, the targeted pre-tax profit is VND 1.08 trillion, which is 7% lower than the same period.

Source: VietstockFinance

|

DHG’s cautious plan is set against the backdrop of the company having just broken its profit record with nearly VND 1.1 trillion in net profit in 2023 (the previous record was VND 988 billion in 2022).

With these results, the company is expected to propose a dividend payout ratio of 75% for 2023 (equivalent to VND 7,500 per share), which is also the highest level ever. At the 2023 annual general meeting of shareholders, the dividend payout ratio for 2023 is expected to be only 35%. In 2024, the company also plans to maintain a similar dividend payout ratio of 75%.

The positive results of the company have also driven DHG’s stock price higher. Since mid-January 2024, DHG’s stock price has increased by nearly 11%, with a market price of VND 115,100 per share as of the morning session on March 18th.

| Stock price performance of DHG since the beginning of 2024 |

This annual general meeting of shareholders will also elect members of the Board of Directors and Supervisory Board for the new term (2024-2028). In which, at least 1/3 of the members of the Board of Directors must be non-executive members. However, the number and list of members have not been announced.

The 2024 annual general meeting of shareholders of DHG is scheduled to take place at 8:00 am on April 23rd at Muong Thanh Can Tho Hotel, located in E1 Zone, Con Cai Khe Ward, Ninh Kieu District, Can Tho City.