Long-term solution: Dr. Can Van Luc and the team of authors from the BIDV Training and Research Institute have just published a report on a comprehensive solution to enhance the access and absorption capacity of businesses and individuals in the current context. We would like to present the full report for easier reference.

————

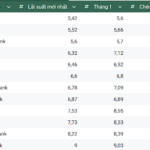

1. Credit growth in the banking sector in 2023 and the first two months of 2024: in 2023, according to the SBV, total credit in the banking system increased by 13.71% compared to the end of 2022, close to the SBV’s target of 14%. This is a reasonable level of credit growth that matches the economic growth and the absorption capacity of the economy. Similarly, mobilized capital increased by 14%, ensuring system liquidity and the ability to supply capital to the economy (Figure 1).

However, average monthly credit growth in 2023 was only 10.5%, the lowest since 2013 (meaning that credit growth was concentrated at the end of the year, rather than evenly distributed throughout the months).

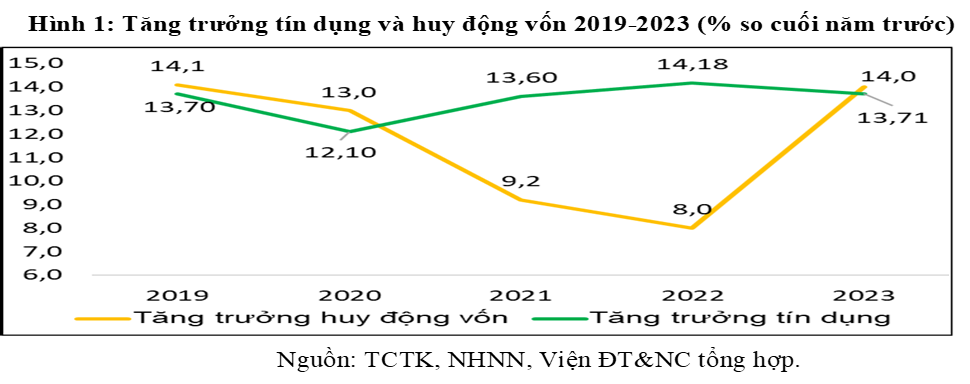

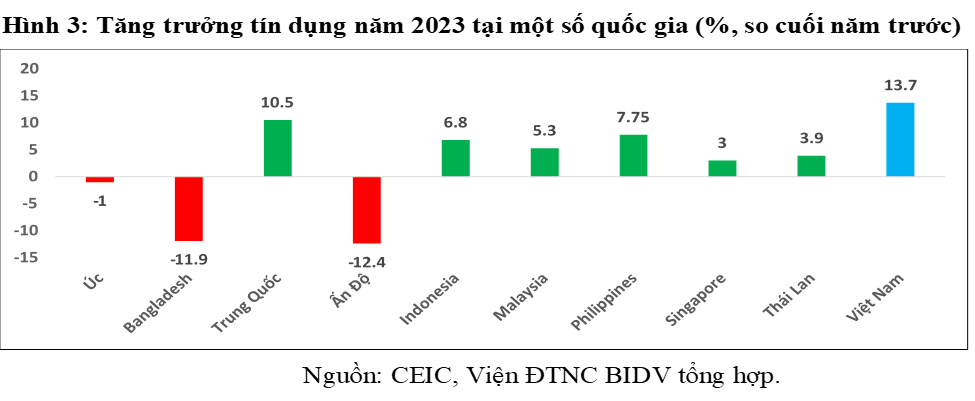

At the beginning of 2024, despite favorable factors such as lower interest rates (decreased by around 3% compared to the beginning of 2023), several preferential credit packages (such as a 30 trillion VND credit package with a 2% preferential interest rate for export of agricultural and aquatic products, a 20 trillion VND consumer credit package for workers, etc.), credit still declined (as of the end of February 2024, bank credit decreased by 0.72% compared to the end of 2023, lower than the same period in previous years – Figure 2, but increased 12% compared to the same period last year). This indicates the need for comprehensive, scientific analysis and evaluation to find more accurate and effective solutions.

However, there is no need to worry excessively due to the following reasons.

According to the forecast of the BIDV Training and Research Institute, credit growth in 2024 can still be higher than in 2023, reaching around 14-15% with four main reasons: (i) The SBV has set a credit growth target of 15% right from the beginning of the year and can adjust it appropriately based on the actual situation, helping credit institutions proactively increase credit evenly throughout the months, resulting in higher average credit growth; (ii) The macroeconomic situation is forecasted to be more favorable (with a projected GDP growth rate of 6-6.5%, higher than the 5.05% in 2023), inflation is expected to be controlled (around 3.5-4%)…; in which the growth drivers (such as exports, investment, consumption along with business operations) continue to recover, credit demand will also increase (in fact, credit is recovering with a smaller decrease); (iii) Interest rates have continuously decreased in the second half of 2023 and are expected to remain low in 2024 (with slight decreases at certain times and with certain preferential credit packages). Low interest rates not only help stimulate credit demand but also reduce interest expenses, capital costs from issuing corporate bonds (CBs), thereby, the CB market will also recover better in 2024, contributing to increasing medium- and long-term capital for the economy; and (iv) The real estate market is gradually recovering, with clearer forecasts from the end of the second quarter of 2024, thereby increasing credit demand, especially for housing loans (which had very low growth in 2023 as mentioned below).

2. Reasons for the slow credit growth in the first two months of 2024

– Supply-side factors (not the main reasons):

Non-performing loans tend to increase rapidly. According to the SBV, as of the end of 2023, the non-performing loan ratio in the entire banking system was about 4.55%, higher than the Government’s target (3%), a significant increase compared to the end of 2022 (1.92%), even though it did not include restructured loans according to Circular 02/2023/TT-NHNN (estimated at around 183.5 trillion VND until the end of 2023, accounting for 1.35% of total outstanding loans). However, if excluding the non-performing loans of the three mandatory-purchase credit institutions and the two special control credit institutions (Dong A Bank and SCB), the non-performing loan ratio of the system of credit institutions is estimated to be below 3%. Along with the current much-improved financial capacity of credit institutions compared to ten years ago, it shows that non-performing loans are still under control. However, the increase in non-performing loans is one of the reasons that have made credit institutions more cautious in lending while the creditworthiness of some businesses (enterprises) has decreased (due to slow business recovery and reduced collateral value, especially real estate), but it is not the main reason for the low credit growth.

– Demand-side factors (the main reasons):

According to us, there are five main reasons why credit growth has been slow in the first two months of 2024.

– First, there are seasonal factors and the Tet holiday: loan demand typically increases in the fourth quarter of each year and slows down in January and February (the month of Tet). At the end of 2023, loan demand increased rapidly (especially in the last two months, which increased by an additional 6.3% compared to the end of October 2023), and many loans were disbursed at the end of the year, so there was no additional loan demand at the beginning of the year. In addition, the business culture factor (people and businesses tend to borrow less at the beginning of the new year after the Lunar New Year) also contributes to the low credit growth.

– Second, the global economy still faces many risks and challenges, including: (i) crises in the Red Sea, ongoing conflicts in Russia-Ukraine, Israel-Hamas, unpredictable strategic competition among major countries, increasing protectionism; (ii) inflation, global interest rates, despite signs of decline, remain high; (iii) high risk of public debt and private debt (government debt, corporate debt); (iv) the global economy is recovering slowly (especially leading economies in the Eurozone, UK, US, China, Japan…) with slower growth; (v) energy security, food and natural disasters, extreme weather events are still constant concerns. These risks and challenges have negative impacts on the global economic recovery and the demand for Vietnam’s exports and investment.

– Third, both external difficulties along with the Tet holiday and internal difficulties have led to a decrease in exports, investment, and consumption in February compared to January, resulting in a reduction in the ability of businesses and individuals to access and absorb capital, specifically:

+ The Industrial Production Index (IIP) in February 2024 decreased by 18% compared to the previous month and decreased by 6.81% compared to the same period last year (mainly due to the fact that the Lunar New Year fell in February 2024). However, in the first two months of this year, the IIP index is estimated to increase by 5.74% (compared to a decrease of 6.32% in the same period of 2023), indicating a recovery trend as the main trend.

+ Consumer demand is still weak: the total volume of retail goods and services in February 2024 decreased by 2.3% compared to the previous month and increased by 8.5% compared to the same period last year (partly due to the low base of last year). In the first two months of this year, the total retail volume is estimated to increase by 8.1% compared to the same period last year, which is still lower than the growth rate of 14.7% in the same period of 2023 and lower than the growth rate of 12.2% in the same period of 2019 (the year before the pandemic), although it is higher than the growth rate in the same period of 2020 and 2022 (the years of the pandemic and the outbreak of the war). Excluding the price factor, the total retail volume increased by 5% compared to the same period last year, equivalent to about 50% of the growth rate of 10.9% in the same period of 2023 and the pre-pandemic period of 2018-2019 (9.3%). In particular, the retail volume of goods — the highest proportion (nearly 80% of retail revenue) — increased by 6.8%, the lowest among the four components and lower than the same period in 2019 — before the pandemic (14.4%) and the years 2020-2022 (8.3%, 7.8%, and 10.1% respectively) due to the fact that people’s incomes have not increased along with defensive psychology, cautious consumption due to concerns about the uncertain global situation, difficult economy, and changing consumer behavior prioritizing essential needs rather than luxury goods, etc. Accordingly, consumer credit (including credit cards) accounts for 21.2% of the total economy’s credit, increasing by 7.83% in 2023 (much lower than the growth rate of 28% in 2022 and over 20% in the 2018-2019 period).

– Fourth, the real estate market has many difficulties, and the recovery is still slow. According to the SBV, real estate credit in 2023 only increased by 11.81% (lower than the overall credit growth rate of 13.7%), in which investment and business financing credit for real estate (accounting for 37.8% of the total real estate credit), increased by 35.4%(much higher than the growth rate of 10.73% in 2022); whereas housing loans (accounting for 62.2% of the total real estate debt) increased by only 1.08% (much lower than the growth rate of 31% in 2022), reflecting a very low demand for home loans and home improvement loans from individuals and the expectation of price reductions, at least until the end of the first quarter of 2024. In addition, the difficulties in the real estate market have reduced collateral value, resulting in a slowdown in the liquidation of bad debts secured by real estate, making it more difficult to access capital and handle bad debts.

– Fifth, business operations continue to face difficulties, as shown by the decrease in the number of newly established enterprises in February by 36.5% compared to the previous month (however, the accumulated total in the first two months still increased by 12.4% compared to the same period last year). The number of businesses returning to operation in February decreased by 61.3% compared to the previous month (the accumulated total in the first two months increased by 4.4% compared to the same period last year). In addition, the number of businesses temporarily ceasing operations for a limited period in February decreased by 88.3% compared to the previous month, but the accumulated total in the first two months still increased by 27.1%….and so on. This is a high growth rate compared to the same period in previous years.

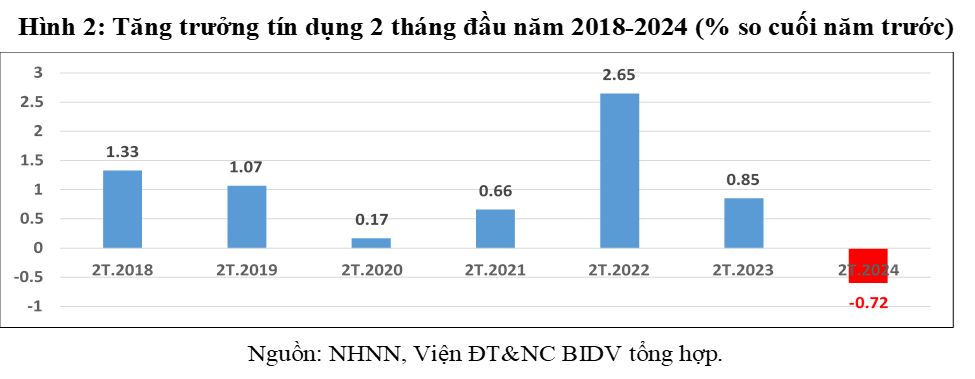

In light of the difficulties mentioned above, along with the reduced creditworthiness and capital demand, lower absorption capacity mentioned above, the credit growth in 2023 and the first two months of 2024 remains consistent with the market situation. As shown in Figure 1, credit growth in 2023 (13.7%) was close to the growth rate in 2019 (before the Covid-19 pandemic), higher than the growth rate in the 2020-2022 period, and also the highest growth rate compared to other countries in the region (Figure 3).

3. Solutions to enhance the access and absorption capacity of businesses and individuals:

To increase the access and absorption capacity of the economy, we propose that the Government, the Ministry, local authorities, the SBV, businesses, and credit institutions prioritize the implementation of 8 groups of solutions that impact both supply and demand in 2024 as follows:

First, the Government should strictly implement recent resolutions, directives, decrees, and official dispatches (especially Resolutions 01, 02; Directives 06, 07, and most recently Official Dispatch No. 18/CD-TTg dated March 5, 2024 on managing credit growth in 2024); continue to closely monitor the global economic situation, proactively analyze, and forecast to have appropriate response scenarios; continue to stabilize and strengthen markets (stock market, corporate bond market, real estate market, gold market, etc.) to consolidate the trust of investors, businesses, and the public.

Second, enhance the effectiveness of policy coordination (especially between monetary policy, fiscal policy, and other macro policies), strive to further reduce interest rates, stabilize exchange rates, stabilize prices of essential goods and financial markets, land, and real estate markets…; contribute to promoting growth, controlling inflation, and ensuring macroeconomic stability. In this regard, we recommend the National Assembly and the Government to allow the continued implementation of policies that support individuals and businesses as in 2023 (such as tax and fee deferral, debt restructuring, amendments to Circular 02/NHNN, amendments to Circular 06/NHNN, etc.).

Third, promote economic growth, with a focus on growth drivers. Accordingly, there is a need to boost exports, encourage private investment by resolutely improving the investment-business environment, boost consumer demand (currently growing at a low rate as mentioned above), in addition to strong solutions set out by the Prime Minister and the Government on disbursing public investment, attracting high-quality FDI…etc. At the same time, pay attention to promoting new growth drivers such as regional linkages by promoting the growth of leading economic centers and improving the spillover effect, especially Hanoi, Ho Chi Minh City, and Da Nang (these three localities contributed about 32% of the country’s GDP in 2023), and the digital economy, green economy, circular economy, and increasing labor productivity…etc.

Fourth, there needs to be a correct assessment of the current business situation, and timely and accurate resolution of identified issues and obstacles; provide support to businesses negatively affected by the business environment, including: (i) better exploitation of signed FTAs, more effective trade promotion, diversification of goods and export markets, investment; (ii) continued efforts to improve the investment-business environment, administrative procedures, especially the executive apparatus (including procedures for tax refund, fire prevention and fighting, land valuation, land clearance, supply of raw materials…); (iii) early issuance of mechanisms and policies to support businesses affected by the implementation of the global minimum tax policy; (iv) settlement of violations in the securities, real estate markets to consolidate trust among the public and businesses; (v) more resolute efforts in resolving difficulties and challenges in the public debt market, the real estate market (especially legal issues) as prescribed in the recent resolutions, decrees, and directives of the government, early consideration of establishing a social housing development fund (as a strong support program for the recovery of the real estate market)…etc.

Fifth, increase resources for credit institutions to support the economy. Accordingly, the National Assembly and the Government should continue to allow state-owned commercial banks to retain annual state profits to increase capital, create conditions for credit institutions to lead, participate in the restructuring of weak credit institutions, meet credit expansion requirements, and implement support packages and interest rate reductions.

Sixth, develop a more balanced financial market, focusing on removing difficulties for the public debt market to reduce the burden on the credit channel (consider amending Decree 65 to replace Decree 08 (2023), which has expired); accelerate the implementation of solutions to upgrade the Vietnam stock market.

Seventh, accelerate the process of improving institutions (especially issuing guidelines for the implementation of the Housing Law, the Real Estate Business Law, the Land Law, amendments to laws on credit institutions, etc.); along with removing barriers, paying attention to building institutions and policies for digital economic development, green economy, circular economy…to both seize opportunities, overcome difficulties and challenges, and ensure sustainable development.

Finally, businesses and credit institutions also need to prioritize the implementation of the following groups of solutions:

– First, businesses need to be determined to restructure and reduce costs; improve the efficiency and responsibility of capital use, transparent information (according to commitments, issuance documents or loan borrowings); fulfill all debt repayment commitments(investors, real estate businesses should consider further reducing selling prices to a reasonable and suitable level for people’s incomes); build a listing plan; apply credit ratings appropriately…etc.

– Second, diversify capital sources (avoid relying only on one source of credit, pay more attention to financial leasing, supply chain financing…); strengthen risk management, especially financial risk, interest rates, exchange rates, fraud, cybersecurity (can collaborate with technology companies, credit institutions, trade associations)…etc.

– Fourth, for credit institutions, it is necessary to consistently and systematically reduce costs, balance mobilizing costs, strive to further reduce lending interest rates, proactively implement Circular 02/2023/TT-NHNN on debt restructuring, Circulars 06 and 10 on lending activities of credit institutions; effectively implement the committed credit programs; and promote the application of IT and digital transformation, non-cash payments (both cost reduction and paperwork reduction and in line with the trend)…etc.