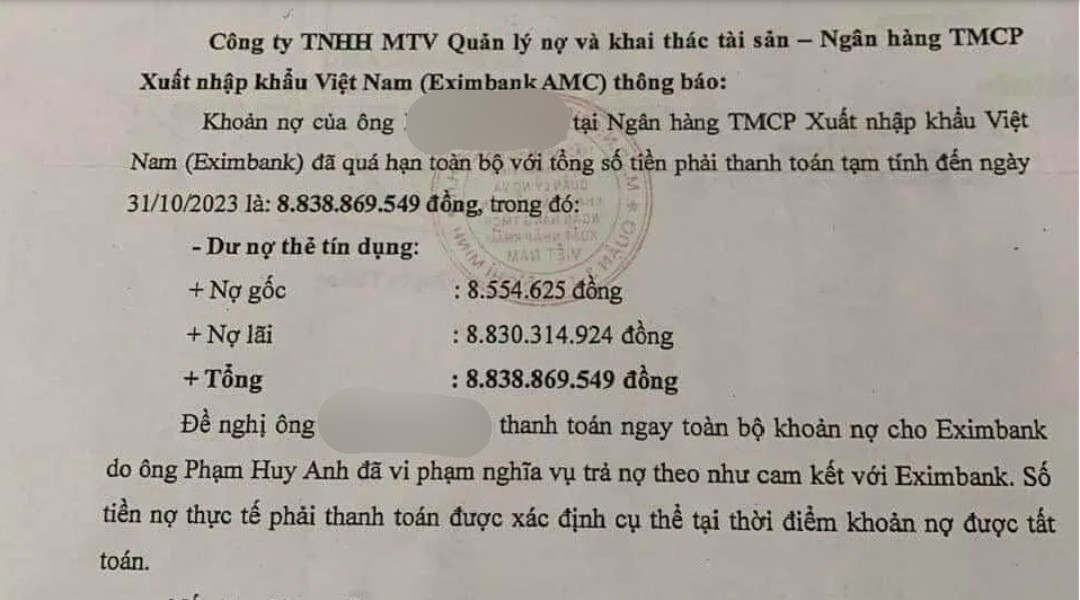

Eximbank has recently announced that Mr. P.H.A’s overdue debt at Eximbank has reached a total amount of over VND 8.8 billion, including principal and estimated interest as of October 31, 2023.

It is worth noting that the outstanding credit card debt is only over VND 8.5 million.

Eximbank requests the customer to immediately pay the full amount of credit card debt to the bank. The actual amount to be paid will be determined at the time of debt settlement.

“If Mr. P.H.A fails to repay the debt to Eximbank as stated, the bank, through Eximbank AMC, will proceed with legal proceedings and/or take other legally prescribed measures to recover the debt for the bank,” stated the Eximbank AMC announcement.

The announcement from Eximbank AMC has attracted attention from many people

The announcement from Eximbank AMC has caused a buzz on the internet and attracted attention from many people.

In a conversation with Bao Nguoi Lao Dong reporter regarding the incident, on the morning of March 14, Eximbank stated that the customer P.H.A opened a Master Card at Eximbank’s Quang Ninh Branch on March 23, 2013, with a credit limit of VND 10 million. Two payment transactions occurred on April 23, 2013, and July 26, 2013, at an accepting point of transaction. Since September 14, 2013, the aforementioned card debt has become bad debt, with an overdue period of nearly 11 years as of the notification date.

During this time, Eximbank has carried out many procedures to recover Mr. P.H.A’s debt, from sending written notices to customers regarding the violation of the debt repayment obligation.

However, on December 12, 2017, the customer lodged a complaint about not receiving a notice regarding the violation of the payment obligation.

Then, in December 2017, Eximbank’s Quang Ninh Branch replied in writing regarding the payment obligation and requested Mr. P.H.A to come up with a debt repayment plan.

Since then, Eximbank AMC, through delegation, has directly worked on resolving the debt for Mr. P.H.A, including a meeting with Mr. P.H.A to discuss and find solutions to support the customer in handling the debt.

On November 8, 2023, Eximbank AMC continues to send a letter to the customer to notify the obligation to pay and coordinate with the bank to handle the aforementioned debt.

“This is an overdue debt that has lasted nearly 11 years. Eximbank has notified and worked directly with the customer many times, but the customer still does not have a debt repayment plan. Sending a notice of debt obligation to customers is a regular business activity in the process of handling and recovering debts. As of now, Eximbank has not received any payment from the customer,” stressed the Eximbank representative.

According to the bank, the method of calculating interest and fees for credit cards is fully compliant with the agreement between Eximbank and the customer as stated in the card opening dossier with the customer’s complete signature (fee and interest regulations are clearly specified in the Issuance and Use Fee Schedule which has been published publicly on Eximbank’s website).

Currently, Eximbank is continuing to work and coordinate with the customer to find a solution to support the customer in handling the debt.