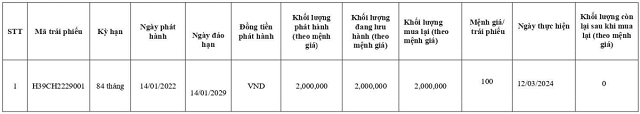

On March 12, 2024, Hung Thinh Investment bought back the entire H39CH2229001 bond prematurely for a value of 2,000 billion VND. According to data from HNX, the bond was issued on January 14, 2022 and will mature on January 14, 2029, corresponding to a 7-year term. Therefore, the company has bought back the bond prematurely by 5 years.

This is a non-convertible bond, without warrants, backed by assets, issued for individuals and professional organizations with an interest rate of 9% per year, interest payment every 12 months at the end of each period, and the depositary institution is Tien Phong Commercial Joint Stock Bank (TPBank, HOSE: TPB).

|

Result of Hung Thinh Investment’s premature bond repurchase

Unit: Million VND

Source: HNX

|

This premature repurchase has caused many surprises because Hung Thinh Investment was late in paying nearly 269.4 billion VND in interest at the 15/01/2024 period of this bond.

At that time, the company stated that due to unfavorable developments in the financial and real estate markets, which affected revenue, it was unable to arrange sufficient funds to pay the bondholders in full and on time according to the plan. At the same time, the company stated that it is planning to seek opinions from bondholders regarding the extension of the bond interest payment period.

Hung Thinh Investment is not an unfamiliar name when it comes to bond interest payment delays, with a total of 11 extraordinary disclosures about late payment of principal and bond interest on the HNX system since March 2023.

|

Instances of extraordinary disclosures about Hung Thinh Investment’s late payment of principal and bond interest

Source: HNX

|

After the repurchase, the company still has two outstanding bonds with a total value of nearly 904 billion VND, including the H39CH2225002 bond with a value of nearly 162 billion VND, issued on August 29, 2022, with a term from August 29, 2022 to August 29, 2024, and the H39CH2224003 bond with a value of over 742 billion VND, issued on August 10, 2022, with a term from August 10, 2022 to February 10, 2025.

Both bonds have an issuance interest rate of 10.5%, regular interest payment every 3 months at the end of each period, and have the same depository institution, Petroleum Securities Joint Stock Company (HNX: PSI).

Hung Thinh Investment Corporation was established on March 20, 2020, and its main activities are in the real estate sector, with its headquarters located in District 3, Ho Chi Minh City. Its charter capital is 2,779 billion VND, and the legal representative is Mr. Nguyen Van Cuong.

According to the introduction on the website of Hung Thinh Corporation, Hung Thinh Investment is the unit that determines and plans the financial resources and implements investment activities of the Corporation into companies/businesses in various industries, not only supporting the development of the real estate market, but also including banking, insurance, tourism, e-commerce platforms, education, health, sports…

|

Ecosystem of Hung Thinh Corporation

Source: Hung Thinh

|

Hung Thinh Investment is also a major shareholder of a member company within the Hung Thinh “ecosystem”, which is Hung Thinh Incons Joint Stock Company (HOSE: HTN). According to information from HTN’s 2023 management report, Hung Thinh Investment holds 12.5 million shares, equivalent to a 14.03% stake.

As of the end of June 2023, the company’s equity capital was 2,599 billion VND, and its debts payable amounted to 6,705 billion VND, 2.58 times the equity capital, including bond debts of 4,340 billion VND, 1.67 times the equity capital.

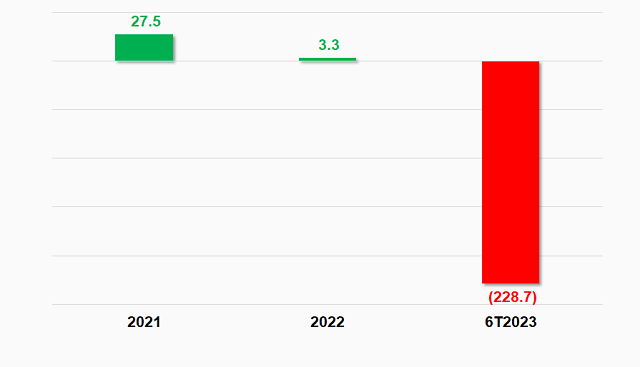

In the first half of 2023, Hung Thinh Investment incurred a loss of over 228.7 billion VND, while in the same period it made a profit of over 23 billion VND, resulting in a negative return on equity (ROE) of 8.8%, instead of a slight positive 0.8% like the previous year.

|

Hung Thinh Investment incurred heavy losses in the first half of 2023

Unit: Billion VND

Source: HNX

|

Huy Khai