Some declines occurred in the morning session, but ultimately the market maintained a positive balance. Trading volume on both exchanges reached the lowest level in 6 morning sessions, indicating a decrease in selling pressure.

The total value of matched orders on HOSE and HNX reached only VND 10.224 trillion, a 65% decrease compared to yesterday morning. HOSE also decreased by 65%, reaching VND 9.299 trillion. Looking at the massive selling session yesterday, this trading volume shows a decrease in selling pressure.

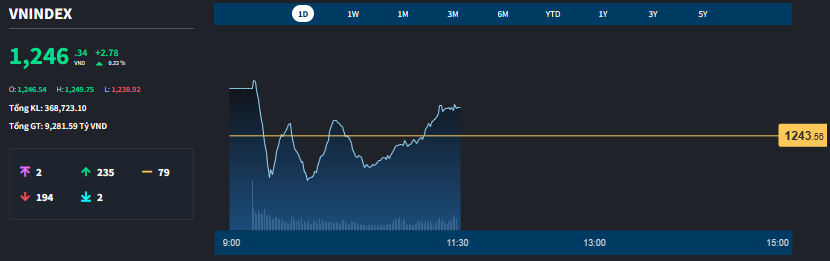

In addition, stock prices and overall indices showed narrow fluctuations. VN-Index experienced 3 red sessions in the morning with the deepest decline being less than 5 points. From around 10:30, the market rebounded, and the closing index increased by 2.78 points, equivalent to +0.22%.

The breadth of the market shows that this fluctuation is still dominated by sellers. In the red VN-Index sessions, the number of declining stocks still dominates. For example, at the lowest point at 9:50, VN-Index recorded 155 gaining stocks / 203 declining stocks. At the third bottom at 10:30, there were 156 gaining stocks / 250 declining stocks. However, at the end of the session, there were 235 gaining stocks / 194 declining stocks.

Blue-chip stocks increased slightly but still provided support to the market. The VN30-Index was mostly red and only increased by 0.07% with 13 gaining stocks / 13 declining stocks. Only HPG had significant growth with a rate of 3.04%. The top 10 market capitalization stocks on HOSE included 6 gaining stocks: GAS, VHM, CTG, VPB, and VNM, but all were weak. The VN30 basket added GVR with an increase of 2.92%, and PLX with a very good increase of 3.15%, but the capitalization was not much. Conversely, there were no significantly decreasing stocks, with the leading one being HDB with a decrease of 2.02%, but the capitalization was not in the top 20. BID decreased 1.15%, and FPT decreased 1.06%, affecting the top 10 market capitalization stocks.

Looking at the overall morning session, the market maintained a balanced state, which is the most positive signal. In the 194 declining stocks, only 52 decreased by more than 1%, and this trading volume accounted for only 7.6% of the total HOSE trading volume. In the gaining side, there were 235 stocks, of which 87 increased by more than 1%, and this trading volume accounted for 37.4% of the market. Thus, although the overall trading volume decreased significantly, the capital allocation structure still showed significant price-driven effectiveness.

On the other hand, in the context of the market being “chaotic” with unfavorable information and a record-breaking sell-off day, stability in psychology is the best initial signal. Only when investors remain calm can supply and demand be accurately evaluated.

Currently, money flows are still seen “evading” large-cap stocks. Out of 33 liquid stocks on HOSE with trading value of VND 100 billion or more, only 13 belong to the VN30 basket. Besides, apart from leading the market, the other highest trading stocks are EIB, CII, NKG, DIG, PDR… Quite a few stocks attract impressive capital flows in proportion to their capitalization and market impact. Small and medium-sized stocks have the best performance. Notable examples include NKG with ceiling price and trading value of VND 357.5 billion; TV2 increased 5.47% with trading value of VND 30.9 billion; HSG increased 5.31% with VND 214.2 billion; PHR increased 4.96% with VND 56.5 billion; CNG increased 4.84% with VND 21.2 billion; BCG increased 4.52% with VND 141.7 billion…

Thus, in the context of weakened money flows due to investors taking a break to observe, average to low liquidity stocks have more favorable conditions for price increase. If considering the recovery range yesterday, trading at the bottom in many stocks even achieved very good profits. This is a significant attraction for speculative funds.