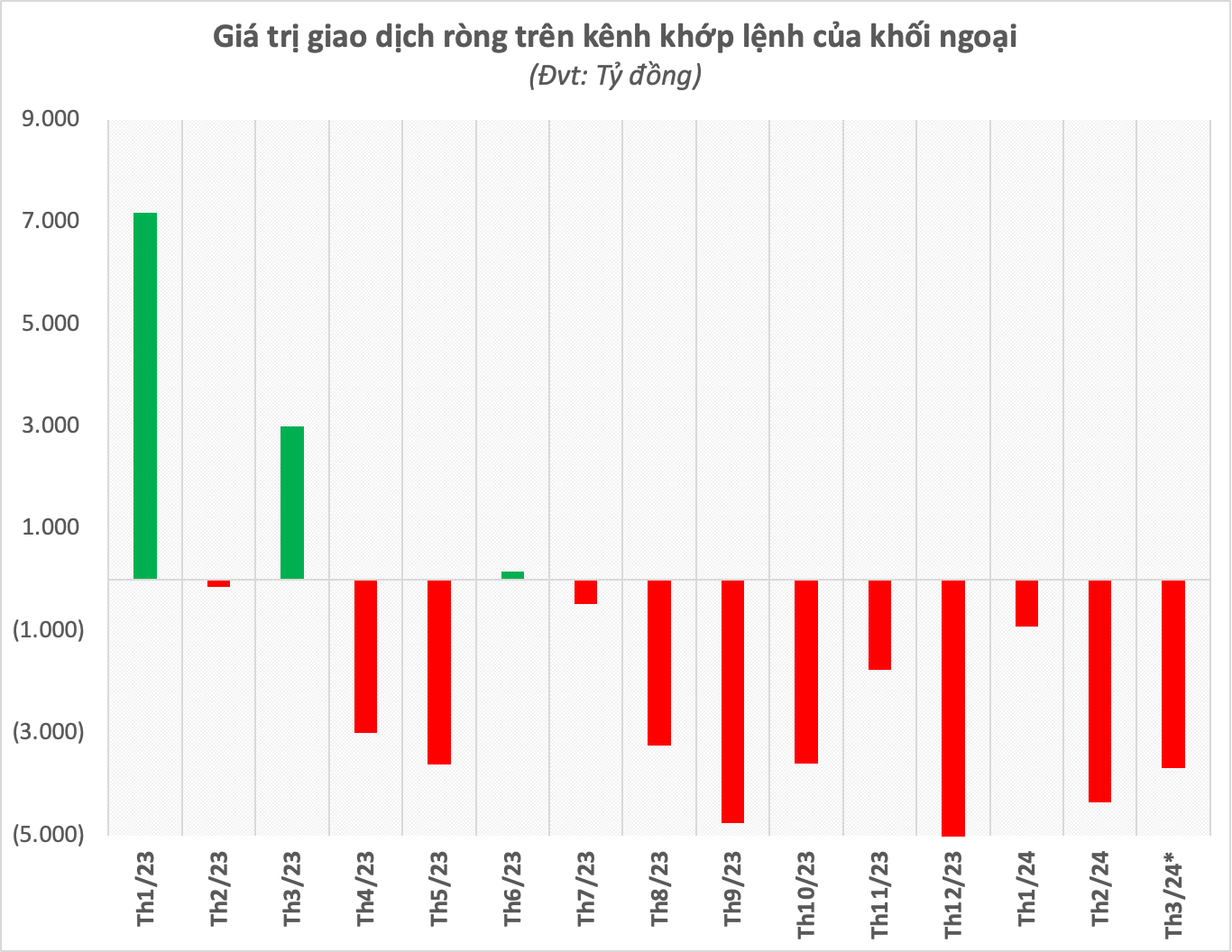

The selling pressure from foreign investors has not cooled down, in fact, it is getting stronger. Foreign investors have just recorded the largest weekly net selling in the past 3 months, bringing the total net selling since the beginning of 2024 on the order matching channel to approximately 9,000 billion dong.

March 2024 value updated to the end of March 15 session

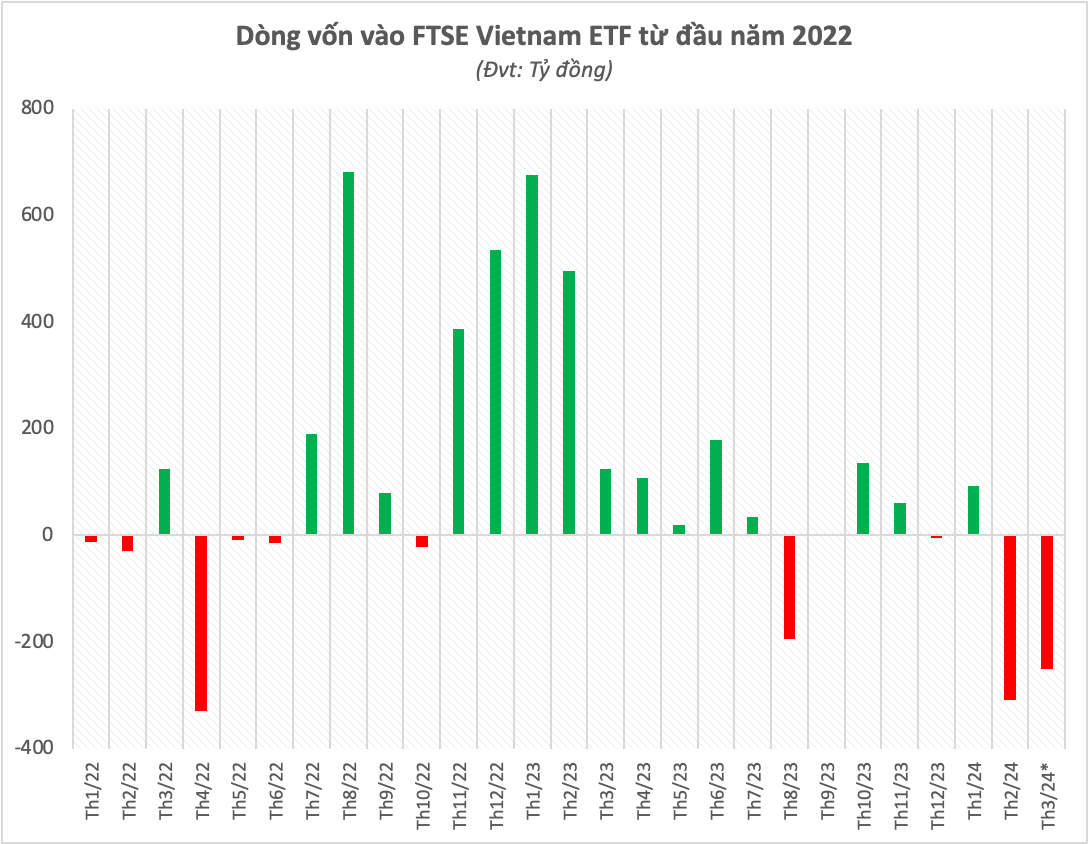

The withdrawal of foreign capital from the market has been significantly influenced by the strong withdrawal of ETF funds in recent times. Among them, it is worth noting that one of the well-known foreign ETF funds in the Vietnamese stock market, FTSE Vietnam ETF, has seen a strong withdrawal of funds, with a scale of hundreds of billion dong.

Data from FTSE Vietnam ETF shows that the withdrawal of funds from this ETF took place from the second half of February 2024 (session on February 19), until the end of the session on March 15, the fund has been withdrawn nearly 23 million USD (560 billion dong) in less than 1 month. If calculated from the beginning of 2024, thanks to a slight net withdrawal in January, the fund recorded a net withdrawal value of nearly 19 million USD (about 465 dong).

Furthermore, FTSE Vietnam ETF recorded a net withdrawal of over 1,600 billion in 2023, but in reality it mainly concentrated in the first half of the year. On the contrary, the capital inflow through the fund gradually decreased in value towards the end of the year, even reversing the net withdrawal in August and December of last year. The fund returned to a slight net inflow at the beginning of 2024 and then returned to a strong net withdrawal.

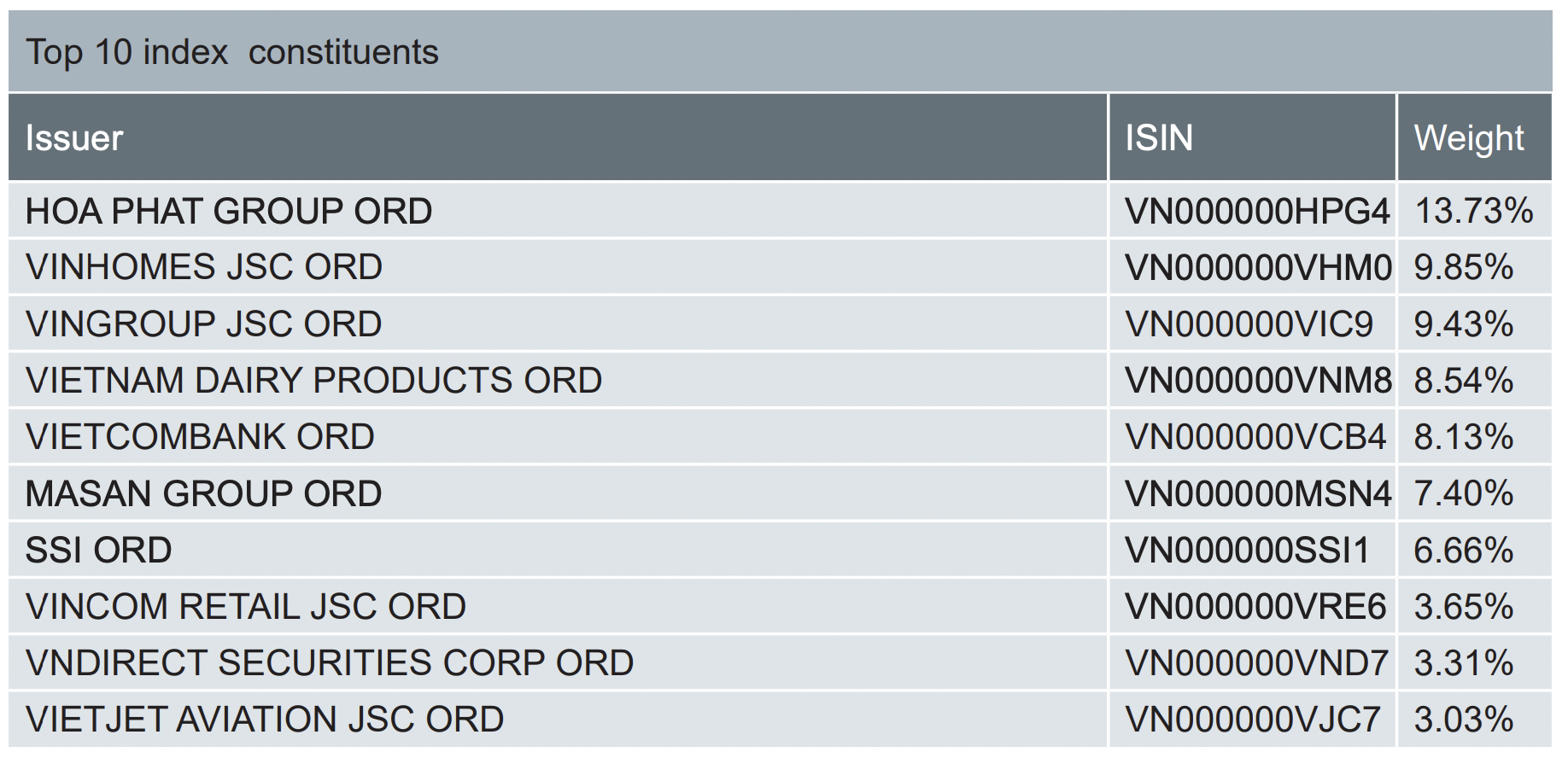

As of March 14, 2024, the scale of the FTSE Vietnam ETF portfolio reached about 355 million USD, in which the fund invests 100% in Vietnamese stocks. The FTSE Vietnam ETF portfolio mimics the FTSE Vietnam Index with 27 stocks. In this index structure, stocks such as HPG, VHM, VIC, VNM, VCB, MSN, SSI, VRE, VND,… are the leading names.

Most recently, in the first quarter 2024 review, FTSE Vietnam ETF added EVF to its portfolio. The new portfolio takes effect after the closing time of the trading session on Friday (March 15) and officially starts trading from the session on March 18.

FTSE Vietnam ETF portfolio as of February 29, 2024

FTSE Vietnam ETF is known as the oldest foreign ETF on the Vietnamese stock market. In the past, the portfolio restructuring activities of these two ETFs had a significant impact on the market. However, with the strong growth of the market scale and the wave of individual investors participating “en masse”, the level of impact from the portfolio restructuring of this ETF has been significantly reduced. Moreover, the increasing presence of ETFs with new appetites has also somewhat overshadowed this foreign ETF.

Along with FTSE Vietnam ETF, two domestic ETFs managed by Dragon Captial, DCVFM VNDiamond ETF and DCVFM VN30 ETF, are also experiencing a trend of capital withdrawal with a total net withdrawal value of over 2,000 billion dong from the beginning of the year until now. This means that billions of Vietnamese dong worth of stocks have been net sold by these funds in just the past 3 months.