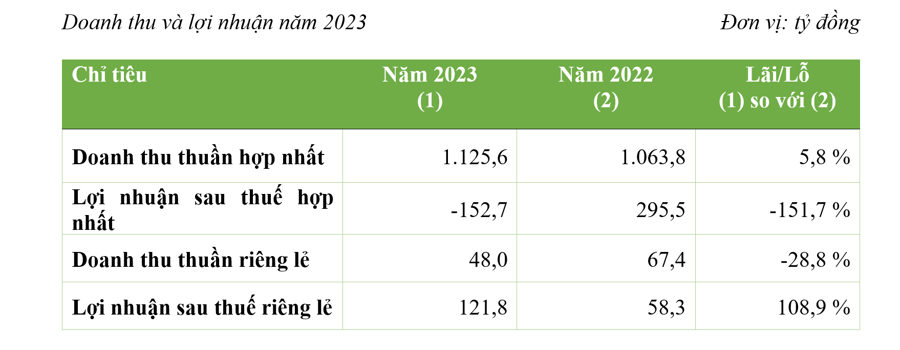

Net revenue reached VND 1,125.6 billion (a 5.8% increase compared to the same period in 2022), thanks to the solar power plants operating at over 100% efficiency compared to projections. The unallocated post-tax profit of the company as of December 31, 2023, was VND 186.6 billion.

The negative post-tax profit of VND 152.7 billion is primarily due to two reasons: the exchange rate difference for USD loans with a total outstanding debt of approximately USD 140 million, although this loss has not been realized; and one-time financial costs related to international financial support packages, such as advisory fees for capital arrangement and appraisal costs. However, the unallocated post-tax profit of BCG Energy as of December 31, 2023, was VND 186.6 billion.

The growth in revenue of the renewable energy segment in 2023 is mainly due to the high efficiency of solar power plants that have been put into operation and the limited reduction in power generation. Some plants even exceeded the projected capacity by more than 100% in the last few months of the year. In addition, the rooftop solar portfolio also expanded, contributing to the revenue in 2023.

In terms of the separate report, although BCG Energy recorded a net revenue of VND 48 billion in 2023, a decrease of 28.78% compared to the same period in 2022, the post-tax profit reached VND 121.8 billion, a growth of 108.9% compared to the previous year, as the Company recognized financial revenue during the period.

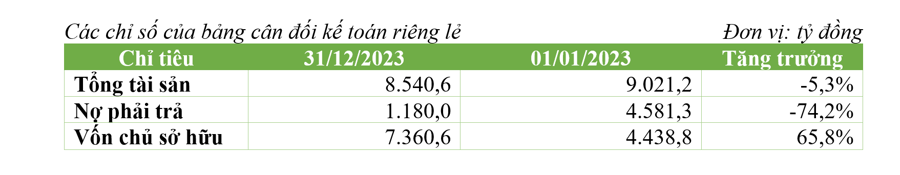

The total assets of the Company as of December 31, 2023, reached VND 8,540.6 billion, a slight decrease of 5.3% compared to the beginning of the year, but the payable debt decreased significantly by 74.2% to VND 1,180 billion.

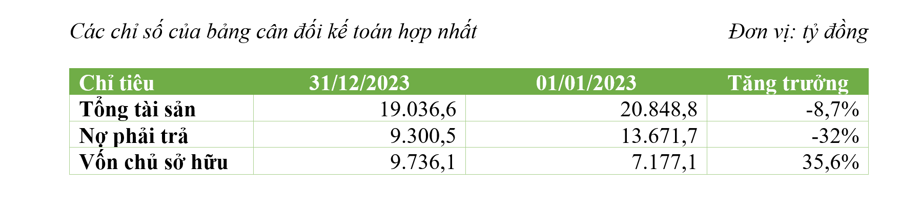

Similarly to the individual financial statements, the consolidated total assets of BCG Energy as of December 31, 2023, were VND 19,036.5 billion, a decrease of 8.7% compared to the beginning of the year due to the depreciation of fixed assets, liquidation and recovery of short-term and long-term investment cooperation, as well as a decrease in the accounts receivable balance due to the tax refund received for two solar power projects.

Notably, the total payable debt decreased to VND 9,300.5 billion, a decrease of 31.97% thanks to BCG Energy proactively repurchasing two bond lots worth VND 2,500 billion before maturity.

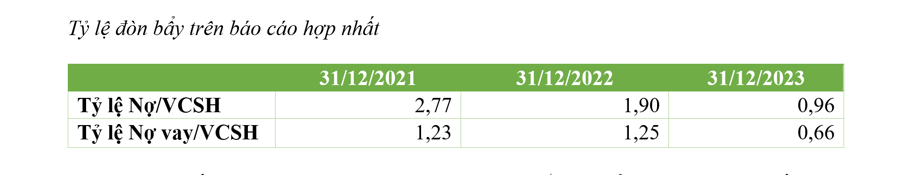

The debt-to-equity ratio of BCG Energy has significantly improved year by year: at the end of 2021, the debt-to-equity ratio was 2.77 times; at the end of 2022, this ratio decreased to 1.9 times; and at the end of 2023, it was only 0.96 times. In addition, the debt-to-equity ratio also decreased to 0.66 times.

BCG Energy also achieved positive cash flow changes in 2023. Specifically, net cash flow from operating activities changed from negative VND 130.9 billion in 2022 to negative VND 33.6 billion in 2023.

In general, during the difficult period of 2023 with many challenges and obstacles, and the delayed issuance of the 8th Power Development Plan, BCG Energy proactively reduced new investment activities and focused on internal restructuring, capital restructuring, and improving corporate health, ready to seize business opportunities in the future.

After overcoming the most difficult period, BCG Energy transitioned to a proactive defensive strategy, seizing potential opportunities in the renewable energy sector. At the beginning of 2024, BCG Energy expanded its operations into the waste-to-energy sector by acquiring a waste treatment company in Ho Chi Minh City, specifically the Tamsinhnghia Investment Development Joint Stock Company.

In the period of 2024-2025, BCG Energy aims to build a waste-to-energy power plant with a total investment of over VND 5,000 billion in the Northwest Solid Waste Treatment Complex in Cu Chi District, Ho Chi Minh City. The plant has a waste incineration capacity of 2,000 tons per day, equivalent to a power generation capacity of 40 MW. The entire plant will apply advanced waste treatment and incineration technologies, without causing environmental pollution. After completion, in the following stage, the waste-to-energy power plant can increase the processing capacity to 5,200 tons per day and the power generation capacity to 130 MW.

It can be seen that the development roadmap of BCG Energy closely follows the plan set by the Bamboo Capital Group. After a period of continuous capital mobilization for project development, BCG Energy now owns a portfolio of nearly 600 MW of installed power capacity. The company has carried out financial restructuring, bringing the debt ratio to a safe level, providing room for the next expansion phase when specific action programs of the 8th Power Development Plan are issued.