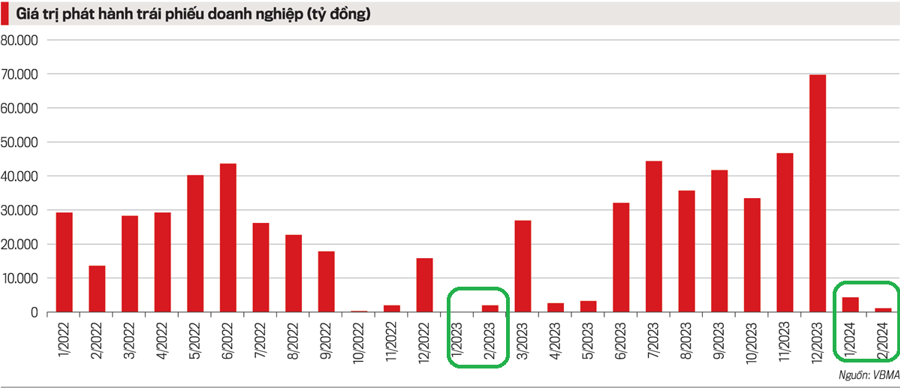

According to the Ministry of Finance, as of February 23, 2024, there were 11 companies issuing bonds with a volume of 7.25 trillion dong, 8 times higher than the same period in 2023; of which 52.4% of the issued bonds are secured. However, when comparing with the lively bond issuance volume in the second half of last year, it can be clearly seen the sluggishness of the corporate bond market in the first two months of 2024.

SLOW NEW ISSUANCE, BUY BEFORE MATURITY

According to experts, the market has been growing slowly since the beginning of the year in the context of tightening discipline requirements, higher requirements for market participants as many provisions in Decree No. 08/2023/ND-CP on amending, supplementing and suspending the effectiveness of implementing some provisions in the decrees regulating private placement, trading of bonds of enterprises in the domestic market and offering of corporate bonds to the international market (Decree 08), have expired and been re-enforced as Decree No. 65/2022/ND-CP on September 16, 2022, which is the criteria for determining professional individual investors and credit rating requirements.

In terms of issuance structure by industry, since the beginning of this year, real estate and construction have been the two industries with the highest issuance value.

Accordingly, the real estate group accounted for the dominant 52% (VND 3.75 trillion) and construction accounted for 24% (VND 1.7 trillion). Large-value issuing enterprises such as Ho Chi Minh City Infrastructure Investment Joint Stock Company (CII) successfully issued VND 2.8 trillion, Becamex Industrial Development and Investment Corporation (VND 1.3 trillion), BOT Ninh Thuan Company (VND 1.2 trillion), Vingroup Corporation (VND 2 trillion)…

Thus, the value of issued bonds is no longer focused in the banking sector as seen before. It seems that enterprises in various fields are entering a recovery phase.

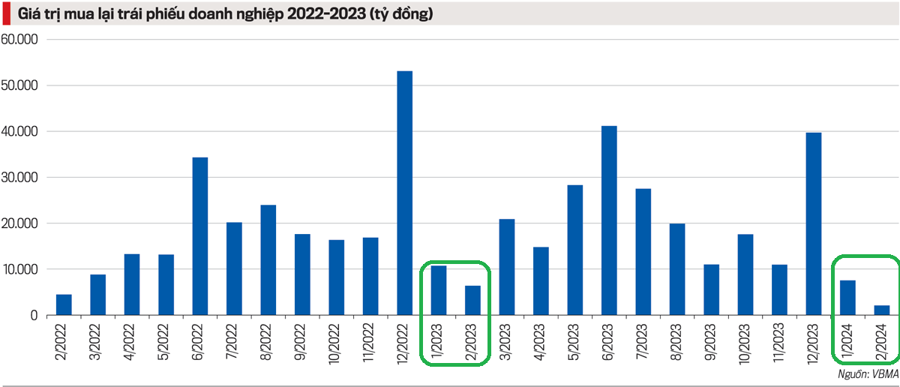

The average issuance interest rate is 10.26% per year and the average issuance term is 5.5 years. The structure of investors buying corporate bonds mainly consists of institutions, of which, domestic investors account for 80.6%; foreign investors account for 6.2%; individual investors hold 13%. After a long period of active bond repurchase in 2023, the volume of pre-mature repurchase in the first two months of 2024 reached VND 9.1 trillion, a sharp decrease of 41.2% compared to the same period in 2023.

Recently, Nguyen Hoang Duong, Deputy Head of the Banking and Financial Institutions Department (Ministry of Finance), said that based on the regulations of Decree 08, enterprises and bondholders are making great efforts to negotiate bond payments due.

Statistics from the Hanoi Stock Exchange (HNX) show that in 2023, 35 companies no longer have the burden of bond debts due to increased early repurchase activities, with a total amount of over 20,000 billion dong.

For example, Kinh Bac Urban Development Corporation completely wrote off VND 2.4 trillion of bond debts.

All bond lots of Phat Dat Real Estate Development Joint Stock Company, Ha Do Group listed on HNX are also in a “fully canceled” state, in order to reduce debts and improve financial indicators, reducing loan pressure.

In terms of abnormal information disclosure, the Vietnam Bond Market Association (VBMA) said that 7 companies have delayed principal and interest payment in February 2024, with a total value of about 6,213 billion dong (including interest and remaining debt of bonds) and 24 bond codes have their payment period, principal or bond repurchase time extended ahead of maturity.

The policy allows for bond rescheduling, debt rescheduling, and bond exchange for real estate or other products, which is extended until 2024, helping many enterprises to “soft landing” and reduce pressure on the maturity date. VBMA estimates that in the remaining 10 months of 2024, there will be about VND 255,732 billion of bonds due, of which, a large part comes from real estate bonds with VND 98,127 billion, equivalent to 38.4%.

According to the Ministry of Finance, the trading activities on the separate corporate bond trading market have become more active. Currently, the number of bond codes registered for trading on the system announced on the information page on corporate bond of the Hanoi Stock Exchange is 936 codes of 266 companies, with a registered trading value of 652.9 thousand billion dong.

Among them, 264 bond codes of 110 issuing organizations have generated transactions, with the total market trading value reaching 333.3 thousand billion dong, and the average trading value is 2.2 thousand billion dong/session. In addition, the secondary market gradually reflects the bond risk level in the bond interest rate pricing on the market.

NEED TO REINFORCE THE MARKET

Although the early issuance situation is sluggish, experts from Fiinratings expressed optimism about the prospect that the corporate bond mobilization channel in 2024 will be livelier than in 2023 thanks to the effort to improve the macro environment by the Government, better business conditions, and the market getting used to the new standards of Decree 65.

Investors will benefit from the transparency and quality of newly issued corporate bond lots is expected to improve, and the market enters a new development stage.

Sharing from a positive point of view, economic expert Can Van Luc believes that the market is gradually recovering and trust is gradually returning but there are still 5 barriers, main shortcomings that need to be removed for the market to develop better. First, the biggest barrier is the form of issuance. Preliminary statistics show that 90% of corporate bonds are privately placed and only 10% are made public, clearly this structure is very unbalanced.

Second, the structure of investors. In the primary market, retail individual investors only account for about 5% but through the secondary market, retail individual investors account for nearly 30%. This shows that many individual investors lack professionalism, lack knowledge and risk assessment abilities, but still actively participate in the market recently.

In addition, one of the solutions that needs to be focused on is diversifying the investor base, especially institutional investors, professional investors, especially investment funds, pension funds, … currently the mechanism for domestic investment funds to participate in the market is relatively limited.

Third, transparency is still limited, especially with private placement bonds.

Fourth, the public issuance process is still relatively complicated. Therefore, the procedures and approval process need to be further improved to stimulate companies to make more public issuances.

Fifth, compliance, respecting the law by businesses and even some investors have not been strict, causing unfortunate incidents recently.

Sharing the same viewpoint, Assoc. Prof. Dr. Nguyen Thi Phuong Hoa, Head of the Audit Department, National Economics University, said that implementation of regulations still encounters many difficulties, some corporate bond issuers have mobilized capital for wrong purposes and have indications of violating the law. Therefore, it is necessary to continue improving the legal framework and members in the market complying with regulations to develop a sustainable corporate bond market, creating motivation for the development of the economy in the future.

According to representatives from National Economic University, first of all, it is necessary to continue implementing a synchronized mechanism to stabilize the macro economy, flexibly manage the relationship between fiscal policy and monetary policy. Only when the production and business activities of issuing enterprises improve will difficulties be gradually removed…

The contents of the article are published in the Vietnam Economic Journal issue No. 12-2024 released on March 18, 2024. Dear readers, please find the publication here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam