A group of major shareholders has announced that it has completed the sale of a total of 3 million FPT Securities Joint Stock Company (FPTS) shares in the past 2 days, March 13 and 15, for portfolio restructuring purposes. At the closing price of FTS over the 2 trading sessions, the shareholders can earn about VND 190 billion.

The shareholder group consists of 4 individuals, including noteworthy Ms. Nguyen Thi Thai Anh, who was a member of FPTS board of directors from 2019 to 2022. Thai Anh is also known as one of the early members of FPTS, contributing to the company since its early days.

In the recent divestment, the majority of shares were sold by Ms. Nguyen Thi Minh, Thai Anh’s mother, with a volume of over 2.7 million shares. After the transactions, the shareholder group reduced its ownership to 14.2 million shares, equivalent to 6.62% of total capital in FPTS.

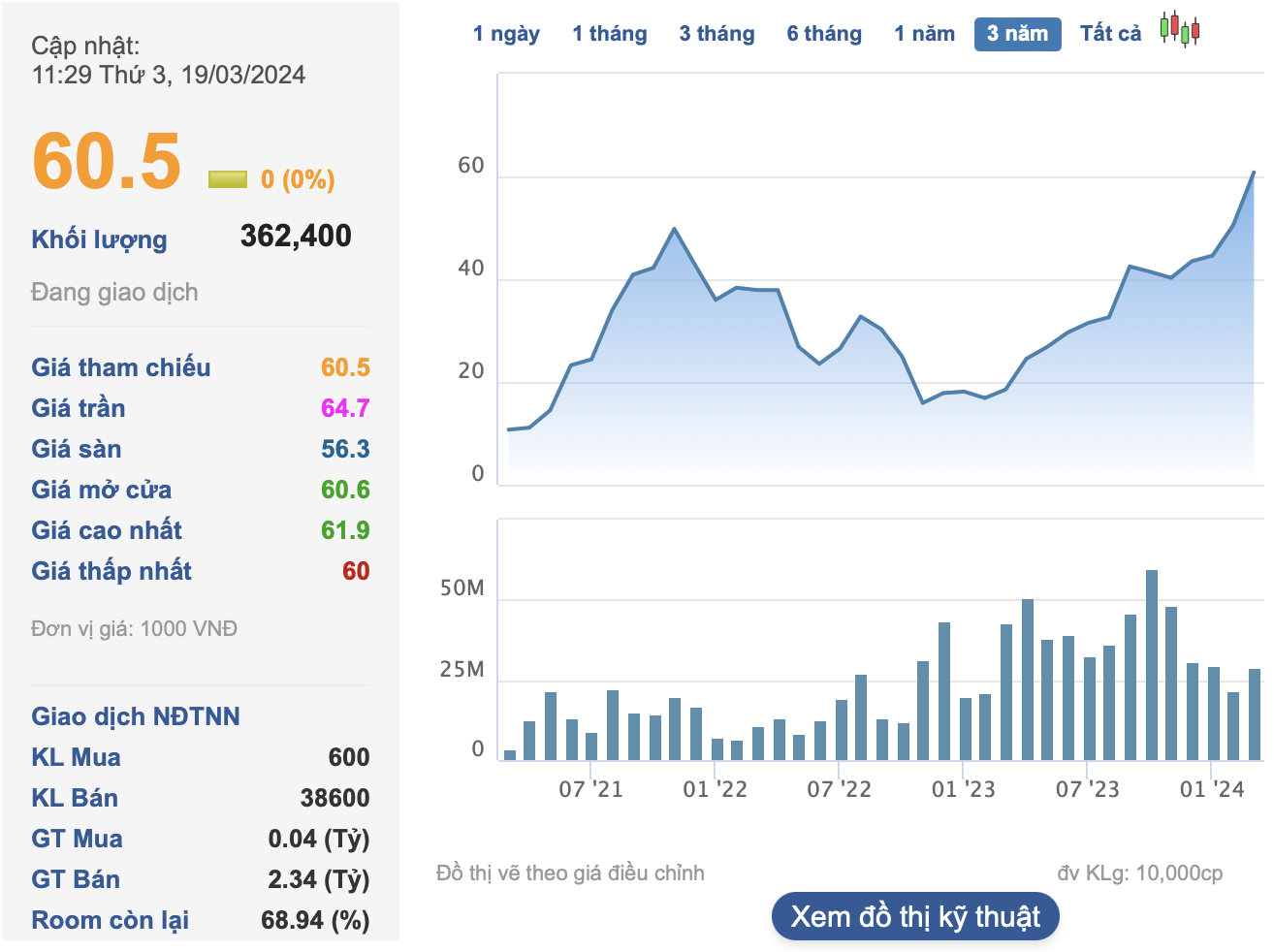

In the market, FTS shares, after reaching a new peak on March 15, have slightly corrected and are currently trading around VND 60,500 per share. Compared to the beginning of the year, FTS’s stock price has increased by more than 35%. The corresponding market capitalization is about VND 13 trillion.

On March 28, FPTS is expected to hold its annual general shareholders’ meeting 2024 in Hanoi. According to the meeting agenda, the company will present its business plan for 2024 to shareholders, targeting revenue and pre-tax profit of VND 845 billion and VND 420 billion respectively, down around 8% and 18% compared to the previous year.

Prior to that, in the whole year of 2023, FPTS achieved pre-tax profit of nearly VND 542 billion, an increase of 23% and exceeded the target profit for the whole year of 2023 (VND 420 billion). With the above results, FPTS plans to propose to shareholders the distribution of the 2023 profit with a cash dividend rate of 5%, equivalent to over VND 107 billion. The implementation is expected to be in the second quarter of 2024.

In addition, FPTS will also propose to shareholders a capital increase plan with a total of over 91 million new shares to be issued. This includes 86 million bonus shares to increase registered capital from equity capital for existing shareholders at a ratio of 10:4 and 5.5 million ESOP shares at a price of VND 10,000 per share.

The implementation of both plans is expected to be in the second and third quarters of 2024 after approval by the State Securities Commission. If completed, FPTS’s registered capital is expected to increase from over VND 2.145 trillion to VND 3.059 trillion.

Also in the program at the General Meeting, FPTS will propose to shareholders the removal of Board Members for the term 2023-2028 for Mr. Taro Ueno and the election of Mr. Kenji Nakanishi as a new member.