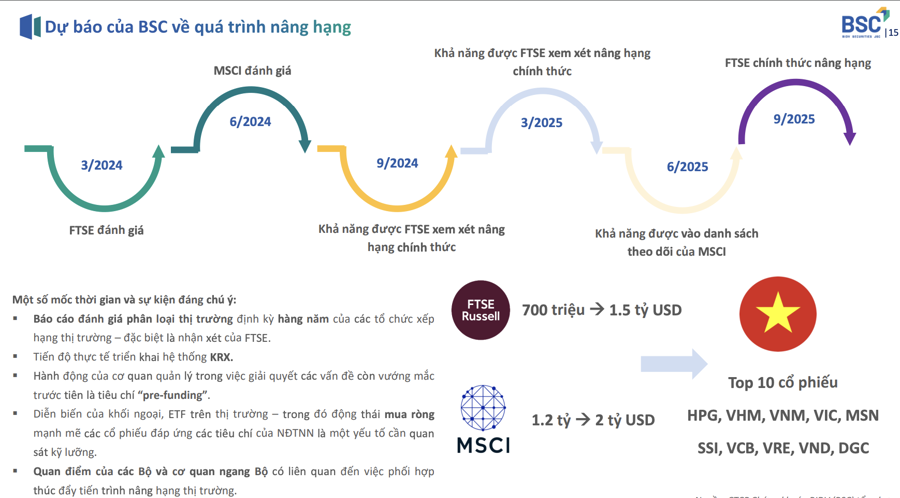

According to BSC, the stock market upgrade progress in Vietnam is forecasted as follows: In March 2024, FTSE will have an assessment period, and by September 2024, there is a possibility of Vietnam’s stock market being officially considered for an upgrade by FTSE. And by September 2025, FTSE will officially upgrade Vietnam’s stock market to an emerging market.

Meanwhile, the possibility of being included in the MSCI watchlist will be evaluated by June 2025.

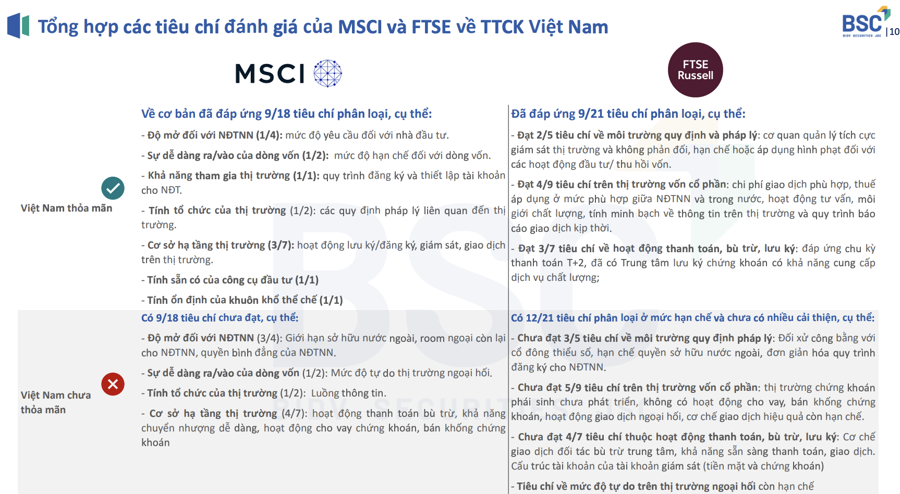

Among the qualitative criteria set by FTSE Russel and MSCI, the requirements from FTSE Russel are relatively simpler, mainly because FTSE Russel categorizes emerging markets into two levels based on their development stage, namely Secondary and Advanced Emerging Markets. Vietnam has met all 5 criteria of the market according to FTSE’s criteria, whereas MSCI still requires improvements in the foreign room for foreign investors…

Regarding the quantitative criteria, FTSE requires payment cycles and significant transaction failures, while MSCI also requires transferability and netting capability.

As for the custody requirement, according to the VSD leadership, applying the central counterparties (CCP) partnership model with the approval of the State Bank, where the custodian bank must be a clearing member, is the optimal solution to address the pre-funding issues.

To address the foreign ownership ratio issue, changes in regulations for each industry and restricted market access lists for foreign investors will be needed.

The current regulations on foreign ownership ratios are stipulated in the Investment Law (Decree 31/2021/ND-CP guiding the implementation) and the Securities Law (Decree 155/2020/ND-CP guiding the implementation). In addition, researching and piloting the application of non-voting depository receipts (NVDR) – a model that has been successfully implemented in the Thai stock market – also requires a mechanism that aligns with the provisions of the Enterprise Law.

Looking at the external perspective, the stock markets of countries usually show positive trends before the official announcement of a market upgrade, with significantly improved liquidity, as seen with the Chinese stock market. However, in 2018, China entered into a trade war with the United States, which led to a decline in the stock market.

Afterward, the stock market in China recorded impressive growth. After the announcement of the approval of the market upgrade, liquidity and scores showed signs of decline in countries such as Qatar and the UAE.

For Saudi Arabia – a country with a prolonged transition period of 06 stages – liquidity declined, and the stock index recorded a slight increase after the official approval of the upgrade was announced.

One thing to note is that the stock market trends also depend on the economic and socio-political context of each country at different times. The upgrade factor is not the main condition influencing the stock market.

Meanwhile, the liquidity and trends of the stock indexes in Thailand and Malaysia both showed positive movements before being approved for an upgrade by FTSE from Secondary Emerging Market to Advanced Emerging Market.

This reflects the stability of Advanced Markets compared to Frontier/Unclassified Markets. When being upgraded to Advanced, these countries’ stock markets showed positive trends as they received significant capital inflows from foreign investors, considering the impact of the 2008 financial crisis that still affected global markets.

In Vietnam, BSC expects to attract $1.5 billion after the stock market is upgraded by FTSE Russel, and if MSCI upgrades as well, it could attract an additional $2 billion.

However, the prospect of an upgrade also depends on the actual implementation progress of the KRX system; Actions taken by management agencies to address remaining issues, particularly the “pre-funding” criteria. The developments of foreign investors, ETFs in the market – including strong net purchases of stocks that meet foreign investors’ criteria – are factors that need to be carefully monitored.

Lastly, the viewpoints of relevant ministries and agencies regarding coordination to promote the stock market upgrade process need to be considered.