Members of DAN’s Board of Directors simultaneously divested shares.

Two members of the Board of Directors of Danapha Pharmaceutical Joint Stock Company (UPCoM: DAN) have successfully sold a total of over 13.1 million shares of DAN.

In particular, the member of the Board of Directors cum CEO Le Thang Binh sold more than 2.8 million shares, equivalent to a 13.6% stake on March 13. After the transaction, Mr. Binh only holds a round 50 thousand shares (0.24%).

Another member of the Board of Directors, Nguyen Quoc Thang, sold his entire 49.03% stake in DAN, equivalent to over 10.2 million shares and is no longer a shareholder here.

Earlier in early March, member of the Board of Directors Pham Huong Giang also registered to sell all 366 thousand shares, equivalent to a 1.75% stake.

On March 13, DAN’s stock closed at 28,500 VND/share. Based on this price, Mr. Thang and Mr. Binh can earn over 292 billion VND and over 81 billion VND from the deal, respectively.

Japanese partner continues to increase ownership in Ha Tay Pharmaceutical

ASKA Pharmaceutical (Japan) successfully bought nearly 1.1 million shares of Ha Tay Pharmaceutical Joint Stock Company (HNX: DHT) from February 27 to March 5, 2024.

After the transaction, this Japanese partner continued to increase ownership from over 27.7 million shares (33.67%) to over 28.8 million shares (34.99%) in DHT.

Prior to that from January 23 to February 21, 2024, ASKA registered to buy 2 million DHT shares to increase ownership. However, at the end of the transaction period, the pharmaceutical group only successfully bought over 910 thousand shares, increasing ownership from 32.56% to 33.67% (equivalent to over 27.7 million shares) as reported. The reason is that the market price did not meet expectations.

Valued stock, a member of DHC’s Board of Directors wants to sell 2 million shares

Mr. Nguyen Thanh Nghia, a member of the Board of Directors of Dong Hai Ben Tre Joint Stock Company (HOSE: DHC), has registered to sell 2 million DHC shares from March 18 to April 12, 2024 for financial needs.

Currently, Mr. Nghia holds nearly 10.4 million DHC shares, corresponding to a 12.9% stake. If the sales are successful, his ownership in the company will decrease to 10.42%.

Based on the closing price on March 13 of DHC’s stock at 44,100 VND/share, the estimated value of Mr. Nghia’s deal could exceed 88 billion VND.

Previously, from February 16 to March 7, 2024, Mr. Nghia had just completed a transaction to sell 1 million DHC shares, thereby reducing ownership from 14.14% to the current 12.9%.

On the rise, Deputy Chairman of VPI wants to sell some shares

Mr. To Nhu Thang, Deputy Chairman of the Board of Directors of Van Phu – INVEST Investment Joint Stock Company (HOSE: VPI), registered to sell 3.5 million VPI shares from March 18 to 22, 2024, by agreement and matching orders.

Currently, Mr. Thang holds over 14 million VPI shares, corresponding to a 5.82% stake. If the sales are successful, his ownership in the company will decrease to 4.38% and will no longer be a major shareholder.

At the end of 2023, this Deputy Chairman had sold 3 million VPI shares, reducing ownership from over 17 million shares (7.06%) to over 14 million shares (5.82%) as now.

As of the close on March 13, 2024, VPI’s stock price reached 58,500 VND/share, up over 6% since the beginning of the year. Based on this price, Mr. Thang could earn nearly 205 billion VND.

Mother of Deputy Chairman of SMC wants to sell all 10.2 million shares

Ms. Nguyen Cam Van, mother of Ms. Nguyen Ngoc Y Nhi – Deputy Chairman of the Board of Directors of SMC Trading Investment Joint Stock Company (HOSE: SMC), has just registered to sell all 10.2 million SMC shares, accounting for a 13.82% stake here.

Ms. Van said the expected time to sell all the shares starts from March 15 and ends on April 13.

Notably, during this time, her daughter – Ms. Y Nhi, Deputy Chairman of the Board of Directors of SMC also registered to buy 10 million SMC shares. If successful, Ms. Nhi will increase ownership in the company from 777,464 shares (1.06%) to 10.78 million shares (14.63%).

Therefore, it is likely that Ms. Nhi will “inherit” 10 million SMC shares from her biological mother, Ms. Van.

|

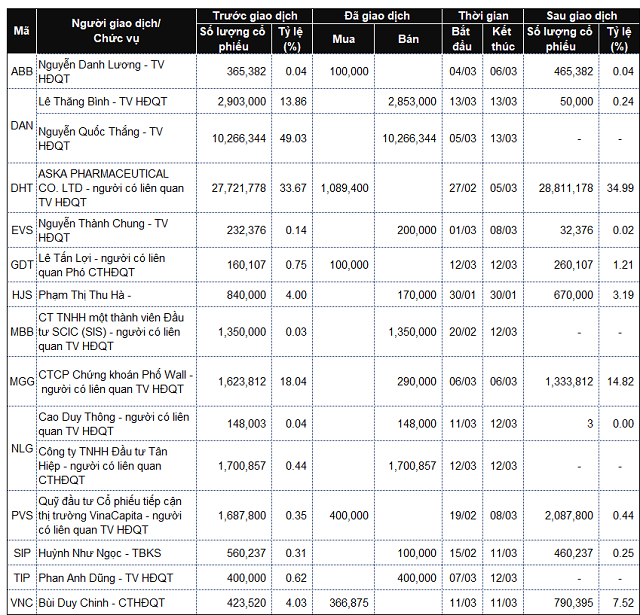

List of company leaders and relatives transacting from March 11-15, 2024

Source: VietstockFinance

|

|

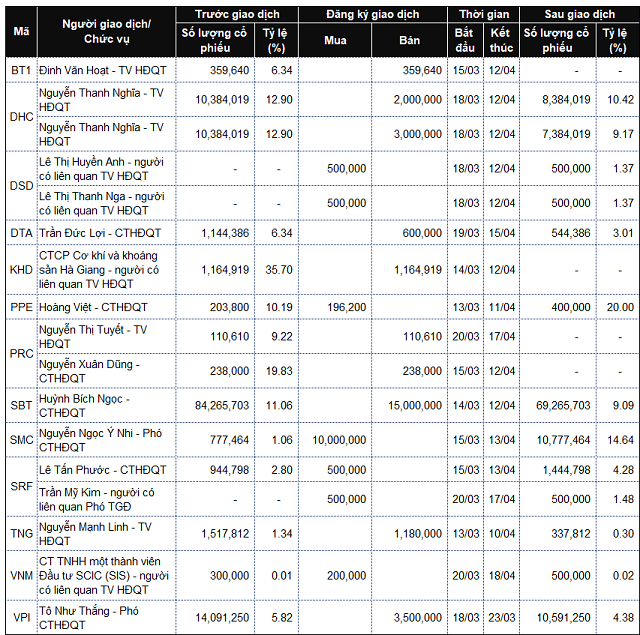

List of company leaders and relatives registering to transact from March 11-15, 2024

Source: VietstockFinance

|

Thanh Tu