SCS

loses major shareholders

Last week,

VN-Index rose

16.43 points to 1,263.78 points. Trading volume on HoSE reached over VND 126,155 billion, with an average trading volume of over 900 million

shares

per session. Similarly, HNX-Index increased by 3.22 points to 239.54 points.

On the HoSE exchange, foreign investors net sold 93.09 million units, with a total net selling value of over VND 2,609 billion, nearly 8 times higher in volume and nearly 3 times higher in value compared to the previous week. On HNX, foreign investors also net sold 4.37 million units, with a total net selling value of over VND 88 billion.

With Upcom market, foreign investors net sold 5.39 million units, with a total net selling value of over VND 152 billion. Therefore, in the trading week from March 11 to 15, foreign investors net sold 102.86 million units, with a total net selling value of over VND 2,849 billion.

Two Deputy General Directors of LPBank registered to sell nearly 1.2 million shares of LPB.

Two Deputy General Directors

of LPBank

– Tran Anh Tung and Vu Quoc Khanh – have registered to sell nearly 1.2 million shares of LPB from March 20 to April 17. Specifically, Deputy General Director

Tran Anh Tung

has registered to sell all 952,355 shares of LPB, through agreement and matching orders.

Similarly,

Mr. Vu Quoc Khanh

– Permanent Deputy General Director of LPBank – has registered to sell 200,000 shares of LPB. If the transaction is successful, Mr. Khanh’s ownership at LPBank will decrease from more than 1.28 million shares to more than 1.08 million shares.

In 2023, LPBank achieved a pre-tax profit of VND 7,039 billion, completing 117% of the annual plan, up 24% compared to 2022. Charter capital increased sharply from VND 17,291 billion to VND 25,576 billion, corresponding to a 48% increase compared to the beginning of the year.

PYN Elite Fund from Finland has just sold 95,200 shares of SCS of Saigon Cargo Services Corporation. After the transaction, PYN Elite Fund reduced its ownership ratio to 4,627,535 shares, equivalent to 4.9% of charter capital and no longer a major shareholder in SCS.

It is estimated that PYN Elite Fund will earn more than VND 7.3 billion. The move to sell by foreign funds took place when SCS shares have increased strongly recently. From the beginning of 2024 to March 11, SCS shares increased by 13.5%.

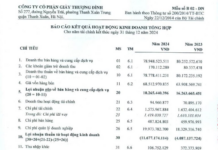

In 2023,

SCS achieved

net revenue of VND 705 billion, down 17% compared to 2022. After-tax profit reached over VND 498 billion, down 23% compared to the performance of 2022. Saigon Cargo Services Corporation holds 15% of nationwide market share and 45% of market share at Tan Son Nhat airport.

330 million shares

about to be listed on HoSE

Ms. Le Thi Xuan Duc unexpectedly submitted a resignation letter as Chairwoman of the Control Board of Siba Group (Siba Group – stock code: SBG) for personal reasons.

Ms. Duc has a Bachelor’s degree in Auditing and has been assuming the position of Chairwoman of the Control Board at Siba Group since March 2022. Prior to that, on December 21, 2023, Siba Group approved the dismissal of the title Chief Accountant for Ms. Ha Thi Ngoc Son and elected Ms. Tran Thi Thu Thao as a replacement.

Two important personnel of Siba Group each requested resignation.

HoSE has just announced that it has received the listing application of DNSE Securities Joint Stock Company. Accordingly, with a charter capital of VND 3,300 billion, DNSE Securities will register to list 330 million shares on HoSE.

At the end of January, DNSE Securities offered for sale 30 million shares at a price not lower than VND 30,000 per share, raising over VND 900 billion. Currently, DNSE has a charter capital of VND 3,300 billion. The parent company is Encapital Financial Technology Company Limited, which holds 51% of charter capital, followed by Encapital Holdings Joint Stock Company, which holds 10% and PYN Elite Fund, which holds 10.91% of charter capital.

Truong Thanh Energy and Real Estate Joint Stock Company (stock code: TEG) has just announced a change in listing due to the sale of shares to existing shareholders. Accordingly, the additional listed shares are 48 million shares, increasing the total listed shares on the exchange to nearly 120.81 million shares. The effective date of the listing change is March 13, 2024.

The company also plans to use over VND 53 billion to invest in shares of Truong Thanh Energy Joint Stock Company and allocate VND 69 billion to repay the company’s loans. The remaining VND 57.2 billion will be deposited in the bank. Depending on the business situation and actual needs in 2024, TEG will consider continuing to disburse over VND 57.2 billion into the company’s working capital.