Illustrative image.

Oil prices rise 2% to a 4-month high on lower exports from Iraq, Saudi Arabia

Oil prices rose about 2% to a 4-month high at the beginning of the week due to lower crude exports from Iraq and Saudi Arabia and signs of stronger demand and economic growth in China and the U.S.

Brent crude rose $1.55, or 1.8%, to close at $86.89 a barrel, while U.S. West Texas Intermediate (WTI) crude rose $1.68, or 2.1%, to close at $82.72.

This means Brent crude closed at its highest level since October 31, 2023, and WTI closed at its highest level since October 27, 2023. U.S. gasoline prices closed at their highest level since August 31, 2023.

Iraq, the second largest producer in OPEC, said it would reduce crude oil exports to 3.3 million barrels per day in the coming months to compensate for OPEC+’s excess production since January 2024.

In January and February, Iraq pumped significantly more oil than its target production level set in January when some members of the Organization of Petroleum Exporting Countries (OPEC) and allies like Russia, a group called OPEC+, agreed to support the market.

In Saudi Arabia, OPEC’s largest producer, crude oil exports fell for the second month in a row, to 6.297 million barrels per day in January 2024 from 6.308 million barrels per day in December 2023.

Meanwhile, in Russia, Ukraine’s attacks on energy infrastructure caused about 7% of oil refining capacity to be offline in the first quarter, according to Reuters analysis.

Gold edges higher as investors await a series of central bank meetings

Gold prices rose after falling to a one-week low as investors awaited a series of central bank meetings this week, including the Federal Reserve’s policy decision on Wednesday, to gain insight into inflation and interest rates.

Spot gold rose 0.2% to $2,159.69 an ounce at 18:20 GMT after hitting its lowest level since March 7 during the session. Gold bullion reached a record high of $2,194.99 on March 8, 2024. U.S. gold futures rose 0.1% to $2,164.3.

The Bank of Japan is expected to exit its extremely accommodative monetary policy at a two-day meeting ending on Tuesday. The Bank of England will hold its meeting on Thursday and is expected to keep interest rates unchanged. The market also predicts no change in interest rates at the end of the Federal Reserve’s two-day policy meeting on Wednesday.

Copper hits an 11-month high as China cuts production

Copper prices reached their highest level in 11 months as production cuts in China and a weaker U.S. dollar triggered buying.

A rare agreement by China’s copper smelters to cut output last week has fueled a rally that pushed copper prices to $9,164.50 a ton on the London Metal Exchange (LME). On the Shanghai Futures Exchange (ShFE), the metal used in electricity and construction reached a record high of 73,440 Chinese yuan.

Copper prices on the LME rose 0.1% to $9,085 per ton.

China’s industrial output grew 7% in January and February 2024, the fastest pace in nearly two years. However, prolonged Chinese real estate crisis is still weighing on the copper market.

Iron ore rebounds on upbeat data from China

Iron ore futures rose back as upbeat data from China renewed hopes for a recovery in steel demand in the coming weeks.

Iron ore contracts for May 2024 delivery on the Dalian Commodity Exchange (DCE) in China closed 0.9% higher at 803 yuan ($111.56) per tonne, rebounding from an 11% drop at the end of last week.

Iron ore futures for April 2024 delivery on the Singapore Exchange rose 3.7% to $103.65 per tonne.

Real estate investment in China was down 9% from the same period last year in the first two months of the year, compared with a 24% decline in December 2023.

Coke prices rose 1.1% while coal coke prices remained flat. Steel rebar prices rose 0.3%, hot rolled coil prices rose 0.7%, stainless steel prices rose 1.4%, while steel bar prices fell 0.3%.

China’s crude steel production increased 1.6% in the first two months of 2024 compared with a year earlier.

Wheat jumps as tensions in the Black Sea rise, soybeans slump

U.S. wheat futures rose over 2% as weekend attacks by Russia on Ukrainian ports showed risks to grain supplies that can be exported from the Black Sea region.

However, soybean futures fell as Brazil’s harvest progressed, prompting farmers to sell oilseed. CBOT corn prices edged lower in a dull trading session.

CBOT wheat futures for May 2024 delivery rose 12-3/4 cents to $5.41-1/3 a bushel. Soybean futures for May 2024 delivery fell 7-1/4 cents to $11.91 a bushel, and corn futures for May 2024 delivery fell 1-1/2 cents to $4.35-1/4 a bushel.

Wheat rose as Russia’s airstrikes damaged agricultural businesses and destroyed some industrial buildings in the port city of Odessa on the Black Sea. The port city of Mykolaiv on the Black Sea was also attacked.

Cocoa at record high while coffee and sugar also rise

New York and London cocoa futures prices hit record highs on supply concerns following a poor harvest in West Africa, while coffee and sugar prices also rose.

July cocoa futures in New York rose 0.1% to $7,230 per ton after reaching a record high of $7,735 during the session. July London cocoa futures rose 2.7% to 5,921 pounds per ton after hitting a record high of 6,246 pounds.

Robusta coffee futures for May rose 0.9% to $3,339 per ton. Arabica coffee futures for May rose 0.03% to $1.83 per pound.

Traders said supplies at Vietnam’s leading robusta coffee producer remained tight and supportive fundamentals were narrowing discounts for arabica beans.

Raw sugar futures for May rose 0.1% to 22.15 cents per pound. White sugar futures for May rose 0.4% to $626 per ton.

Traders said the market continued to be supported by concerns that dry conditions will reduce the size of Brazil’s Center-South cane crop in the upcoming 2024/25 season.

Japan rubber at nearly 13-year high

Japanese rubber futures prices rose for the tenth consecutive session to close at the highest level in nearly 13 years, amid concerns about the weather in Thailand, the leading producer, and higher oil prices. Rubber futures for August 2024 delivery closed up 2.2 yen, or 0.62%, at 354.2 yen ($2.37) per kg, the highest since September 20, 2011.

Rubber futures on the Shanghai Futures Exchange (SHFE) for May delivery rose 875 yuan to 15,500 yuan ($2,153) per tonne.

The previous month’s rubber futures on the SICOM platform for April delivery closed at 173.4 US cents per kg, up 3.4%.

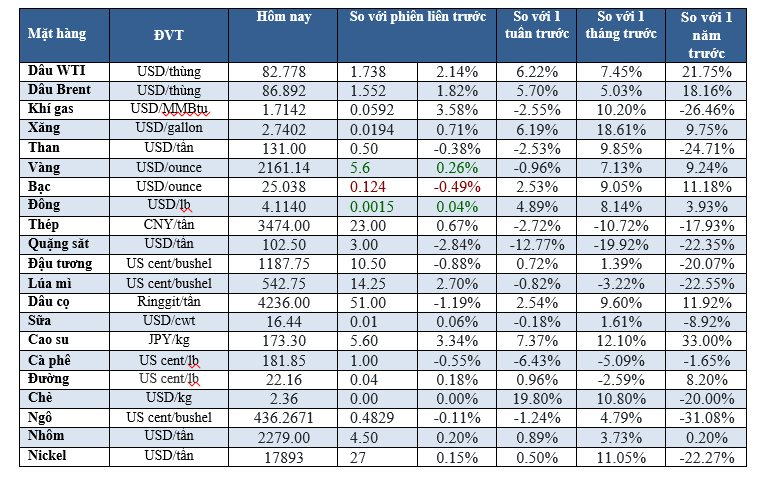

Prices of some key commodities on the morning of March 19, 2024