Buy KDH shares with a target price of 44,500 dong/share

BIDV Securities Company (BSC) maintains a buy recommendation for KDH shares of Khang Dien Investment and Trading Joint Stock Company and raises the target price to 44,500 dong/share.

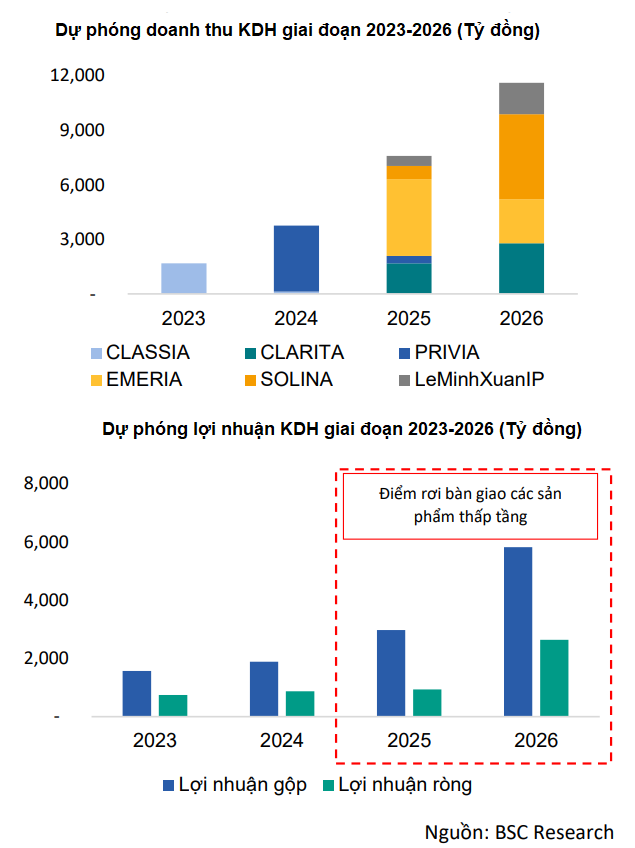

Based on the actual market situation in Ho Chi Minh City and the company’s deployment plan, BSC expects KDH’s new sales volume to explode in the period 2024-2026, creating a new high level 2.1 times higher than the 2021-2023 period.

In detail, the revenue of new sales in 2024 is estimated at 4,214 billion dong, a decrease of 14.2% compared to the same period. In the 2025-2026 period, the new sales volume will reach 7,295 billion dong (a 25.6% increase) contributed by Clarita & Emeria and 8,048 billion dong (a 14% increase) from The Solina.

In 2024, BSC forecasts KDH’s net revenue and net profit to reach 3,827 billion dong (an 86% increase compared to the same period) and 874 billion dong (a 17% increase), mainly contributed by the remaining products at Classia and the handover of most of The Privia products.

BSC sees that the 2025-2026 handover points at Clarita & Emeria will lead to the profit growth of KDH. Projected net revenue in 2025-2026 will reach 7,659 billion dong (100% increase compared to the same period) and 11,699 billion dong (a 53% increase). However, since these are two cooperative projects with Keppel Land, net profit will grow at a lower rate of 939 billion dong (an 8% increase) in 2025 and 2,635 billion dong in 2026 (a 180% increase, due to the additional contribution from The Solina).

On February 23, 2024, KDH’s board of directors approved a private placement plan to offer 110 million shares to strategic shareholders with a total expected value of 2,700 billion dong (offering price of 27,250 dong/share).

BSC believes that the private placement is a signal that KDH will strengthen its resources to resolve land-related issues and complete financial obligations at Tan Tao and Phong Phu 2 in 2024-2025, before the land price list becomes effective and affects expected profit margins.

See more here

Buy TCH shares with a target price of 16,000 dong/share

According to Agribank Securities Company (Agriseco Research), Hoang Huy Financial Services Investment Joint Stock Company (TCH), listed on HOSE, continues to expand its land fund of nearly 150 hectares with a focus in Thuy Nguyen district, Hai Phong, including Do Muoi Urban Area, Hoang Huy Green River, and Hoang Huy New City.

TCH’s real estate projects are expected to be developed starting in 2024 and are expected to benefit from the selling price and absorption rate in the next 3-5 years due to the early recovery potential and long-term development opportunities of the Hai Phong real estate market. In particular, Thuy Nguyen district is expected to develop into a new multi-sector economic center of Hai Phong.

Agriserco Research expects that the development of Thuy Nguyen district will stimulate increased housing demand and the scarcity of premium projects will be an opportunity for TCH in the long term. The company also has the advantage of owning low-cost land in Hai Phong from implementing BT projects.

TCH has a safe financial condition with a debt-to-equity ratio that is consistently low and a cash dividend payment ratio of 5-15% annually. This company forecasts that with the expected growth in business and stable finances, TCH will continue to pay cash dividends from 10-15% in the near future.

TCH’s business results are expected to improve as it starts to hand over and recognize revenue and profit from the Hoang Huy Commerce project – Block H1 and the Hoang Huy New City social housing project. Therefore, Agriseco Research recommends buying TCH shares with a target price of 16,000 dong/share.

See more here

Buy PVD shares with a target price of 38,259 dong/share

Yuanta Vietnam Securities Company (Yuanta) recognizes that the drilling industry is quite dynamic and the rental rates for rigs continue to trend upward. At PetroVietnam Drilling and Well Services Corporation (PVD), all self-lifting rigs have been leased for the period 2024-2025, and the company is currently focusing on orders for 2026.

Therefore, Yuanta projects PVD’s drilling revenue in 2024 to reach 5,039 billion dong, a 23.8% increase compared to the same period, and accounting for 68% of the expected total revenue.

This securities company also highlights the short-term drivers of PVD, such as the high probability that the average rental rates will continue to increase until 2026. In addition, the assumption that the company will invest in another self-lifting rig with a cost of 90 million USD, plus an additional 20 million USD for related equipment in 2024.

Finally, the potential commencement of the Lot B, O Mon project in 2025 will further stimulate the demand for drilling-related services.

Yuanta forecasts PVD’s revenue in 2024 to reach 7,400 billion dong, a 27.4% increase compared to the same period. Based on the forecasted increase in rig rental rates, the gross profit margin is expected to increase by 3.3 percentage points, leading to an expected net profit of 1,200 billion dong, a 114% increase.

Based on the above arguments, Yuanta maintains a buy recommendation for PVD shares and raises the target price to 38,259 dong/share, corresponding to a 26.3% profit in 12 months. Risks may come from the high correlation between stock prices and oil price fluctuations, as well as the possibility of delays in the Lot B project.

See more here

—