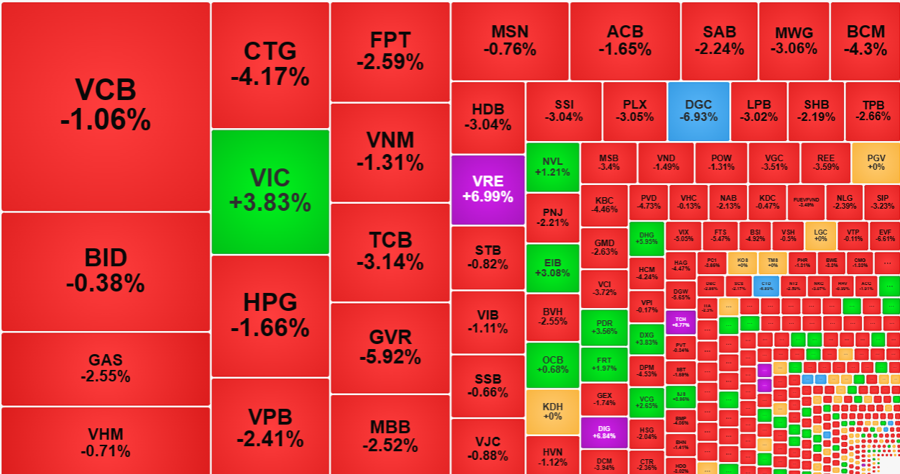

The afternoon trading session saw an unexpected sharp decrease in liquidity, with the two exchanges only matching an additional 15,165 billion dong, a decrease of 48% compared to the morning session. This level of trading is also only equivalent to the previous week’s afternoon sessions, meaning that the selling pressure has not further spread. Many stocks have the opportunity to recover, although they are still far from the reference price. The real estate group performed the best, with some stocks hitting the trading limit.

The VNREAL index on the HoSE exchange even closed up 1.41% while all other sector indices were in the red. Of course, in the context of overall selling pressure, many real estate stocks were unable to rise, but there were also many stocks that performed very well.

VRE, QCG, and TCH are representative stocks of the real estate group that hit the trading limit. VRE received information that Vingroup’s divestment plan had turned around. At the end of the morning session, this stock was still down 0.97%, but in the first few minutes of the afternoon session, it reached the trading limit, equivalent to a 7.84% increase from the previous price. By the end of the session, VRE hit the trading limit, equivalent to an 8.04% increase in the afternoon session alone. VRE is one of the few stocks with good liquidity as overall market trading has been weaker than the morning session. About 708 billion dong pushed VRE’s price to the limit.

In addition to VRE, DIG also had an impressive afternoon trading session with a liquidity of 693.3 billion dong. In the morning session, DIG hit the trading limit for a while but then saw profit-taking and ended the session with a 3.51% increase. In the afternoon, DIG gradually climbed and eventually hit the trading limit. Throughout the session, DIG had a trading volume of nearly 2,357 billion dong, leading the market and setting a new record. The strong price increase also pushed DIG above the peak of September last year, reaching the highest level in 18 months.

Other strong real estate stocks include ITC with a 4.89% increase, HQC with a 4.89% increase, SCR with a 4.91% increase, SJS with a 3.95% increase, DXG with a 3.83% increase, VIC with a 3.83% increase, PDR with a 3.56% increase, HDC with a 3.45% increase, CII with a 2.43% increase, DXS with a 2.28% increase, NBB with a 2.2% increase…

However, real estate stocks are only a small part of the market, and most of the rest of the market still experienced a significant decline. Some other stocks also increased, but they are not representative, such as EVG, DHG, HHS, FRT, BCG… The breadth of the VN-Index at the end of the session was 103 stocks up / 407 stocks down, although it was more positive than in the morning session (38 stocks up / 461 stocks down).

The price level was raised quite well thanks to bottom-fishing demand in the afternoon. At the end of the morning session, HoSE had 205 stocks down more than 2%, and by the end of the session, there were only 140 stocks. The narrowing of the decline is the dominant trend, and the first supporting factor is the decrease in selling pressure. Indeed, the indices did not create deeper lows in the afternoon session but gradually rebounded. Compared to the selling frenzy in the morning session, this is clearly a good signal. Thanks to that, the bottom-fishing demand worked more effectively. Stock prices were widely raised. Statistics show that about 67% of the stocks with trading today have recovered by at least 1%, about 46% have recovered by at least 2%.

The VN-Index closed down only 20.22 points, equivalent to -1.6% compared to the reference price. This is a good result considering the bottom level was more than 42 points lower. This index has also recovered 1.79% from the lowest price. VIC and VRE were the two best performing stocks. In addition, it is not surprising that many small real estate stocks were also among the top gainers, such as DIG, PDR, TCH, DXG, NVL, because these are simply rare stocks that have increased in price.