According to the investigation, during its operation, Van Thinh Phat Group has established more than 1,000 member companies divided into 4 main groups closely related to each other:

+ Financial institutions group in Vietnam: SCB, Tan Viet Securities, Vietnam Vinh Phu Financial Investment

+ Group of companies operating in Vietnam: mostly operating in real estate, restaurants, hotels… are companies with large charter capital, dominating the activities of many member companies such as Saigon Peninsula Group JSC (VND 18,000 trillion), An Dong Investment Group JSC (VND 9,000 trillion)… Windsor Real Estate Management Group JSC, Times Square Vietnam Investment Joint Stock Company, Saigon Handicraft Industry Import – Export JSC…

+ Group of ghost companies in Vietnam: established to raise legal entities to contribute capital to projects, borrow money from banks, convert debts, sign contracts…

+ Network of companies abroad…

During the trial, the Judges asked Ms. Truong My Lan (former Chairman of Van Thinh Phat Group) about the solution to assets to overcome the consequences in the case. In addition to the well-known “giant” real estate, a number of other famous buildings have also emerged as assets in the hands of the female giant.

Capital Place building-billion dollar

In the previous trial, Ms. Truong My Lan said that she had Capital Place building worth USD 1 billion in Hanoi and was having her daughter sell it to overcome the consequences. According to preliminary information, there have been inquiries with a price of USD 360 million.

Capital Place building used to be part of the Vinhomes Metropolis project, then transferred to the Twin-Peaks Joint Stock Company owned by Singapore’s Capitaland real estate group.

However, in early 2022, a new real estate brand at that time, Viva Land, announced the acquisition of Capital Place for SGD 751 million (USD 550 million), lower than the number Mrs. Lan declared in court. Viva Land was established in 2020 and is headquartered in Singapore.

Viva Land has been mentioned by the real estate industry as a company having a relationship with Van Thinh Phat. The official website of Van Thinh Phat Group also mentioned Viva Land as a partner. Van Thinh Phat’s website introduced: “Viva Land is a real estate management and development company.

As of the end of April 2022, a secret entity, Saigon Helios Joint Stock Company, owns 45% of Twin-Peaks Joint Stock Company.

Daewoo Hotel Hanoi – once a symbol of Hanoi

Daewoo Hotel Hanoi – an asset that Mrs. Lan proposed selling to overcome the consequences. This is a famous 5-star hotel in Hanoi. The hotel was built in 1996, under the direct direction of former Chairman of Daewoo, Kim Woo-choong. After completion, Dewoo Hanoi Hotel has become an icon of the Capital with the largest and most luxurious scale at that time.

Located in the “golden land” at the center of the western gateway to Ho Chi Minh City with 411 rooms, Dewoo Hanoi is not only the largest hotel in the capital but also attracts businessmen and politicians with a classical architecture with elegance and sophistication. Daewoo Hotel has welcomed prominent politicians such as former US President Clinton, Russian President Putin.

In 2015, Bong Sen Joint Stock Company – a company in the Van Thinh Phat ecosystem – spent about VND 3,650 billion to acquire 51% of the capital of Daeha – a company that owns Daewoo Hotel and office building in Hanoi, the equivalent value of this complex is up to nearly VND 7,200 billion ($320 million).

In addition, Bong Sen also owns a series of high-class restaurants and hotels in Ho Chi Minh City with the following names: Palace Saigon Hotel, Bong Sen Saigon Hotel, Bong Sen Annex Hotel, Lemongrass Restaurant, Buffet Gánh Restaurant, Lion Restaurant, Vegetarian Restaurant…

Image: Daewoo Hotel Hanoi.

Owning a series of real estate in Nguyen Hue – Dong Khoi area

It is known that most of the names related to Van Thinh Phat are working in the real estate sector with prestigious projects; focusing on Nguyen Hue Street (where Van Thinh Phat’s headquarters is located), Dong Khoi and surrounding areas in the center of Saigon (District 1, District 3, etc.).

Located in the most prime location of Ho Chi Minh City, after the pedestrian street went into operation, the value of projects along Nguyen Hue Street increased exponentially. Large-scale projects are emerging more and more along the road, and there are also many investors who want to own a “collection of gold land” here.

A report by Cushman & Wakefield ranks Dong Khoi Street as the world’s 13th highest retail space. Rent on Dong Khoi Street is $390/square foot/year (about VND 101 million/m2/year), up 17% compared to the same period last year.

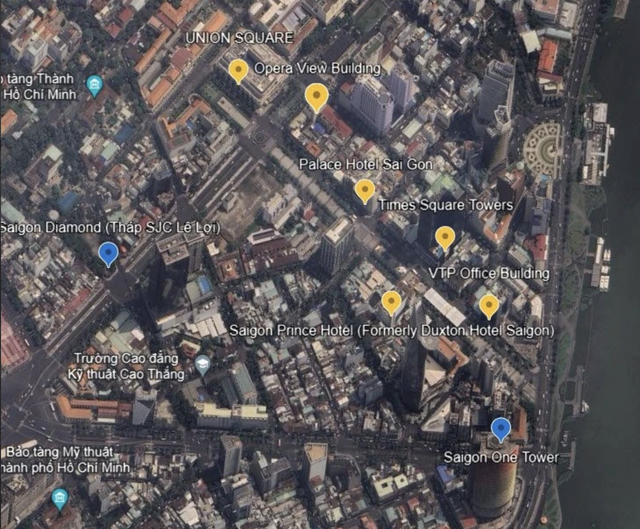

Image: Owning a series of real estate in Nguyen Hue – Dong Khoi area.

Among the companies that own real estate/conduct business activities directly mentioned in the investigation conclusion, there is Times Square Vietnam Investment Joint Stock Company which owns a complex consisting of 2 twin towers – hotel and high-end apartments. This is one of the most prominent high-rise buildings in the center of Ho Chi Minh City.

The building has 2 main facades facing Nguyen Hue and Dong Khoi streets.

Image: Times Square building on Nguyen Hue Street, District 1, HCMC.

Vinametric JSC: Saigon Prince Hotel

Located across Times Square on the other side of Nguyen Hue Street is Saigon Prince Hotel (formerly Duxton Hotel), which was bought back by VTP from foreign ownership for about USD 50 million.

Also on Nguyen Hue Street is the Palace Hotel Saigon managed by Bong Sen Joint Stock Company.

Image: Saigon Prince Hotel on Nguyen Hue Street, District 1, HCMC.

Union Square Company Limited – Union Square complex

Located at the “diamond land” with 4 facades of Dong Khoi – Le Loi – Nguyen Hue – Le Thanh Ton streets in the center of District 1, gathering a large number of tourists, but Union Square is deserted.

This center is located on expensive and prime land in the center of Ho Chi Minh City with an area of about 8,800 m2, a total floor area of up to 91,000m2, a scale of 6 basement floors and 9 upper floors, including 5 upper floors of a 5-star hotel.

Image: Union Square – Union Square complex on “4 facades of Dong Khoi – Le Loi – Nguyen Hue – Le Thanh Ton streets, District 1, HCMC.

Artex Saigon JSC (also known as Saigon Handicraft Industry Import – Export JSC) – Opera View building

Opera View is located opposite the City Theater, right at the intersection of Le Loi and Dong Khoi, in the center of the city and surrounded by famous 5-star hotels and bustling shopping centers. This building is one of the famous locations for luxury business.

Image: Opera View building at 161 Dong Khoi, District 1, HCMC.

Thien Phuc International Hotel (Minerva JSC is the owner of Novotel Saigon Centre) 4-star hotel (247 rooms at 167 Hai Ba Trung, District 3, HCM City).

Image: Novotel Saigon Centre in District 3, HCMC.

Saigon Diamond JSC – SJC Tower

SJC Tower is planned to start construction on a 4 facades land area of Le Loi – Nam Ky Khoi Nghia – Le Thanh Ton – Nguyen Trung Truc streets, an area of nearly 4,000 m2. The project is invested by Saigon Diamond JSC.

Image: The planned construction area of SJC Tower with 4 facades of Le Loi – Nam Ky Khoi Nghia – Le Thanh Ton – Nguyen Trung Truc streets, District 1, Ho Chi Minh City.

Saigon One Tower JSC – Saigon One Tower building on 34 Ton Duc Thang Street

Saigon One Tower is considered one of the most prime projects in Ho Chi Minh City because it is located on over 6,600 m2 of golden land at the intersection of Ton Duc Thang – Ham Nghi (District 1, HCMC) but has a rather tragic fate.

Image: Saigon One Tower building on 34 Ton Duc Thang, District 1, HCMC.

In District 5, An Dong Plaza – Winsor Hotel (18 An Duong Vuong Street, District 5, HCMC) has a total investment capital of nearly VND 1,300 billion with a 25-story building and a commercial center, conference facility.

Of which, Windsor Hotel is the first 5-star hotel invested and managed by Vietnamese private sector, meeting the 5-star standards of the Vietnam National Administration of Tourism, including 400 rooms, commercial center, unique restaurants, conference rooms with a capacity of up to 1,800 people and many entertainment facilities.

At the moment, An Dong Plaza – Winsor Hotel is still operating normally.

Image: Winsor Hotel in District 5, HCMC.

Another project is Thuan Kieu Plaza acquired by An Dong Joint Stock Company in 2015. The project is a 3-story high-rise building with a total floor area of over 24,000m2, including 13,000m2 of commercial areas with many utilities and services, including the ChoLon Theater. After coming to Vân Thịnh Phát Group, the project was renamed The Garden Mall and it was rumored that the entire project would be demolished to be replaced by another project.

Image: Thuan Kieu Plaza apartment building in District 5, HCMC.

Minerva Joint Stock Company – Ancient villa at 110-112 Vo Van Tan

The house was built on a 2,819m2 plot of land with ancient French architecture, a 2-storey, 3-storey house, with a total construction floor area of over 2,000m2.

In 2013, when the real estate market was booming, this villa over 100 years old was offered for sale for $47 million. But in 2015, Minerva Joint Stock Company successfully bought it for $35 million (about 700 billion VND at that time’s exchange rate).

Image: Ancient villa at 110-112 Vo Van Tan, District 3, HCM City.

In addition to the prime real estate projects in the Nguyen Hue – Dong Khoi area that are being exploited such as Times Square, Opera View, Union Square, some hotels… the Van Thinh Phat ecosystem also owns a series of abandoned projects or existing only on paper.