Since the beginning of the year, the State Bank of Vietnam has continuously urged commercial banks to enhance credit promotion in order to support economic growth in the context of the economy’s limited absorption capacity. The expansion of credit has been considered a necessary step to stimulate domestic investment and consumption, but it also raises concerns about the safety and sustainability of the economy when credit exceeds the economy’s limited absorption capacity.

Looking back over the past few decades, excessive reliance on credit to sustain growth has become a pressing issue in Vietnam’s economy. Whether using debt to stimulate growth is truly a good choice or not needs to be evaluated based on a profound understanding of the nature and significance of debt in generating economic growth.

Debt and labor productivity

Debt plays an important role in boosting labor productivity, particularly in developing economies like Vietnam. When debt is used efficiently, it can help enhance investment in key industries, thereby increasing labor productivity. This has been demonstrated through the experiences of Japan, South Korea, and China in the past, where credit-focused policies strongly supported the development of industries and increased labor productivity. Specifically, Japan in the 1970s, South Korea in the 1980s, and China in the 2000s witnessed rapid growth in key industries through concentrated investment in technology and infrastructure, largely funded through debt. In these countries, selective investment in high-potential sectors has significantly increased labor productivity, promoting not only economic growth but also improving the living standards of the people.

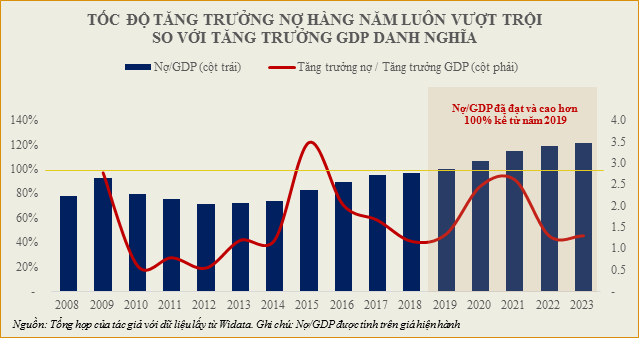

In recent decades, Vietnam has also focused on promoting credit for strategic industries. However, the effectiveness of capital utilization in Vietnam is showing worrying signs of decline. The clearest evidence for this argument is the decreasing monetary velocity, which was around 0.6 at the end of 2022 compared to 1.2-1.4 in the United States. This implies that the annual growth rates of money supply and credit are much higher than the nominal economic growth rate. It means that we need 10 units of money supply/credit growth to achieve 6 units of nominal growth. Consequently, in order to achieve a high economic growth rate, Vietnam’s debt accumulation has also been increasing. The figures below show that the Debt/GDP ratio has continuously increased from 2014 to reach 125% of GDP at the end of 2022, making Vietnam the developing country with the highest Debt/GDP ratio.

While debt is increasing, Vietnam is facing difficulties in improving labor productivity. From 2015 to 2020, Vietnam’s labor productivity growth rate was modest, not proportional to credit and investment growth. Although GDP growth reached 8.02% in 2022, labor productivity only increased by 4.8%. Overall, the productivity growth rate in the past three years was much lower than the previous period. This shows a complex picture of productivity and economic efficiency. This is because investment in improving productivity has not been properly emphasized, with ineffective labor allocation and dependence on low-quality labor-intensive industries. The delay in improving labor productivity not only affects the country’s competitiveness in the international market but also reduces the efficiency of capital utilization.

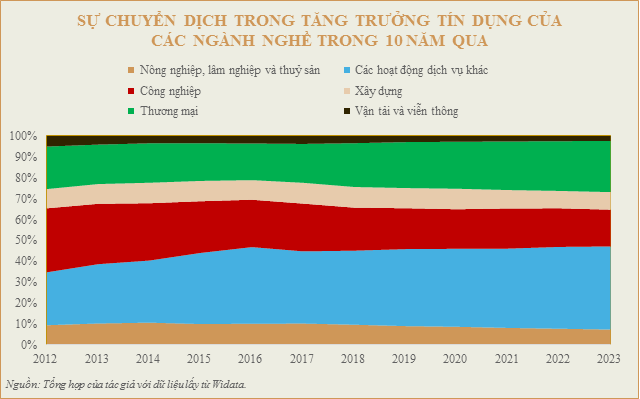

Over the past 10 years, Vietnam’s credit structure by sector has shifted towards the trade and service sectors. In contrast, the proportion for the industrial sector has decreased from 30.6% to only 17.6% by the end of 2023. As recently mentioned by a member of the National Assembly, Ho Chi Minh City has many “leading cranes” in the real estate sector but is very modest in positioning itself as an industrial city. When the industry is not developed, Vietnam faces many difficulties in developing the service sector, resulting in the economy only consisting of low-grade products and completely lacking the platforms to develop high-end services such as technology, finance, banking, and education.

Debt and consumption

Increasing consumption through debt plays a crucial role in short-term economic growth stimulation. However, it also leads to a reduced ability to spend in the long term, while consumer assets cannot create changes in labor productivity and waste household and social resources. Real estate accounts for a large proportion of individuals’ debt. In addition, buying real estate at prices higher than the actual value, along with the burden of loan interest, reduces the future purchasing power of the population. Real estate prices in major cities have increased significantly over the past 10 years, while people’s incomes have not correspondingly increased, resulting in an increasingly heavy debt burden. This not only reduces current consumption capability but also has long-term effects on households’ spending due to loan interest and principal repayment. Thus, it is clear that indiscriminate expenditure on real estate not only puts financial pressure on individuals but also has a negative impact on overall economic growth.

Being trapped in real estate has clearly been shown through declining consumption in both China and Vietnam in the past two years. Overinvestment in real estate not only absorbs a large amount of capital but also reduces society’s consumption capacity. For example, the recent real estate crisis in China has reduced overall purchasing power, with many households reducing their expenses to cope with debt, and even China has experienced inflation in recent months due to weak domestic demand. Similarly, in Vietnam, the slowdown of the real estate market, especially in the speculative segment, has led to households’ assets being buried in banks along with regular interest payments to the bank. The financial burden significantly reduces households’ consumption power, directly impacting economic growth and leading to a slowdown in business investment activities.

Debt is not always bad if used effectively. The wise use of debt can help enhance production capacity and increase the value of human resources, improving labor productivity. However, when debt is used to invest in sectors that do not create real value for society, such as real estate for speculative purposes, it can become a threat to economic stability. In the context of slowing labor productivity, this becomes even more dangerous, with the potential risk of a slow-burning “debt bomb,” requiring restructuring before it’s too late. This is not only true for the economy but also for the cells of society.

Lê Hoài Ân, CFA – Đặng Phú, VDSC