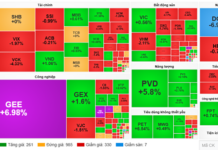

After the lunch break, investor sentiment has become more stable. Selling pressure has also gradually decreased at lower price levels while bottom-fishing demand has become more decisive. The stock market has thus stood strong amidst the ups and downs with support from the duo of Vingroup (VIC) and Vincom Retail (VRE) stocks.

VIC increased xx% while VRE increased sharply, becoming the two stocks that contributed the most to the index. This development followed the news that Vingroup signed an agreement to sell its entire capital contribution, amounting to 100% of the charter capital, in SDI – the company that currently owns over 99% of the charter capital of Sado Trading and Business Joint Stock Company, a major shareholder of Vincom Retail. After the transaction, Vingroup only directly owns 18.37% of the charter capital, equivalent to 18.82% of Vincom Retail’s voting rights.

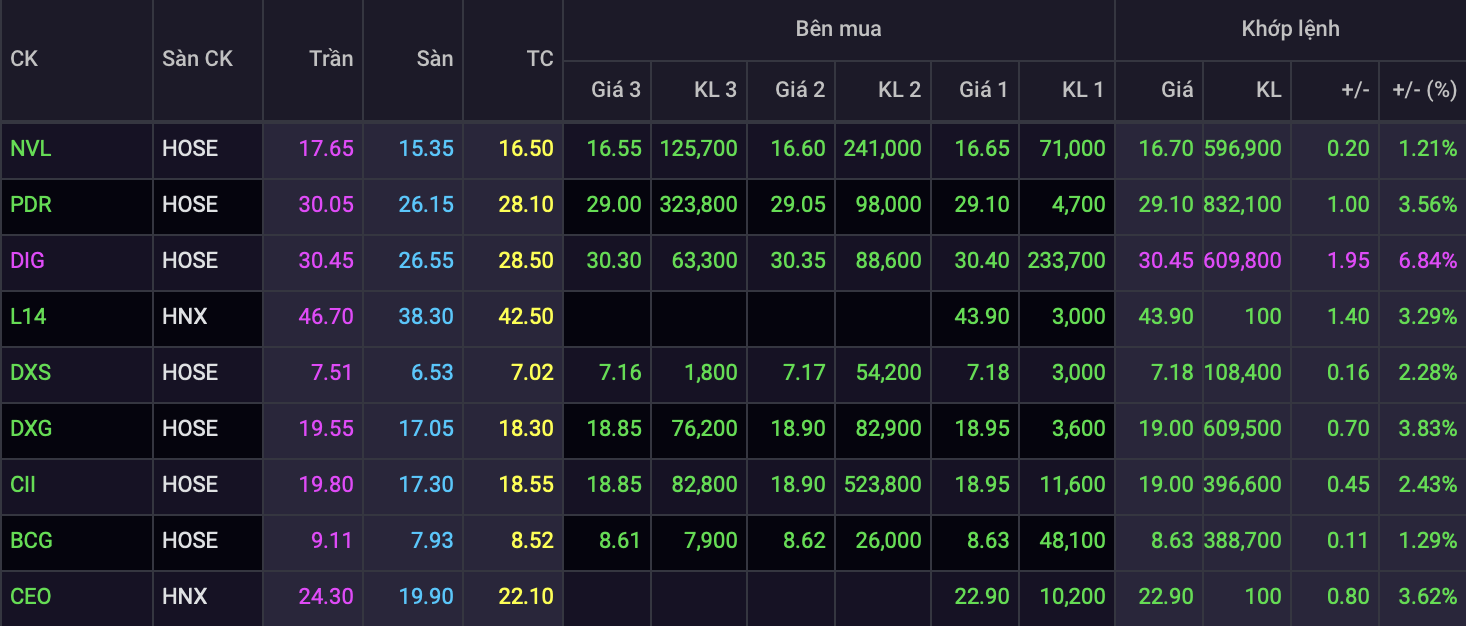

The real estate group provided support for Vingroup and Vincom Retail. Several stocks such as NVL, PDR, CEO, DXG, DXS, CII,… all returned to the green with strong increases, just like at the beginning of the session. Moreover, DIG even hit its daily trading limit with the highest liquidity since the divestment session of the Ministry of Construction at the end of November 2017.

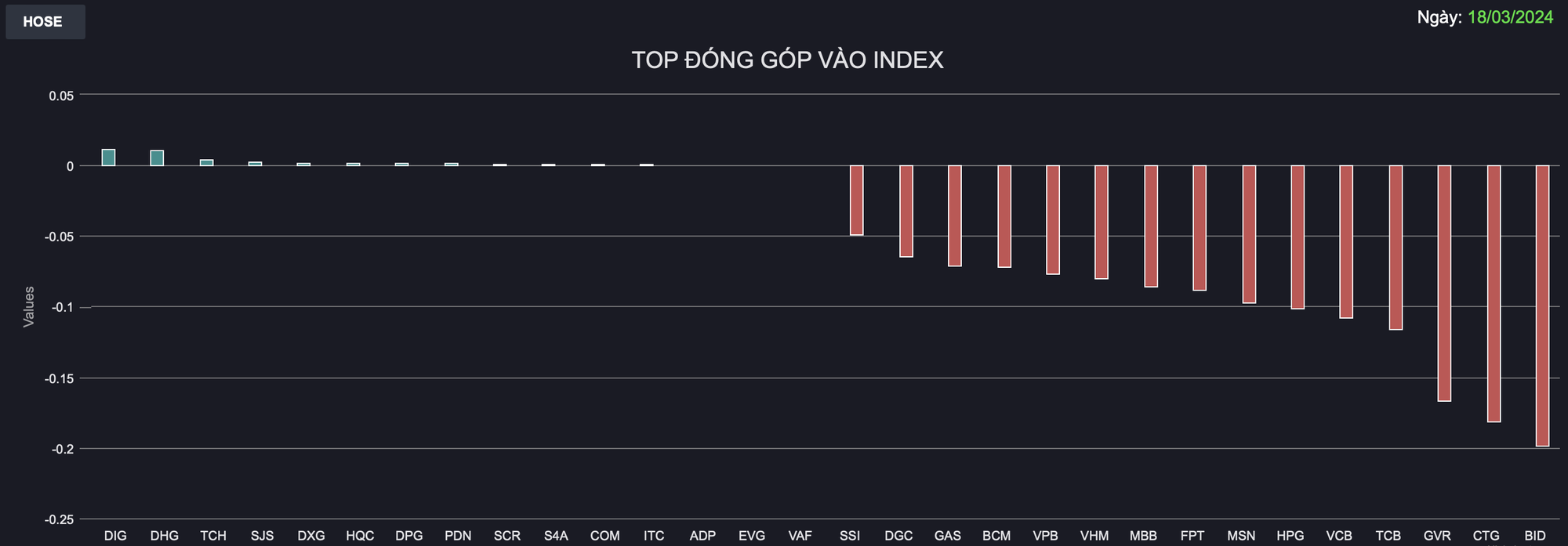

Many other groups such as banks, securities, steel, oil and gas,… also narrowed their decline slightly, but the red color still dominated overall. Some large-cap stocks such as CTG, GVR managed to avoid falling, but there were still names that experienced significant declines such as DGC.

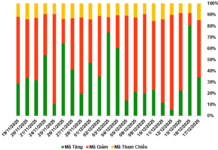

The VN-Index decreased by 20.22 points (-1.6%) to the level of 1,243.56 points with very high liquidity. The trading volume on HoSE reached over 1.6 billion shares, the highest since the session on August 18, 2023 when VN-Index fell by 4.5%. The trading value on HoSE reached over 40,000 billion VND, the second highest in history, only after the session on November 19, 2021.

Notably, foreign investors have significantly reduced their net selling scale in the matched order channel compared to the morning session, now only at 141 billion VND on HoSE. Among them, VHM, DGC, VPB, VNM,… are among the heavily sold names, while VRE, DIG, FRT, EIB,… are being accumulated with a relatively large value.

============================================

After unexpectedly dropping nearly 30 points, the market decline stopped briefly when selling pressure eased and bottom-fishing demand entered more decisively. However, this situation did not last long as selling pressure increased significantly afterward and continued to spread.

Selling pressure dominated large-cap stocks, especially bank stocks. Many real estate stocks also sharply reversed from high prices at the beginning of the session, causing the market to lack supporting force. The number of stocks with deep declines increased rapidly, with CTG, GAS, NLG, KDH,… touching the floor alongside the names that fell early on in the session.

In general, profit-taking pressure is understandable as the market has experienced a long period of growth without any significant corrections. VN-Index has increased nearly 12% since the beginning of the year, along with many stocks reaching new highs, surpassing historical peaks,… The sharp market decline partly comes from concerns that VN-Index has formed a double-top pattern, affecting investor sentiment.

Mr. Nguyen Anh Khoa, Head of Analysis and Research at Agriseco Securities, believes that the market will have to continue experiencing ups and downs with a wide range of fluctuations in the coming week before a clearer trend emerges, as the range of 1,280-1,300 points is considered a strong resistance level for VN-Index. In addition, indicators of momentum are showing signs of weakness, indicating that the index will need time to accumulate if it wants to continue the main upward trend. The risk of forming a double-top pattern is truly considered in the notable support level of 1,250 points being broken.

In addition, the increasing net selling pressure of foreign investors recently is also a restraining factor for the market. Although the long-term prospects of the Vietnamese stock market are still highly regarded, these foreign capital flows are difficult to avoid being influenced by the general trend in the world. The strong net selling activity of foreign investors over the past two weeks, according to Mr. Huy, is an easily understandable negative development.

Mr. Bui Van Huy – Director of Ho Chi Minh City Branch of DSC Securities believes that there have not been any major risks yet, but the market is gradually experiencing more negative factors. Currently, the world markets are in a sensitive area as the increasing momentum of stock exchanges is coming to a halt as they enter the overbought signal and await the Fed meeting next week. The CPI of the US in February continues to rise sharply, and the yields of US government bonds have also increased significantly, which are notable signs. The Fed meeting on 20-21/3 will have a significant directional impact on asset markets.