The State Bank of Vietnam has announced the results of the open market auction held on March 19, 2024.

Accordingly, the State Bank of Vietnam offered 28-day treasury bills, with 13 participants and 10 winning bidders. The total value of issuance is VND 10 trillion, a decrease of VND 5 trillion compared to the previous six sessions. The winning interest rate is 1.35% per annum, slightly lower than the previous rates of 1.4% per annum.

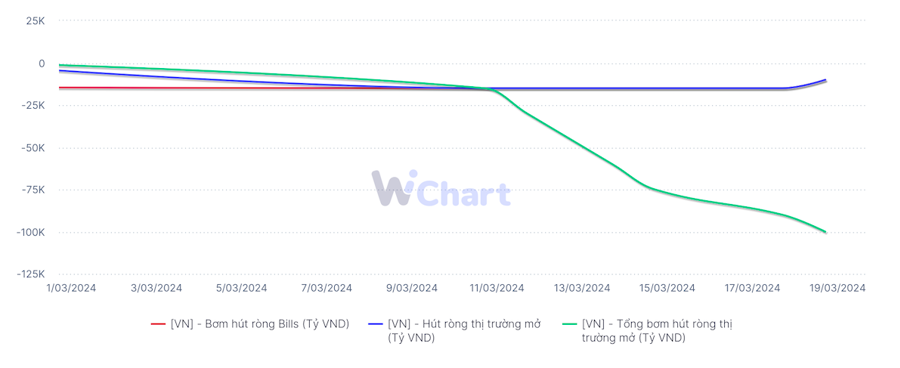

From March 11 to March 19, the State Bank of Vietnam continuously withdrew VND 100 trillion through the issuance of 28-day treasury bills.

Analysts believe that the issuance of treasury bills by the State Bank of Vietnam can be seen as a way to adjust short-term liquidity in the system, reduce speculative pressure on exchange rates, and is a common practice of central banks. However, it does not imply a reversal of monetary policy by the State Bank of Vietnam.

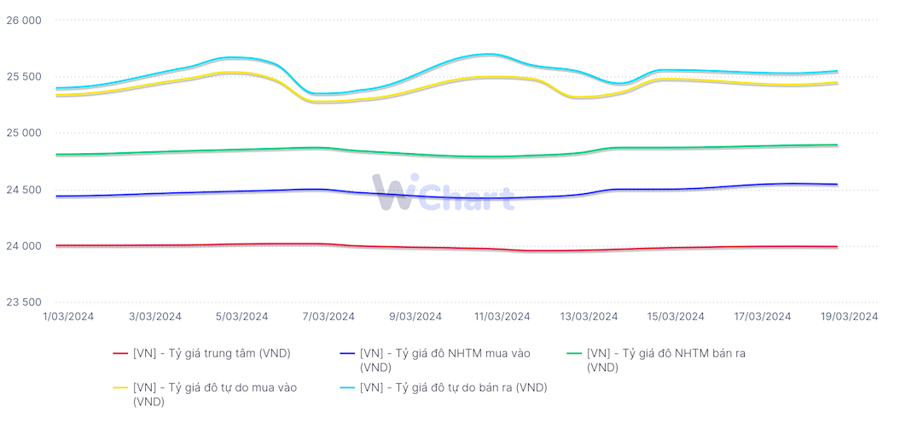

However, since the State Bank of Vietnam withdrew money, exchange rates at commercial banks have remained at historically high levels. The exchange rate in the free market has decreased but is still relatively high. At the same time, the State Bank of Vietnam has also set the central exchange rate close to VND 24,000/USD.

SSI recommends that with the high exchange rate pressure in the international market, the State Bank of Vietnam may have to take stronger measures, including considering extending the treasury bill term or inspecting foreign currency trading activities at commercial banks.

Meanwhile, the overnight interbank interest rate in VND has decreased in the session on March 15, after increasing on March 13 and March 14. Specifically, according to the State Bank of Vietnam, the overnight interbank interest rate (key term) in the session on March 15 decreased by 0.42 percentage points compared to the previous session, to 0.79% per annum. This interest rate level is similar to the time when the State Bank of Vietnam had not issued treasury bills. The one-month interbank interest rate reached 1.6% per annum, slightly higher than the session on March 14.

According to SSI’s analysis in the recently published money market report, the system still has abundant liquidity (credit in the first two months of the year decreased by 0.72% compared to the end of 2023), which may lead the central bank to continue withdrawing money for at least the next two weeks.

SSI estimates that the total net withdrawal volume will be over VND 200 trillion, similar to the end of 2023.

However, SSI also recommends that with the high exchange rate pressure in the international market, the State Bank of Vietnam may have to take stronger measures, including considering extending the treasury bill term or inspecting foreign currency trading activities at commercial banks.

According to statistics from BIDV Securities Company (BSC), during the period from 2018 to 2023, the State Bank of Vietnam also repeatedly withdrew money throughout the year. BSC said that the central bank withdraws money an average of 9.4 times per year, with an average duration of 13.4 days per withdrawal cycle.

The average net withdrawal value per cycle is VND 47.647 trillion, indicating that most withdrawal cycles have small scales. The largest withdrawal cycle was last year, with a scale of nearly VND 240 trillion (according to BSC’s data).

According to BSC, this withdrawal cycle has similarities and differences compared to the end of 2023. In both periods, the exchange rate increased significantly, but at the beginning of 2024, factors affecting the exchange rate such as the USD Index and the policy stance of the US Federal Reserve have eased.

Based on these factors, analysts forecast that the State Bank of Vietnam will withdraw net money of between VND 100 trillion and VND 150 trillion, with an average interest rate ranging from 1.1% per annum to 1.3% per annum.