Zombie factories

In 2017, Hyundai invested $1.15 billion in a new plant in Chongqing, southwestern China, with the aim of producing 300,000 internal combustion engines per year.

But 6 years later, the rapid shift of Chinese consumers towards electric cars caused the company’s sales to decline. Declining business forced the South Korean automaker to sell the plant for less than 25% of its investment value in December last year.

“Hyundai’s plant in Chongqing continues to lose money and the Chinese car market is struggling with overcapacity. No one is willing to buy this plant at a high price,” said Lee Hang-koo, Director of the Jeonbuk Auto Convergence Technology Institute, a South Korean research organization.

Huyndai left Chongqing as combined car sales in China for Hyundai and Kia fell to 310,000 units last year, down from nearly 1.8 million units in 2016.

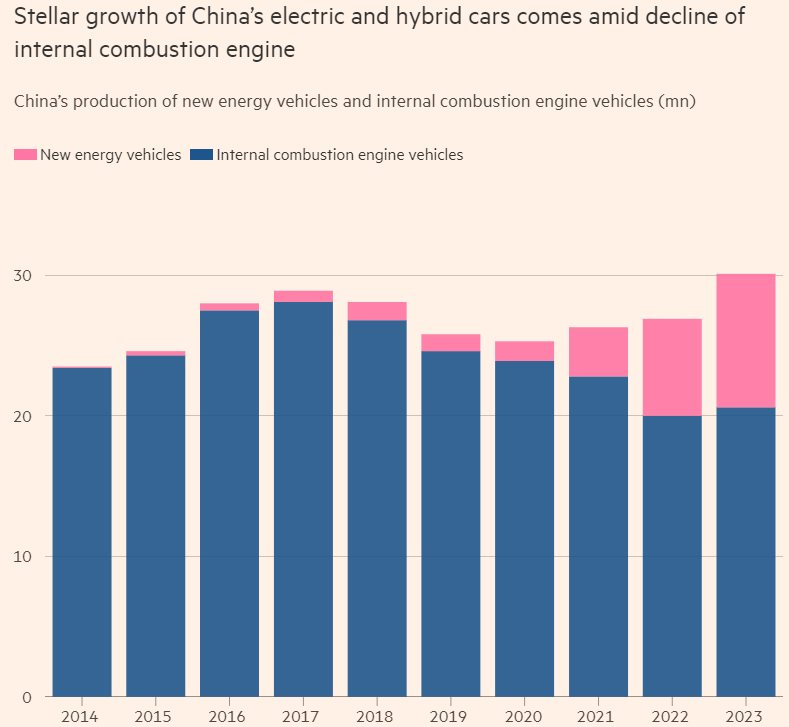

The strong growth of electric and hybrid cars in China takes place against the backdrop of a decline in internal combustion engines.

Analysts predict that in the next decade, the plant will be one of hundreds of “zombie” car assembly plants. This means that businesses are not generating enough cash flow to repay their debts.

According to data from Automobilety, a consultancy in Shanghai, China will produce 17.7 million internal combustion engine cars in 2023, down 37% from the previous peak in 2017.

Bill Russo, former director of Chrysler in China and founder of the consulting firm Automobileity, said the rapid decline in internal combustion engine car sales in China meant that half of the installed capacity (25 million out of 50 million units) is not being used.

While some old factories will be reused to produce hybrid or electric vehicles. There are also many other factories that cannot switch to producing electric cars for various reasons. This will pose challenges for both domestic and foreign car manufacturers.

Many foreign automakers in China will finally face two options: shut down internal combustion engine car assembly plants or continue production and export to Russia or Mexico.

“Survival” strategy: transformation to survive

The fierce price war across the entire Chinese auto industry is putting pressure on traditional automakers, including leading foreign brands such as Toyota, Volkswagen, and General Motors. These companies have been slow to launch cheap electric and hybrid models and have quickly lost market share to rivals like BYD and Tesla.

Until recently, foreign car companies could only enter the Chinese market in the form of joint ventures with local partners.

To cope with the increasingly poor domestic market, Chinese companies are boosting exports of cheap gasoline cars to Russia, a market from which many Western carmakers have left after the Ukraine conflict. However, analysts doubt whether sales in Russia can bring significant profits to Chinese automakers.

Foreign brands are also trying to export more from their factories in China. However, experts believe that in doing so, companies risk having to cut production costs at their own plants in other markets.

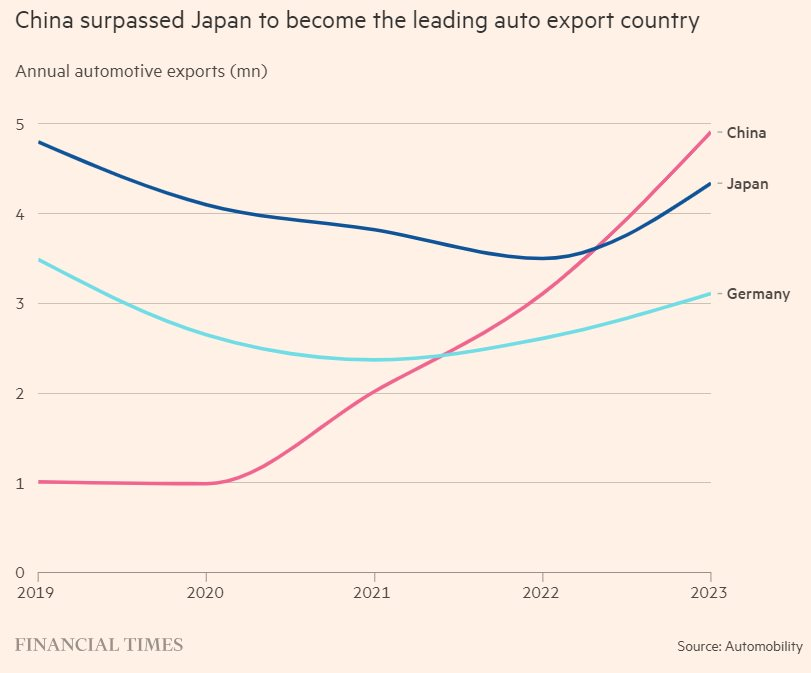

China overtakes Japan as the largest car manufacturer in the world

Recently, Volkswagen (VW), the largest foreign auto manufacturer in China, refused to provide excess capacity data in the country but said the gasoline car market is still profitable. Volkswagen believes in the great growth potential from hundreds of small cities in China, where the population is usually less than 3 million.

This is partly because the car ownership rate in major cities is already very high, and at the same time, management authorities there also limit the sale of new gasoline-powered cars. But another important factor is the lack of electric charging infrastructure in poorer cities, which hampers the development of the electric vehicle industry.

“The car ownership rate in China is still very low, with an average ownership rate of only 185 cars per 1,000 people. In the US, the ownership rate is nearly 800 cars per 1,000 people and about 580 cars per 1,000 people in Germany,” Volkswagen representative said.

Industry leaders said the biggest pressure on all traditional automakers in China comes from the rise of new electric car factories. These factories adopt a completely different approach to production processes.

Accordingly, electric car customers will increasingly want cars with more customizable features rather than mass-market products from a dealer.

John Jiang, plant manager at Nio, said all automakers in China are facing a survival battle. “Ultimately, not every brand can succeed,” he said.

Reference: FT