A reporter from Người Lao Động newspaper recently acknowledged a case in which a credit cardholder from Eximbank in Quảng Ninh had a transaction of 8.5 million VND but received a debt notification of over 8.8 billion VND after nearly 11 years. Many people panicked and contacted banks to check their accounts and close unused cards.

Annual fees also accrue interest

Ms. Lê Thị Diệp, a resident of Phú Nhuận district, Ho Chi Minh City, said that a year ago, a bank employee visited her home to apply for a credit card and informed her that she would be exempt from annual fees in the first year. However, they did not mention how the fees would be calculated in subsequent years, nor did they explain how much interest and fees would be charged if there was overdue debt.

After a year of use with one transaction and having paid off the balance, Ms. Diệp recently received a text message regarding a credit card debt of 2 million VND and a minimum payment of 100,000 VND before March 26th. Immediately, she contacted the issuing bank and found out that this debt was due to the annual fee.

“When I applied for the card, I forgot to ask about the annual fee for the second year. If I had known it was 2 million VND, I might not have agreed to open the card. Did the high fee make the bank employees hesitant to offer the card, so they deliberately overlooked this information?” – Ms. Diệp raised the issue.

Eximbank cardholders are struggling with various fees, despite having no transactions for many years. Photo: HOÀNG TRIỀU

The annual fee has also become a topic of interest for many credit cardholders recently. The annual fees for each type of card and transaction limit range from a few hundred thousand VND to a few million VND. Especially, these fees are added to the monthly balance of the card. If the cardholder forgets or ignores them, the bank will still charge interest and include them in bad debt statistics.

“I had to pay 1.9 million VND for the annual fee to close the credit card account even though there were no transactions in the second year. In the first year, my daughter’s school was affiliated with a bank that offered credit cards to parents for tuition fee discounts. By the second year, I no longer needed it, but when I went to close the card, I had to pay nearly 2 million VND for the annual fee” – Ms. Ngọc Khanh (residing in Thủ Đức, Ho Chi Minh City) said.

Mr. Lê Việt Dũng (a resident of Gò Vấp district, Ho Chi Minh City; credit cardholder of a bank in Ho Chi Minh City) said that he had paid off his outstanding balance at the end of 2023, but he still had to pay a monthly fee of 30,000 VND for receiving account statements sent to his home by mail.

“The amount is not large, but if the letter is lost or I forget to pay, the bank will charge very high interest and penalties. Due to the inconvenience and lack of security following the case of a cardholder with a debt of 8.8 billion VND in Quảng Ninh, I decided to go to the bank, settle the account, and cancel the credit card” – Mr. Dũng said.

Spending millions of VND on closing accounts?

Interestingly, in recent days, not only credit cardholders but also ATM card and debit card users have been surprised after discovering that their unused cards have still been charged various fees by their banks.

Mr. Dương Hải (resident of district 3, Ho Chi Minh City) said that he opened an Eximbank account to receive his salary, but for the past few years, he has not used it because the organization changed to paying salaries at another bank.

“When I went to close the account, I found out that I had to pay nearly 600,000 VND for account management fees, despite the account balance being zero and no transactions occurring for several years. The bank still charged me this fee, and I had to pay it off to close the account” – Mr. Hải said.

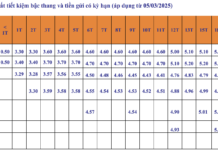

According to the investigation by the reporter of Người Lao Động newspaper, Eximbank’s fee schedule includes a monthly fee for non-term deposit accounts of 10,000 VND (charged when the average balance in the account is below 300,000 VND). This means that when the customer does not use the account, and the balance is below 300,000 VND, the bank will deduct a fee of 10,000 VND per month. Not only Eximbank, but other banks also charge account management fees. However, the fee policies of each bank may vary.

Based on the findings of the reporter on March 18th, many people have visited branches and transaction offices of banks to check and close unused cards and accounts for fear of incurring debt.

Ms. Ngọc Yến (residing in Thủ Đức, Ho Chi Minh City) stated that she spent a day visiting all the banks where she had opened accounts to check and close accounts that were no longer in use. At Agribank, an employee said that her ATM card had been temporarily suspended after 6 months without any transactions. BIDV also automatically temporarily suspends accounts after 12 months without any transactions…

Other banks, such as Sacombank and VietinBank, also confirmed that they freeze the accounts when the balance is zero and no transactions have occurred for 12 months or more.

When exchanging information with the reporter, representatives from Agribank, BIDV, Sacombank, VietinBank… confirmed that when customers have a zero balance in their accounts and no transactions for 12 months, the bank will freeze the accounts to exclude them from statistical reports and avoid incurring additional account management fees.

Controlling various fees and interest rates

Regarding the fees for card services, it is a fact that most ATM cardholders maintain an account balance ranging from a few million VND to hundreds of million VND to facilitate payments. This means that the banks have mobilized a large amount of deposits from millions of customers at a very low cost, as they only have to pay an annual interest rate of 0.2% – 0.5%. However, the banks can use this money to lend for short terms at much higher interest rates.

In addition, banks charge various fees for payment accounts, such as account management fees, fees for receiving balance change notifications (ranging from tens of thousands to hundreds of thousands of VND per month, depending on the number of notifications), ATM withdrawal fees ranging from 1,000 – 3,000 VND per transaction, annual fees, etc.

Some experts believe that charging too many fees in this manner creates an imbalance between the interests of cardholders and banks. Banks should consider reducing these fees to ensure a balance of benefits for all parties and encourage customers to use payment services.

“Having to pay fees and interest charges for an account with a zero balance for many years without being aware of it, without receiving any notifications, and only finding out when checking or closing the account is not fair. It is time to amend the laws and apply unified regulations on interest rates for all economic entities, ensuring fairness and reasonableness” – said a financial expert.

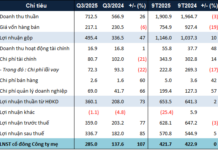

Regarding the case of a credit cardholder from Eximbank with a debt reaching 8.8 billion VND in Quảng Ninh, although it is unclear who is right or wrong, lawyer Trương Thanh Đức, Director of ANVI Law Firm, believes that banks should not be allowed to determine the interest rates for lending, especially for consumer loans. According to the Civil Code, the interest rate for lending can be agreed upon by the parties but must not exceed 20% per year, unless there are other relevant applicable laws. If overdue interest is added, the interest rate should not exceed 30% per year.

According to the Penal Code, when the lending interest rate exceeds 100%, it is considered loan sharking. However, these interest rate limits do not apply to the banking industry. This industry is only regulated by the Law on Credit Institutions, so banks can lend with an interest rate of 100%, charge interest on overdue payments at 150% per year, and even calculate principal and interest in a way known as “interest begets interest”, resulting in large amounts of money without being considered as predatory lending.

Specifically, in the case of Eximbank credit cards, they can apply compound interest, cumulative interest, compound interest added to the principal (commonly known as “mother interest gives birth to child interest”), calculated on a monthly basis. Therefore, it is entirely possible for the debt to jump from 8.5 million VND to 8.8 billion VND, if an interest rate of about 70% per year for overdue debt is applied.

“How customers have to bear the cost of interest, penalties, and various fees will be determined in the loan agreement or credit card usage agreement. However, many times, customers do not read or if they do read, they do not understand it. Therefore, it is time to amend the laws, apply unified regulations on interest rates for all economic entities – high rates are high, and low rates are low, fair, reasonable, and consistent” – said lawyer Trương Thanh Đức.

Charging fees for freezing bank accounts?

TPBank stated that in the case where a customer’s account does not have any transactions but is not locked/closed, there will be an account fee after 6 months of continuous inactivity (5,000 VND/month). “TPBank does not charge a fee when the account balance is zero. The fee policy changes periodically, and at the moment, the bank only charges the fee for the previous period (5,500 VND) for accounts that have been inactive for 6 months” – said a representative of TPBank.