Deputy Prime Minister Le Minh Khai has asked the State Bank of Vietnam (SBV) to coordinate with relevant agencies to urgently and effectively perform the tasks, solutions and plans relating to stabilizing the gold market as directed in the Prime Minister’s dispatches and the Government Office’s documents.

At the same time, the Deputy Prime Minister requested the SBV to closely coordinate with relevant agencies in implementing inspections and controlling the gold market comprehensively, in a focused manner and in accordance with regulations.

In addition, the Deputy Prime Minister proposed to supervise and inspect the operations of gold trading enterprises, shops, distributors and buyers and sellers of gold bars, as well as other entities participating in the market.

The objectives are to ensure the stability, fairness, safety of the gold market, contribute to limiting the monetization of the economy; at the same time, ensure financial security, national currency and the development of a safe, healthy, effective and sustainable gold market. These tasks are required to be reported to the Prime Minister on the results of handling them in March 2024.

Gold prices have been soaring and setting new records, continuously experiencing strong fluctuations recently

Since the end of 2023, the government has repeatedly requested the SBV to take management measures for the gold market, not allowing the price of gold bars to diverge too much from the world price.

Recently, the Prime Minister requested the SBV to urgently evaluate Decree No. 24 on the management of gold business activities; propose effective solutions to manage the gold market in the new situation, to be completed in the first quarter of 2024.

Following the Prime Minister’s directive, the gold market has become more stable, but the price still fluctuates continuously. Recently, the price of gold has reached record highs, including rings and jewelry, while the SJC gold bars have reached nearly 82 million dong per tael, and then gradually cooled down.

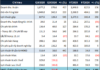

In the morning session today (March 19), Saigon BCS listed buying and selling gold prices at 79.9 – 81.9 million dong per tael, an increase of 500,000 dong per tael for both buying and selling compared to the close of the trading session on March 18. The price difference between buying and selling gold at SJC is 2 million dong per tael.

At the same time, the price of gold at DOJI Group is listed to buy at 79.8 – 81.8 million dong per tael, an increase of 500,000 dong per tael for both buying and selling in both directions compared to the close of the trading session on March 18. The price difference between buying and selling DOJI gold is currently 2 million dong per tael.

In the early hours of March 19 (Vietnam time), the world gold price on the Kitco exchange was trading at $2,159.5 per ounce, up $4.3 per ounce compared to the end of the afternoon session on March 18.

The conversion of the world gold price based on the exchange rates at Vietcombank on the morning of March 19: 1 USD = 24,890 VND, the equivalent world gold price is 64.75 million dong per tael, which is 17.15 million dong per tael lower than the selling price of SJC gold at the same time.