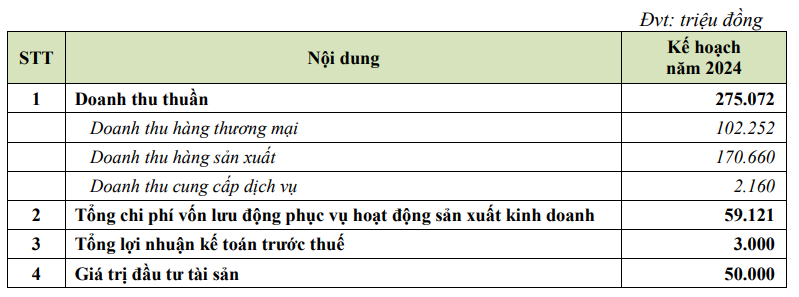

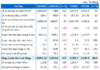

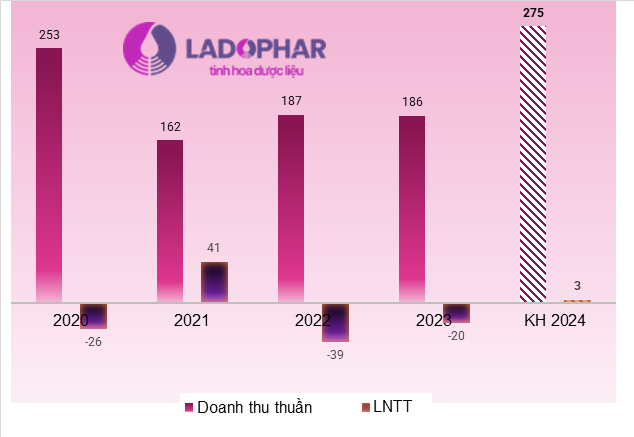

Specifically, LDP plans to achieve a revenue target of VND 275 billion, an increase of 48% compared to the previous year. In which, the commercial segment accounts for 37% (VND 102 billion); the manufacturing segment accounts for 62% (VND 171 billion). The pre-tax profit is expected to be VND 3 billion (a loss of VND 20 billion in 2023). The planned investment in assets is VND 50 billion.

|

LDP’s 2024 Plan

Source: LDP

|

In reality, LDP has incurred losses for two consecutive years (a net loss of nearly VND 39 billion in 2022). In 2024, SSI forecasts limited industry growth at 8.4%. Meanwhile, Mirae Asset forecasts the pharmaceutical industry’s value in 2024 to reach USD 7.89 billion (an increase of 9.1%), with the ETC channel (prescription drugs) growing faster than the OTC channel (over-the-counter drugs) thanks to the universal health insurance coverage reaching 93%.

Source: VietstockFinance

|

Therefore, the company plans to increase revenue for all product groups this year, focusing on finding and expanding distributors, agents, especially in untapped areas.

In addition, it will boost the ETC market in other provinces, focus on manufacturing products, increase research to expand the drug portfolio, target high-end pharmacy chains and functional food chains to increase profits, utilize the profits from previous contract customers and exports, expand the export market, and improve the quality of input materials.

Specifically, the ETC channel will depend on actual bidding plans. The bidding results in 2023 and 2024 will significantly contribute to this year’s revenue of LDP. Meanwhile, the OTC channel is targeted to streamline and standardize the portfolio to gain a competitive advantage in terms of price – also a priority for this year. As for the manufacturing segment, the goal is to ensure profitability, focusing on strategic products for development this year.

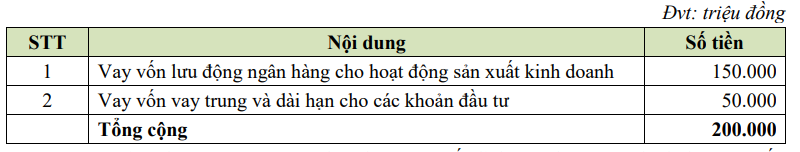

LDP also plans to submit the 2024 General Meeting of Shareholders for the approval of the borrowing limit to have enough resources to meet the business plan. The borrowing includes bank loans for supplementary working capital (VND 150 billion) and medium to long-term loans from credit institutions or support funds for investment in renovation, upgrading of plants, and equipment purchases (VND 50 billion). In total, the proposed borrowing limit is VND 200 billion.

|

LDP’s Borrowing Plan

Source: LDP

|

Regarding the remuneration plan, the company plans to allocate VND 15 million/month for the Chairman of the Board of Directors, VND 10 million/person/month for Board Members, VND 10 million/month for the Chief Accountant, VND 5 million/person/month for Members of the Accounting Department, and VND 5 million/month for the administrative staff (also the Secretary of the Board of Directors).

Selling 6.5 million shares to pay off debts

LDP will also present to the General Meeting of Shareholders a private placement plan for individuals or organizations as professional securities investors.

The expected number of shares to be offered is 6.5 million, corresponding to an increase of VND 65 billion in charter capital. If the private placement is successful, LDP’s charter capital will reach VND 192 billion.

The expected offering price is not lower than VND 10,000/share. The offered shares will be restricted from transfer for 1 year from the completion date. The estimated issuance time is in 2024.

The company stated that assuming a successful offering at VND 10,000/share, the proceeds of VND 65 billion will be used to pay off debts.

Chau An