Market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching over 859 million shares, equivalent to a value of over 21 trillion VND; HNX-Index reached over 76 million shares, equivalent to a value of over 1.5 trillion VND.

| Top 10 stocks with the strongest impact on VN-Index session 20/03/2024 |

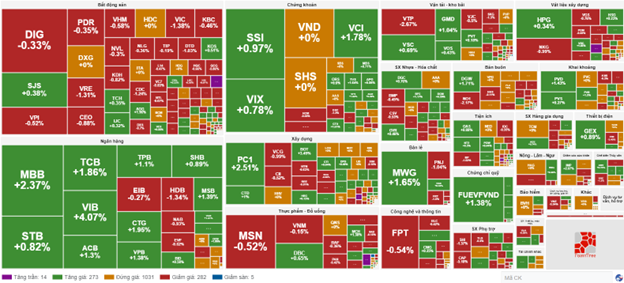

VN-Index opened the afternoon session with an optimistic atmosphere as buying force appeared right from the beginning of the session, pushing the index continuously up and closing near the day’s high. In terms of influence, BID, TCB, CTG, and MBB are the stocks that have the most positive impact on VN-Index with an increase of over 6.4 points. On the contrary, VIC, VHM, and VRE are the stocks that have the most negative impact, taking away more than 1 point from the index.

HNX-Index also had a similar trend, with the index being positively affected by stocks such as LAS (3.13%), L18 (2.81%), SHS (2.13%), BVS (1.92%),…

|

Source: VietstockFinance

|

The retail sector is the strongest recovering sector, with a 3.5% increase mainly coming from stocks like MWG (+5.49%), PNJ (+1.76%), and FRT (+0.2%). Following that are the agriculture – forestry – fisheries sector and the securities sector with increases of 3.25% and 2.48% respectively. On the contrary, the consulting and support services sector has the strongest decline in the market with a 1.02% decrease mainly coming from TV2 (-1.52%) and VNC (-1.09%).

In terms of foreign trading, this session the net selling of this group on HOSE was close to 561 billion VND, focusing on stocks like VIC (174.22 billion), VNM (69.02 billion), MSN (68.66 billion), and BID (50.38 billion). On HNX, foreign investors net bought over 2 billion VND, focusing on stocks like IDC (11.83 billion), TNG (3.88 billion), and HLC (2.21 billion).

| Foreign trading activity |

Morning session: Weakened money flow

At the end of the morning session, the index made efforts to recover after fluctuating right from the beginning of the session. However, the weakened money flow shows the cautious sentiment of investors. The main indexes all recorded growth; VN-Index increased by 6.26 points, to the level of 1,148.72 points; HNX-Index increased by 0.12 points, to the level of 236.29 points. The number of increasing stocks is temporarily slightly higher with 320 stocks up and 308 stocks down.

The trading volume of VN-Index recorded in the morning session reached over 374 million units, with a value of over 9 trillion VND. HNX-Index recorded a trading volume of nearly 30 million units, with a trading value of over 581 billion VND.

The banking sector is contributing the most positive growth to the index in the late morning session. Specifically, most of the stocks in this sector are in the green zone, such as CTG (+2.1%), TCB (+3.23%), VPB (+1.38%), MBB (+3.23), ACB (+2.05%), VIB (+4.98%), NVB (+1.9%), TPB (1.65%), LPB (+2.79%),…

On the other hand, the real estate sector saw a sharp decline right from the beginning of the session. Stocks like VHM (-1.05%), VIC (-1.38%), VRE (-1.87%), and NVL (-0.3%),…

At the end of the morning session, the banking, securities, retail, electrical equipment, and utilities sectors all showed good growth in the morning session. The remaining sectors such as rubber products, real estate, fishery, and food and beverages recorded relatively dull trading.

10:35 AM: Selling pressure still present

Liquidity continues to remain low and the main indexes fluctuate around the reference level, showing the cautious sentiment of investors. As of 10:30 AM, VN-Index decreased by 3.99 points, trading around 1,246 points. HNX-Index decreased by 0.35 points, trading around 235 points.

The large-cap stocks such as VIC, FPT, VHM, and HDB are negatively affecting the VN30-Index by taking away 0.66 points, 0.63 points, 0.31 points, and 0.31 points respectively from the overall index. On the contrary, the banking group stocks like TCB, MBB, VPB, and VIB are supporting the VN30 with a contribution of over 5 points.

Source: VietstockFinance

|

The banking sector is maintaining its positive and prominent performance in the group of leading stocks with VCB increasing by 1.19%, BID increasing by 0.39%, CTG increasing by 1.8%, and VPB increasing by 1.38%…. As of 10:30 AM, over 1,411 billion VND has poured into this sector and the trading volume has reached over 62 million units.

Meanwhile, the real estate sector continues to face many challenges as most of the stocks are in red. Specifically, VHM decreased by 1.05%, VIC decreased by 1.38%, VRE decreased by 1.87%, and NVL decreased by 0.3%…

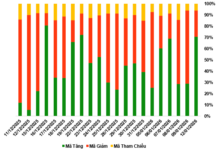

Compared to the market opening, the market breadth with the number of unchanged stocks is quite significant with over 1,000 stocks. The number of increasing stocks is 287 (including 14 limit-up stocks) and the number of decreasing stocks is 287 (including 5 floor-down stocks), showing a balanced breadth. The total trading volume on all 3 exchanges reached over 252 million units, corresponding to over 6.1 trillion VND.

Source: VietstockFinance

|

Market opening: Cautious at the beginning

A slight red color appeared at the beginning of the trading session. It shows the cautious sentiment of investors is still present in the market, the main indexes are slightly decreasing and fluctuating around the reference level.

VN-Index slightly decreased and traded around 1,240 points; HNX-Index went down to 236 points.

Red is temporarily dominating in the VN30 basket with 18 stocks down, 8 stocks up, and 4 stocks unchanged. Among them, GVR, VIC, and CTG are the stocks that have the biggest decrease in points. On the contrary, VIB, TCB, and VRE are the stocks that have the biggest increase in points.

The oil and gas sector is a highlight of the market with widespread green. Stocks like BSR increased by 0.53%, PVD increased by 0.79%, PVC increased by 0.69%.

The banking sector is one of the reasons for the market’s loss of points. Stocks like BID decreased by 1.36%, SSB decreased by 0.45%, and HDB decreased by 1.57%.

The real estate sector sank in red at the beginning of the trading session. Stocks like VHM decreased by 0.58%, DIG decreased by 0.50%, and PDR decreased by 0.52%.