Illustrative image

Oil rises to highest level in months on concerns over Russia’s supply

Oil prices rose to their highest level in months for the second consecutive session as traders assessed how Ukraine’s recent attacks on Russian oil refineries would affect global oil supply.

US benchmark West Texas Intermediate crude oil futures rose 75 cents, or 0.9 percent, to settle at $83.47 a barrel, the highest since October 27, 2023. Global benchmark Brent crude oil prices rose 0.6 percent to $87.38 a barrel, the highest since October 31, 2024.

Based on Hodes’ calculations, attacks on Russian oil refineries could lead to a reduction of about 350,000 barrels per day of global oil supply and push up US crude oil prices another $3 per barrel.

Even if the attacks do not directly result in a loss of Russian crude oil supply, there is still a spillover effect on oil prices as refined product profit margins skyrocket, analyst Bjarne Schieldrop of SEB Research wrote on Monday.

Oil has been supported by reduced crude oil exports from Saudi Arabia and Iraq, as well as signs of stronger demand and economic growth in China and the US.

Gold falls as the US dollar strengthens

Gold prices fell as the US dollar strengthened one day before the Federal Reserve signaled a position on interest rates at the end of its two-day policy meeting.

Spot gold fell 0.2 percent to $2,155.93 an ounce at 6:17 p.m. GMT, hovering near its lowest level in a week reached on Monday.

US gold futures fell 0.2 percent to $2,159.7. The US dollar rose 0.2 percent, after hitting a more than two-week high earlier in the session, making gold more expensive for foreign buyers.

Gold prices hit a record high of $2,194.99 an ounce on March 8, 2024, but fell nearly 1 percent last week as higher-than-expected US consumer and producer prices in February reduced hopes of an early Fed interest rate cut due to persistent inflation risks. Higher inflation forces the Fed to keep interest rates high, weighing on non-yielding gold.

Although the Fed is expected to keep interest rates steady on Wednesday, the market is awaiting comments from Fed Chairman Jerome Powell on the latest interest rate outlook.

Copper falls as the US dollar rises and investors take profit

Copper prices fell in London as investors took profit from a recent rally and the US Federal Reserve’s interest rate decision.

London Metal Exchange’s 3-month copper contract closed 1.3 percent lower at $8,971 per tonne.

The US currency is trading near its highest level since the beginning of March, making the dollar-denominated metal more expensive for buyers using other currencies. It also weighs on the prospect of top consumer China’s demand.

Among other base metals, tin and nickel were affected after supply disruptions at major producer Indonesia showed signs of easing as the country’s leading tin miner resumed exports.

Tin prices on the London Metal Exchange fell 4.7 percent to $27,360 per tonne, while nickel fell 2.8 percent to $17,370.

Indonesia has issued mining quotas for around 70 percent of its estimated annual nickel ore output in 2024 and also sets limits for tin ore, copper ore and bauxite, a raw material for aluminum production.

LME aluminum fell 0.3 percent to $2,271 per tonne, zinc fell 1.1 percent to $2,505, and lead rose 0.2 percent to $2,094.

Iron ore reaches highest level in nearly a week on China’s positive data, immediate delivery increases

Iron ore futures expanded their gains for a second consecutive session, reaching the highest level in almost a week, due to operational reserves in China.

Iron ore contract for May 2024 delivery on China’s Dalian Commodity Exchange (DCE) rose 5.35 percent to settle at 827 renminbi ($114.87) per tonne, the highest since March 13, 2024.

Iron ore for April 2024 delivery at the Singapore Exchange rose 2.91 percent to $106.9 per tonne, the highest since March 13, 2024.

China’s fixed asset investment rose 4.2 percent in the first two months of this year compared to the same period a year earlier, beating expectations of a 3.2 percent increase.

Iron ore trading volume at major Chinese ports rose 66 percent from the previous session to 1.06 million tonnes, data from consultancy Mysteel showed.

Coke prices and coking coal prices rose 3.59 percent and 2.49 percent respectively.

In Shanghai, rebar steel rose 2.85 percent, hot-rolled coil steel rose 2.99 percent, steel billet rose 2.14 percent, while stainless steel was little changed.

Wheat, corn rise sharply; soybeans fall

Wheat and corn futures on the Chicago Board of Trade (CBOT) rose sharply on technical moves as traders sought to unwind bearish positions ahead of uncertain spring weather and upcoming US Department of Agriculture reports, analysts said.

Soybeans fell due to huge supply pressure from South America and reduced demand from China for US soybeans.

CBOT wheat rose 9 3/4 cents, or 1.8 percent, to $5.52 1/2 per bushel.

CBOT corn rose on spillover strength from wheat and potentially adverse weather in the US Corn Belt. Corn rose 3 1/2 cents to $4.39 1/2 per bushel, while soybeans ended down 2 1/4 cents to $11.85 1/2 per bushel.

London cocoa stabilizes after reaching record high

Cocoa futures in London stabilized after hitting a record high as investors took profit despite sharply reduced supply from leading producers Ivory Coast and Ghana. London cocoa futures for July 2024 fell 0.6 percent to 6,118 pounds ($X.XX.XX) per tonne after setting a record high of 6,332 pounds. July cocoa futures in New York fell 1.6 percent to $7,403 per tonne after hitting a record high of $7,735 on Monday.

Sugar falls, coffee rises

Raw sugar futures for May 2024 fell 2.7 percent to 21.57 cents per pound due to improved harvests in India and Thailand. White sugar futures for May 2024 fell 1.6 percent to $617.80 per tonne.

Robusta coffee futures for May 2024 rose 0.4 percent to $3,355 per tonne. Arabica coffee rose 0.3 percent to $1.8100 per pound.

Japanese rubber falls to lowest in 3 days

The price of Japan’s rubber futures has fallen to its lowest level in three days after 10 days of gains due to weaker oil prices. The August 2024 rubber contract closed down 7.7 yen, or 2.17 percent, at 346.5 yen ($2.31) per kilogram, the lowest since March 15, 2024. On the Shanghai Futures Exchange (SHFE), May 2024 rubber futures fell 225 yuan, ending at 15,395 yuan ($2,138.43) per tonne. The price reached the daily price limit of 15,805 yuan at the beginning of the session.

The weather agency of Thailand’s largest rubber producer has warned of summer storms from March 19-20 that could damage crops.

The August 2024 rubber contract on Singapore Exchange for April 2024 delivery ended the session at 171.8 US cents/kg, down 0.87 percent.

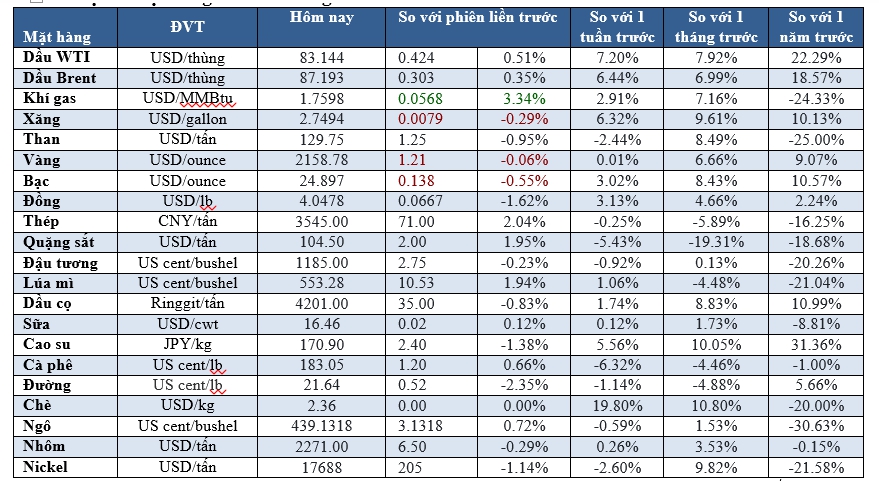

Key commodity prices on March 20, 2024 morning