Illustrative image

The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has recently simultaneously reduced deposit interest rates by 0.1 – 0.3% per annum in all terms, bringing the highest deposit interest rate below 5% per annum.

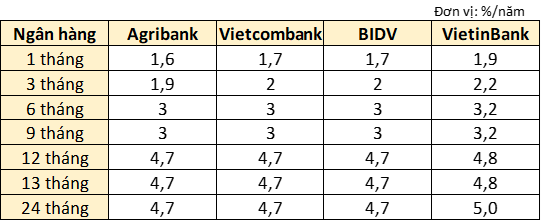

Specifically, the deposit interest rate for 1 – 2 months term has decreased from 1.9% per annum to 1.7% per annum; 3 – 5 months term has decreased from 2.2% per annum to 2% per annum; 6 – 9 months term has decreased from 3.2% per annum to 3% per annum; 12 – 18 months term has decreased from 4.8% per annum to 4.7% per annum; 24 – 36 months term has decreased from 5% per annum to 4.8% per annum.

Prior to BIDV, two banks in the Big4 group, namely Agribank and Vietcombank, had also reduced their savings interest rates below this level.

Since March 15, Agribank has adjusted and reduced interest rates on various terms.

Specifically, the 1-month term deposit interest rate has decreased from 1.7% per annum to 1.6% per annum; the 3 – 5 months term deposit interest rate has decreased from 2% per annum to 1.9% per annum;

For the 6 – 11 months term, the interest rate remains at 3% per annum. Meanwhile, the 12 and 13 months term deposit interest rate has decreased by 0.1%, from 4.8% per annum to 4.7% per annum; the 24 months term deposit interest rate has decreased from 4.9% per annum to 4.7% per annum.

Previously, Vietcombank also reduced its deposit interest rate below 5% per annum since the beginning of January 2023. Currently, the interest rate for deposits under 1 month at Vietcombank is 0.2% per annum; 1 – 2 months term is 1.7% per annum; 3 months term is 2% per annum; 6 and 9 months term have the same interest rate of 3% per annum;

The most preferential interest rate is currently applied by Vietcombank to individual customers, which is 4.7% per annum, for terms of 12 months or more.

Therefore, the deposit interest rate chart of Agribank, Vietcombank, and BIDV are quite similar. Meanwhile, VietinBank is currently the bank with the highest deposit interest rate among the Big4 group, slightly higher than the remaining banks by 0.1 – 0.3% per annum, depending on the terms.

Specifically, deposits from 1 month to less than 3 months in VietinBank have an interest rate of 1.9% per annum; 3 months to less than 6 months term will have a common interest rate of 2.2% per annum;

VietinBank applies an interest rate of 3.2% per annum for the 6 months to less than 12 months term; Individual customers will receive an interest rate of 4.8% per annum when depositing from 12 months to less than 24 months;

The highest deposit interest rate currently applied by VietinBank to individual customers is 5% per annum, for terms of 24 months or more. This is also the highest deposit interest rate among the Big4 group.

Source: Quoc Thuy synthesis

In March, the trend of adjusting and reducing deposit interest rates of most banks continued to be maintained, even some private banks such as ACB, Sacombank, VPBank, Techcombank maintained interest rates much lower than state-owned banks. However, some joint-stock banks have begun to raise deposit interest rates mainly on short terms of less than 5 months to attract more deposits after the Lunar New Year.

According to industry experts, although the deposit interest rates have decreased significantly, the amount of money deposited in the banking system is still at a record high level. Moreover, due to weak credit demand for production, consumption of goods has not improved, so most banks are not enthusiastic about increasing deposit interest rates to attract deposits. However, it is forecasted that credit growth will recover in the second quarter, which will make the system’s liquidity decrease and have the ability to push banks to increase deposit interest rates.

In a newly published analysis report, MB Securities (MBS) believes that the input interest rate has the potential to bottom out in the first quarter and is unlikely to decrease further mainly because credit demand is expected to increase in 2024.

“We forecast that the 12-month term deposit interest rate of major commercial banks may increase by an additional 25 – 50 basis points, return to the level of 5.25% – 5.5% in 2024,” said MBS.

Rong Viet Securities (VDSC) also believes that the contradictory adjustment of deposit interest rates by some banks in February, along with the increasing trend of interbank interest rates, may imply that deposit interest rates may gradually increase from the second quarter of 2024, earlier than the previous expectations of the analyst group that deposit interest rates may increase from the second half of 2024.