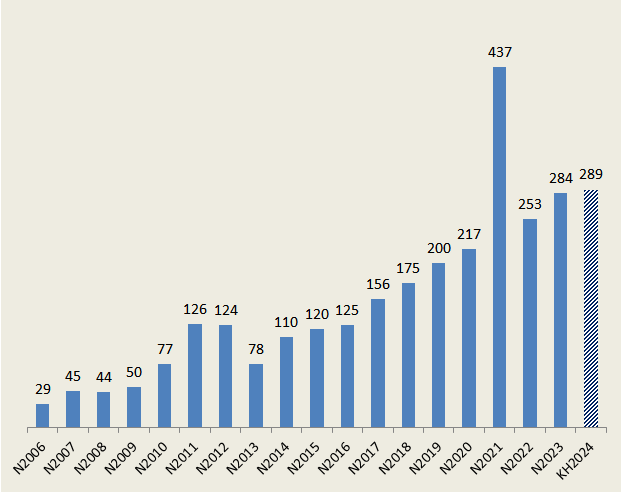

Our target is to achieve a profit before tax of VND 289 billion.

PGI states that the global economy continues to face many difficulties and challenges. According to economic surveys, the global economy is expected to continue to weaken in 2024. Although the global economic recession is diminishing, domestic political and geopolitical issues remain very challenging due to the impact of tight monetary policies, the Russia-Ukraine conflict, and the Israel-Hamas conflict in Gaza, which shows no signs of stopping.

According to PGI, motor vehicle insurance is the backbone of the non-life insurance market, accounting for a high proportion but facing many difficulties due to the continuous decline in car prices, weak market demand, and expectations of a prolonged impact until 2024.

Based on forecasts from Citigroup’s Global Commodities Research, global oil prices in 2024 are expected to decline. The degree of decline could be up to 30-50% compared to oil prices in 2023. As a result, the revenue of PGI’s cargo insurance business may correspondingly decrease.

“On September 6, 2023, the Government issued Decree No. 67/2023/ND-CP on compulsory liability insurance for motor vehicle owners, compulsory fire and explosion insurance, and compulsory construction investment insurance,” allowing insurance companies to increase/decrease premiums by 25%. In the face of competition, the conditions for reducing premiums will affect the insurance revenue trend, leading to a decrease,” assessed PGI.

On November 2, 2023, the Ministry of Finance issued Circular No. 67/2023/TT-BCT providing guidance on certain provisions of the Insurance Business Law and Decree No. 46/2023/ND-CP. PGI noted that when implementing the decree in 2024, there will be many new regulations directly affecting the exploitation work and insurance premium revenue.

In addition, PGI also states that bank interest rates continue to decline sharply, especially the Big 4 group, which ranges from 4.5-5%, a decrease of about 35% compared to the average deposit interest rate in 2023. Therefore, the revenue from deposit investments in 2024 will significantly decrease compared to 2023.

|

PGI’s business plan for 2024. Unit: Billion Vietnamese Dong

Source: VietstockFinance

|

With the negative factors mentioned above, PGI plans to have a flat business plan for 2024 with a total revenue of VND 4,769 billion. Of which, the original insurance revenue is VND 4,024 billion, almost unchanged from 2023. The expected profit before tax is VND 289 billion, a slight increase of 1%, and the dividend payout ratio in cash is 10% of the charter capital.

Change the logo

At this General Meeting, PGI’s Board of Directors will present to shareholders the plan to change the logo in order to strengthen brand promotion and business activities.

Source: PGI’s 2024 General Meeting Documents

|

Dividends for 2023 in cash at a ratio of 12%

In 2023, PGI achieved over VND 4,023 billion in original insurance revenue, a 7% increase compared to the previous year, contributing to a gross insurance business profit of nearly VND 731 billion, a 9% increase. In addition, the gross profit from financial activities increased significantly by 75% to over VND 105 billion, resulting in a net profit increase of over 12% to over VND 229 billion.

Compared to the target of achieving a pre-tax profit of nearly VND 256 billion (almost flat with 2022), the company exceeded the profit target in 2023 by 11%.

Therefore, the dividend payout ratio for 2023 proposed by PGI’s Board of Directors at the General Meeting is 12% of the charter capital, corresponding to the amount distributed to shareholders of VND 133 billion.

Khang Di