Need to eliminate the situation of “blowing the whistle while playing football”

Recently, when consulting the amendment of Decree 24, the State Bank of Vietnam branch in Ho Chi Minh City proposed a series of suggestions, requesting the State Bank to consider, research and develop policy mechanisms and regulations to limit the risk of cash purchases of gold. This proposal is aimed at preventing risks and potential issues in the gold business activities of enterprises, gold trading units, and ensuring compliance with anti-money laundering regulations.

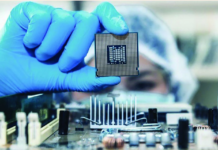

The SJC gold monopoly has caused gold prices to remain high. Photo: Như Ý.

In addition, the State Bank branch in Ho Chi Minh City also proposed considering appropriate management mechanisms to avoid monopolies and group interests for gold trading units to self-list gold prices.

Speaking with PV Tien Phong, Mr. Nguyen The Hung, Vice Chairman of the Vietnam Gold Business Association, said that according to the current regulations on anti-money laundering, organizations and individuals conducting gold transactions worth over 400 million VND must report to the State Bank. “The government’s policy is to promote non-cash payments. I think the legal framework is already in place, and gold cannot be an exception. Therefore, the above proposal will not have much impact on the gold market,” Mr. Hung said.

According to Mr. Hung, the important issue in managing the gold market lies in the monopoly and import of gold. Previously, the Gold Business Association raised many opinions with the State Bank regarding the amendment of Decree 24 on this issue. Currently, in the decree, the State Bank participates in the business and production of gold to supply to the market. Accordingly, the State Bank both has a monopoly on gold import and export and a monopoly on the production of SJC gold bars.

“So, the State Bank is currently blowing the whistle while playing football. The state should only manage but not conduct business…”, Mr. Hung said.

Mr. Hung said that the State Bank cannot provide raw gold because to produce gold, it must be imported. To import gold, it must use foreign exchange reserves. Accordingly, the State Bank cannot intervene in the market by using foreign exchange to purchase gold.

“The fact that the State Bank does not allow the import of gold is within their rights. That is why there is no source. Meanwhile, the domestic supply is scarce, leading to the current increase in gold prices,” Mr. Hung said.

Mr. Hung, Vice Chairman of the Vietnam Gold Business Association, affirmed that it is necessary to separate the management and business and give the business to the market. “Previously, there were up to 10 gold bar brands in the country and there was no significant price difference. Although SJC gold bars have the largest market share, people still have the right to choose different gold bar brands with only a price difference of tens of thousands of dong per tael. When applying Decree 24, there is only 1 brand of SJC gold bars and people have no other choice,” Mr. Hung said.

Mr. Hung added that Decree 24 has done well in preventing gold monetization. Currently, people no longer use gold for payments and do not excessively invest in gold as before, which cannot be called the monetization of the economy.

Can’t let the management agency do gold business

Mr. Hoang Van Cuong, Member of the Financial and Budget Committee of the National Assembly, said that the management agency cannot engage in gold business as it is currently doing. In 2012, people used gold for payment, so the State Bank stepped in for sole business. “I think this is a situational solution. However, now that there is no longer monetization, it is not necessary to have a monopoly,” Mr. Cuong said.

According to Mr. Cuong, all gold business enterprises must be equal. “It is illogical that there is a price difference of over 10 million dong per tael between SJC gold bars and other types of gold. When there is competition and no one imposes, the gold price will balance. If that is done, immediately the price of SJC gold will go down to match the price of other gold,” Mr. Cuong said.

Mr. Pham Xuan Hoe, former Deputy Director of the Institute of Banking Strategy, said that currently, the price difference between SJC gold bars and gold on the world market is up to 18 million dong per tael, even at times close to 20 million dong per tael. “This is extremely unstable. Because this price difference affects social psychology, it can cause risks and negative impacts on the safety of financial, monetary, and economic markets…”, Mr. Hoe said and considered that Decree 24 on gold market management issued 12 years ago has solved the “mess” of and gold market at that time. Accordingly, the State Bank is the exclusive agency for the production of gold bars, has a monopoly in the management of gold material import and export for gold production, and SJC is the national gold brand.

“It must also be admitted that Decree 24 was issued very timely and has had a fairly good effect. Until now, when the market has stabilized and gold has become a commodity, it is necessary to allow the gold market to develop normally,” Mr. Hoe said.