|

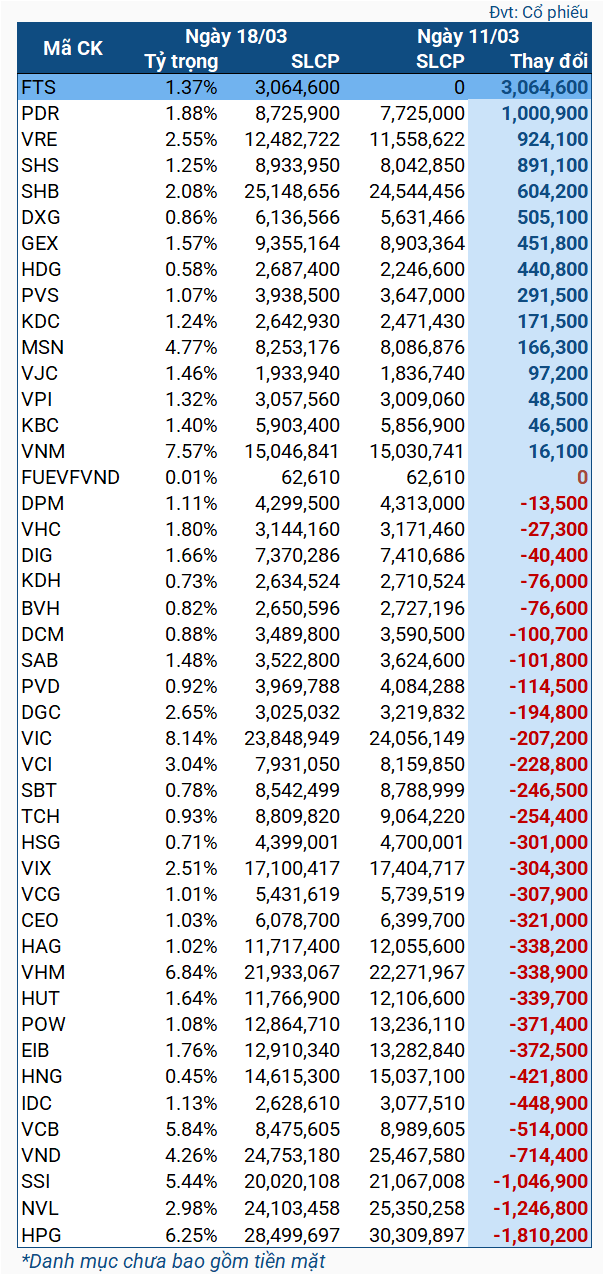

Changes in the portfolio of the VNM ETF fund from 11-18/03/2024

|

In detail, during this period, FTS was added to the portfolio with over 3 million shares – also the strongest purchased stock. In second place is PDR, with over 1 million shares. Additionally, VRE and SHS were also strong purchases, with a volume of around 900 thousand shares.

On the other hand, HPG was sold for over 1.8 million shares. NVL and SSI followed, with over 1.2 million shares and over 1 million shares respectively.

It is known that FTS is a stock added to the portfolio of the MarketVector Vietnam Local Index by MarketVector Indexes – the benchmark index of the VNM ETF – in the Q1/2024 review (announced in the early morning of 09/03, effective from 18/03/2024). According to forecasts, the fund will purchase about 3.2 million shares of FTS. Additionally, PDR and VRE are also forecasted to purchase about 1 million shares, while selling about 1.6 million shares of HPG, corresponding to what actually happened.

Will the FTSE ETF, VNM ETF, and Fubon ETF trade millions of shares of FTS, HPG, EIB?

FTS added to VNM ETF, forecasted to purchase over 3.2 million shares

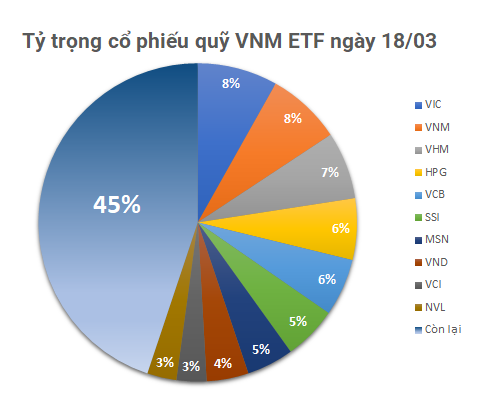

As of March 18th, the total assets value of the VNM ETF fund was $546 million, an increase compared to the $540 million on March 11th, consisting entirely of Vietnamese stocks and a small amount of cash. The top holdings belong to VIC (8.14%), VNM (7.57%), VHM (6.84%), HPG (6.25%), and VCB (5.84%).