Stock valuation remains reasonable

At the recent stock market seminar “Economic Recovery – Banks Leading the Way and Market Prospects,” Mr. Nguyen Minh Hoang, Head of Analysis Department at Nhat Viet Securities Corporation (VFS), believes that based on a strong macroeconomic foundation, the stock market is expected to experience positive developments in 2024.

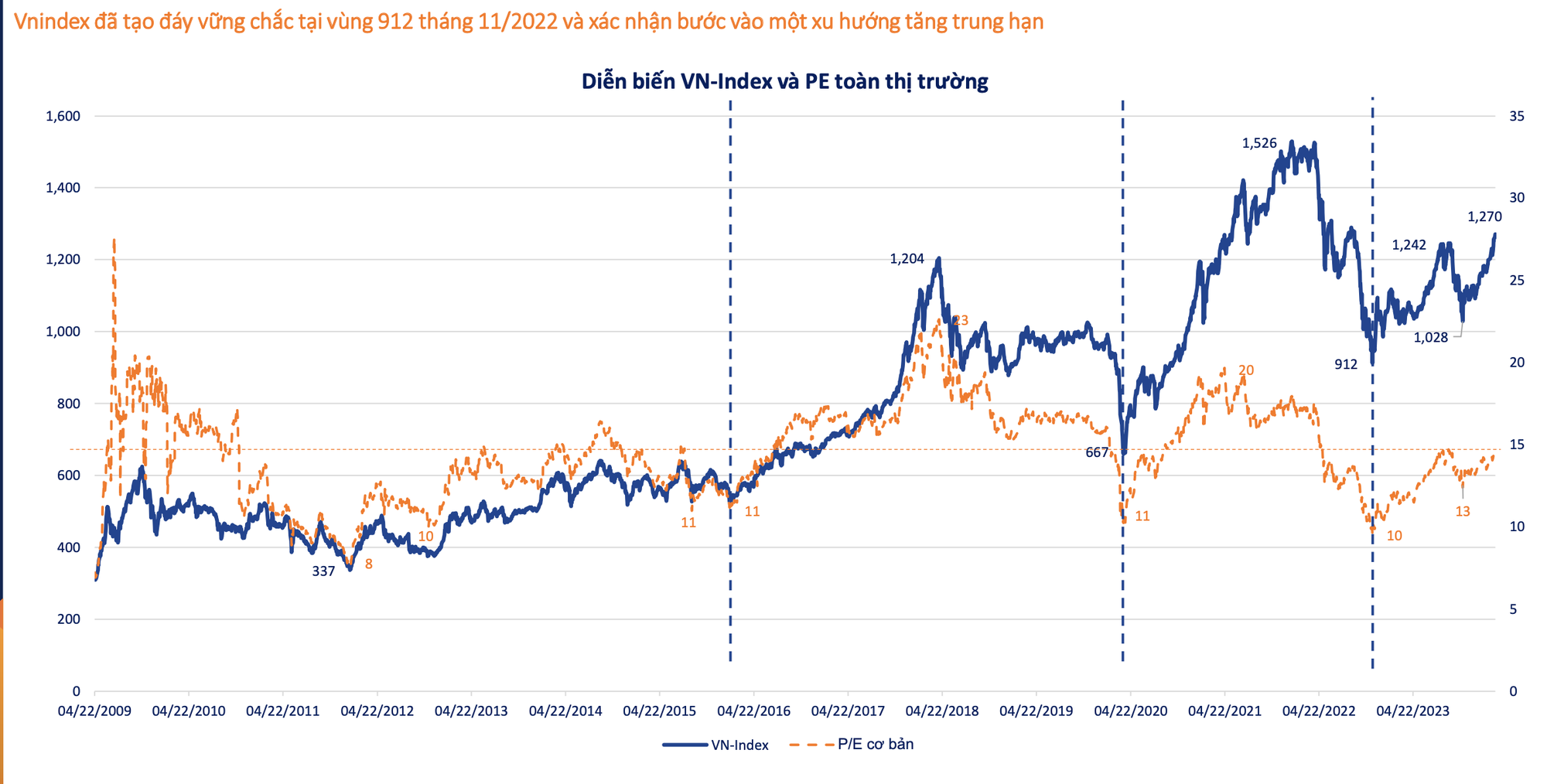

According to statistics on stock market trends and fluctuations of stocks and industry groups in 2023, despite the challenging economic conditions, there were 206 stocks that surpassed their 2022 market capitalization peak. The VN-Index also established a strong bottom at 912 points in November 2022.

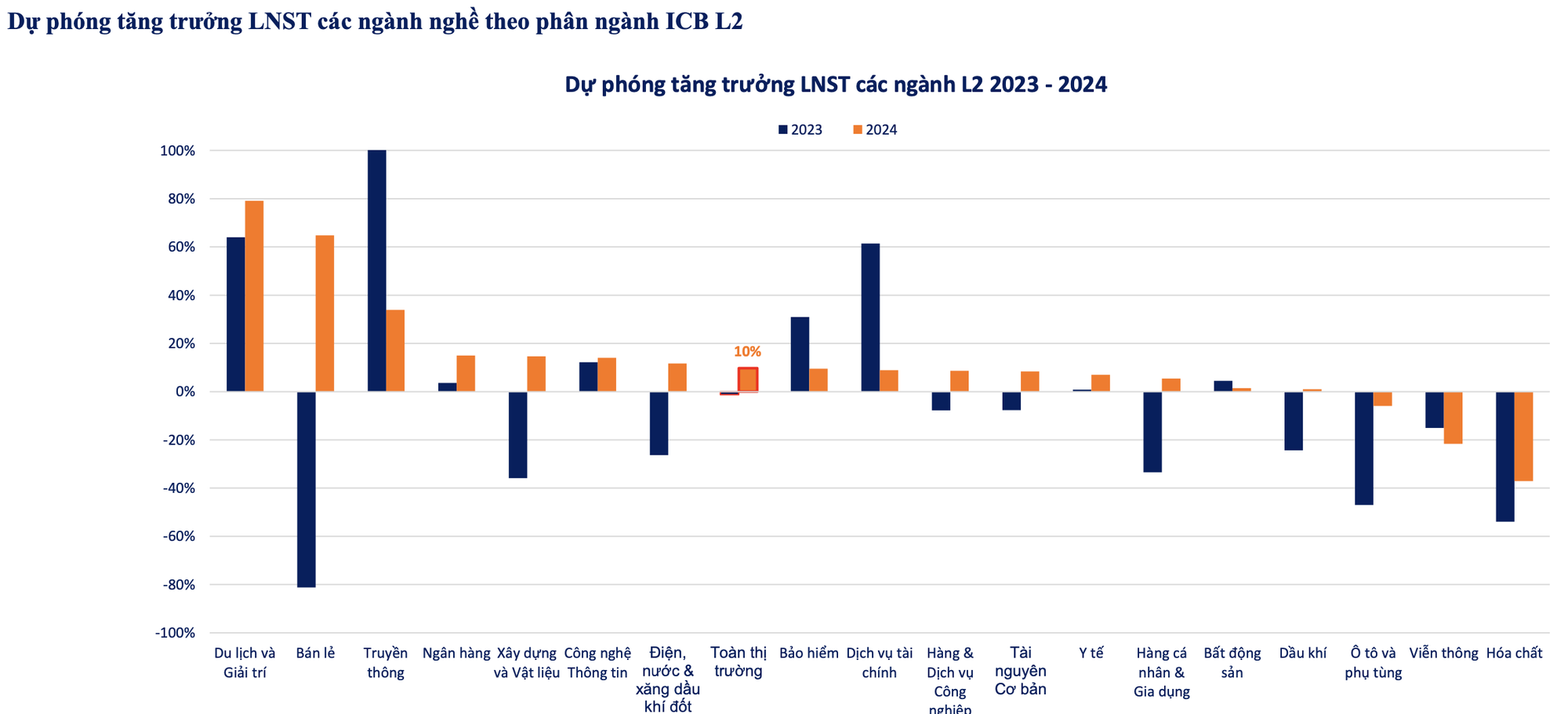

In addition, there has been a significant inflow of capital into the stock market in 2023, which sets the stage for a breakthrough in the market this year. Post-tax profits of businesses began bottoming out in Q4 2022 and Q1 2023, leading to an upward trend in many industry groups.

Therefore, Mr. Nguyen Minh Hoang believes that the stock market will experience significant growth in 2024, driven by the economic recovery, low interest rate environment, and their significant impact on the economy and business performance.

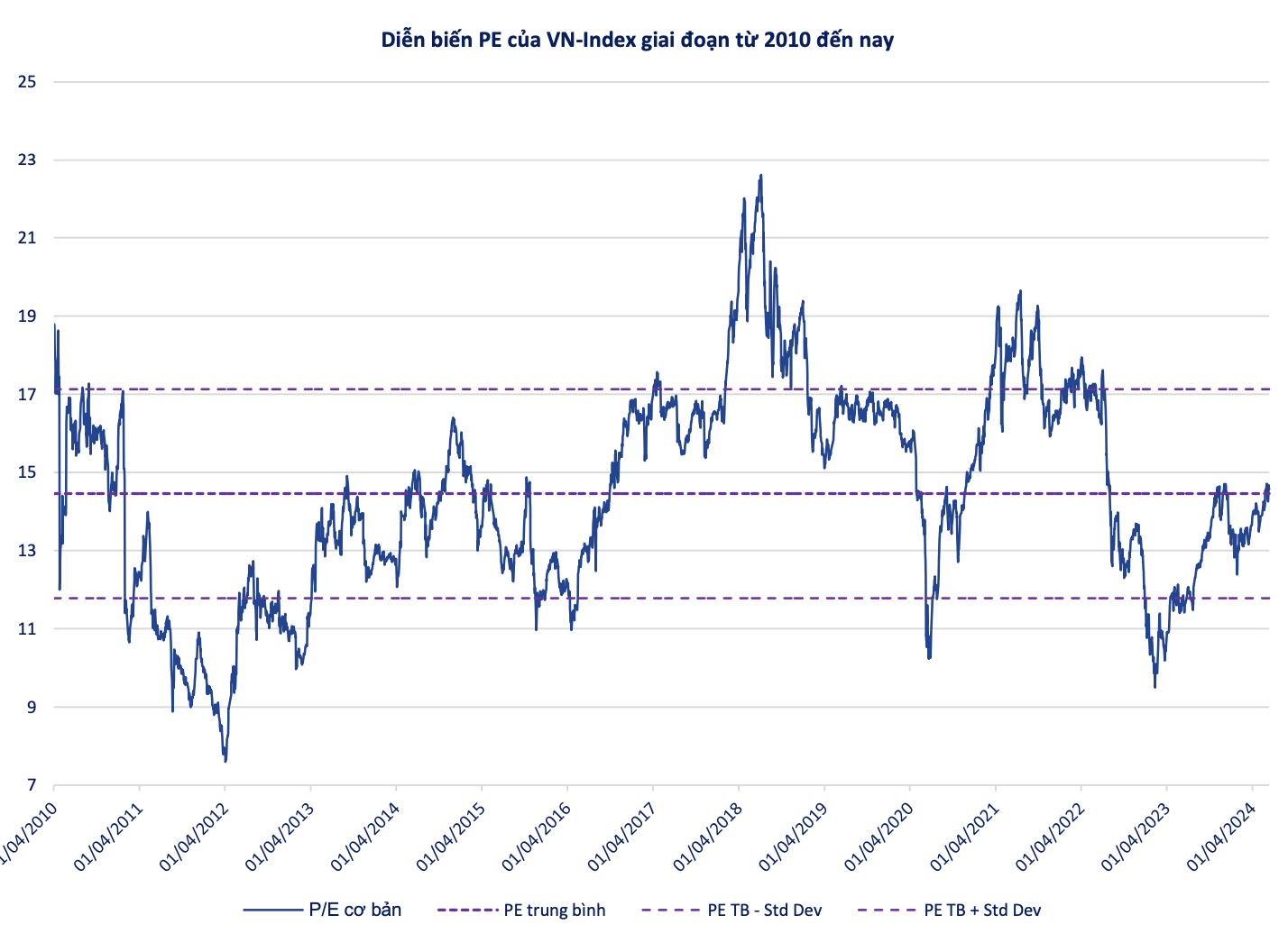

The current valuation of the VN-Index is around 14.3-14.5 times, which is the lower range of the VN-Index’s average valuation over the past 20 years. Typically, when the valuation is in the lower range, it is considered reasonable, and there is room for upward potential. When the market is fluctuating closer to the average line, a market correction becomes softer.

Possibility of an 8% discount on the VN-Index before it goes up

“Looking at the big picture for the year, experts believe that a correction is an opportunity. For example, in the correction on March 18, I believe that the VN-Index will follow an accumulation trend in a longer uptrend rather than a distribution trend. With a 200-point increase since the beginning of the year, equivalent to 12%, an 8% consolidation is reasonable for the VN-Index,” said VFS expert.

With expectations of increased corporate profits and an improved economy, Mr. Hoang presents two scenarios for the market. In the neutral scenario, the VN-Index could reach the range of 1,317 – 1,366 with a P/E ratio in the 13.5 – 14 range and 10% EPS growth. In the positive scenario, the VN-Index could reach the range of 1,391 – 1,441 with a P/E ratio in the 14 – 14.5 range and 12% EPS growth. The expert believes that there are three driving forces for the stock market’s upward trend:

(1) Stocks are still an ideal investment destination in 2024 while other investment channels remain sluggish. “A one-day increase in stock returns equivalent to a year of savings will be the story that continues to attract capital in the coming period,” said Mr. Hoang.

(2) The impact of sustained low interest rates will penetrate the economy and significantly affect the economy and business performance. During upward cycles, the initial low interest rate period often leads to strong index growth.

(3) Core business activities and post-tax profits of enterprises are improving and returning to growth.

Based on criteria such as profit growth, reasonable valuation, attractiveness of capital flow, and macroeconomic support stories, Mr. Nguyen Minh Hoang evaluates that the Banking, Real Estate, and Retail sectors will be the three promising industry groups for 2024.