The trial session of Ms. Truong My Lan and 85 other defendants in the Vạn Thịnh Phát case, Saigon Commercial Bank (SCB), and related units, is currently taking place and attracting attention due to the enormous amount of money drained from SCB, reaching hundreds of trillions of VND. The public questions the responsibility of the auditing firms in “overlooking” signs of misconduct in the business and financial situation of SCB.

Auditing “overlooking” misconduct for decades

According to the investigative agency, from 2012 to 2022, three top auditing companies, Ernst & Young Vietnam, Deloitte Vietnam, and KPMG Vietnam, conducted the financial statement audits of SCB.

Specifically, Ernst & Young Vietnam audited SCB from 2012 to 2016. Deloitte Vietnam audited SCB from 2017 to 2019. KPMG Vietnam audited SCB from 2020 to 2022. However, these auditing firms did not detect any abnormal signs in this bank.

Remarkably, during the 10-year period of auditing the financial statements of SCB, the auditors of these three companies seem to have not discovered anything unusual about the bank. The majority of the reports said “no issues found”, “reflected accurately”, and were in line with accounting standards…

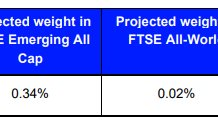

The three auditing companies reporting the financial statements for SCB are part of the Big4 auditing firms in Vietnam

Specifically, in the 2012 audit report and the 2013 semi-annual review report (the first reporting period the bank prepared a review report pursuant to regulations), Ernst & Young Vietnam auditors only noted some issues, including mentioning liquidity risks.

Accordingly, SCB had overdue debts for payment, including loans from SBV, deposits and loans from other credit institutions, and other debts. At the same time, there were also some overdue receivables that have not been recovered, causing difficulties in liquidity and business activities.

The bank had overdue receivables but extended them, so no provisions were made as required. Some overdue corporate bond investments also had no provisions made due to the absence of regulations at that time…

Or in the 2021 financial statements (the year of unexpected profit), the auditors of KPMG raised significant issues, emphasizing that readers pay attention to disclosures related to debt classification, provisions, and treatment of deferred interest as part of the bank restructuring project associated with bad debt handling in 2019-2020.

Meanwhile, in the 2020 audit report and the review report for the first 6 months of 2022, KPMG only highlighted that SCB was implementing the bank restructuring project associated with bad debt handling. KPMG auditors considered the financial statements of SCB to be accurate and reasonable, reflecting the key aspects and the consolidated financial situation of the bank.

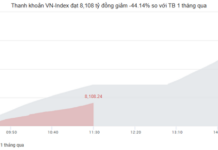

In fact, the financial statements in recent years always show that SCB consistently reported profits. From 2012 to 2019, SCB’s profits stagnated but then accelerated afterward.

For example, SCB’s profit in 2020 unexpectedly tripled compared to 2019, reaching 696 billion VND. In 2021, SCB achieved a remarkable profit of over 1.4 trillion VND. Before the case was prosecuted, SCB’s after-tax profit in the first half of 2022 reached 718 billion VND.

Regarding assets, SCB’s ratio of liabilities to total assets has consistently maintained a high rate of over 90% for many years. In 2019 and 2020, the ratio of liabilities to total assets exceeded 97%.

The report recorded SCB’s total assets as of June 30, 2022, reached 761.178 trillion VND, while the total liabilities were 738.054 trillion VND. Within the total liabilities, customer deposits reached 594.630 trillion VND, an increase of 16% compared to the beginning of the year.

Among the total customer deposits of 594.630 trillion VND in SCB as of the end of Q2/2022, 549.177 trillion VND came from individuals, accounting for 92.4% of the total customer deposits.

After the Ministry of Public Security’s investigation agency initiated the fraud and asset misappropriation case at Van Thinh Phat Group, the investigative agency has verified and assessed the financial situation of SCB.

Accordingly, the actual financial situation of SCB as of June 30, 2017, showed a bad debt ratio of 20.92%, while SCB’s report was only 0.61%; the CAR (Capital Adequacy Ratio) was 6.5%, while the reported figure for SCB was 10.06%; the proportion of real estate loans to total loans was 62.95%, while SCB’s report was 55% (the State Bank of Vietnam allows up to 55%)…

The review and assessment report showed that SCB had negative shareholders’ equity of 443.769 trillion VND and accumulated losses of 464.547 trillion VND. The investigation results showed that throughout the process, Truong My Lan’s group had “drained” over 1.06 million trillion VND from SCB.

Big4 auditing firms, trillion VND revenue but “peanuts” profit

It can be seen that the three auditing companies “overlooked” misconduct at SCB, which are three of the four companies in the Big4 leading auditing firms in Vietnam, including Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), and Klynveld Peat Marwick Goerdeler (KPMG).

With the auditing of 585 units benefiting the public, EY, PwC, Deloitte, and KPMG are serving about 35% of public companies in Vietnam.

However, despite their fame, when scrutinizing their business performance, the Big4 auditing firms’ profits are equivalent to small and medium-sized companies in Vietnam.

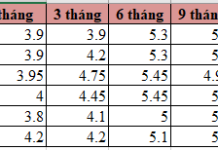

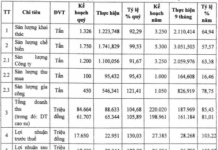

According to the Transparency Report 2023, Deloitte Vietnam achieved 568 billion VND in revenue in 2023, a decrease of nearly 50% compared to 2022. In which, the main contribution came from financial statement auditing services, including auditing non-public interest entities (493 billion VND), followed by auditing public interest entities (51 billion VND).

The total revenue of Deloitte Vietnam sharply decreased due to the decline in revenue from other services, dropping from 624 billion VND in 2022 to only over 12 billion VND in 2023. Deloitte Vietnam has 67 practicing auditors approved, and the company conducted audits for 85 public interest entities in 2023.

Ranking second in terms of revenue is KPMG with 669 billion VND, but its net profit is the lowest among the Big4 with just over 2 billion VND due to the total expenses of KPMG accounting for 667 billion VND. However, this level of profit increased by 53% compared to the previous year.

In 2023, KPMG Vietnam has 41 approved practicing auditors, and the company conducted audits for 134 public interest entities in 2023.

As the auditing firm with the highest total revenue of 1.376 trillion VND, EY achieved a net profit of only over 8 billion VND, an increase of 119% compared to the previous year. Notably, the total expenses reached 1.362 trillion VND, an increase of 22% compared to the previous year (with salary and bonuses for employees accounting for 703 billion VND).

In 2023, EY Vietnam has 59 approved practicing auditors, and the company conducted audits for 314 public interest entities in 2023.

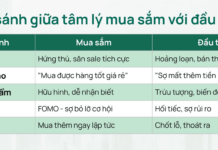

Despite being famous in auditing, each business activity in the Big4 group has its differentiation. PwC focuses mainly on auditing, accounting consulting, valuation, and IFRS report conversion consulting. EY specializes in tax, technology, and transaction advisory services.

Deloitte excels in accounting consulting and financial statements, breakthrough event consulting, accounting operations, and other assurance services. KPMG is strong in auditing, operational consulting, transaction consulting, tax consulting, and legal consulting.