Market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching over 859 million shares, equivalent to a value of over 21 trillion dong; HNX-Index reached over 76 million shares, equivalent to a value of over 1.5 trillion dong.

| Top 10 stocks with the strongest impact on VN-Index on March 20, 2024 session |

VN-Index opened the afternoon session with an optimistic atmosphere as buying force appeared right from the beginning of the session, pushing the index continuously increasing and closing near the highest level of the day. In terms of influence, BID, TCB, CTG, and MBB are the stocks that have the most positive impact on VN-Index with an increase of over 6.4 points. On the contrary, VIC, VHM, and VRE are the stocks that have the most negative impact as they took away more than 1 point from the index.

HNX-Index also had a similar trend, in which the index was positively affected by stocks like LAS (3.13%), L18 (2.81%), SHS (2.13%), BVS (1.92%),…

|

Source: VietstockFinance

|

The retail sector is the sector with the strongest recovery, increasing by 3.5% mainly driven by stocks like MWG (+5.49%), PNJ (+1.76%), and FRT (+0.2%). Following that is the agriculture-forestry-aquatic sector and the securities sector with growth rates of 3.25% and 2.48% respectively. On the contrary, the consulting and support service sector had the strongest decrease in the market with a decrease of 1.02% mainly from stocks like TV2 (-1.52%) and VNC (-1.09%).

In terms of foreign trading, this sector continued to sell net of nearly 561 billion dong on HOSE, focusing on stocks like VIC (174.22 billion), VNM (69.02 billion), MSN (68.66 billion), and BID (50.38 billion). On HNX, foreign investors bought net over 2 billion dong, focusing on stocks like IDC (11.83 billion), TNG (3.88 billion) and HLC (2.21 billion).

| Foreign investors’ trading activities |

Morning session: Weakened capital flow

At the end of the morning session, the index made efforts to recover after fluctuating right from the beginning of the session. However, the weakening capital flow indicates the cautious sentiment of investors. The main indices all recorded an increase; VN-Index increased by 6.26 points, to 1,148.72 points; HNX-Index increased by 0.12 points, to 236.29 points. The number of gainers temporarily exceeded the losers with 320 gainers and 308 losers.

The trading volume of VN-Index recorded in the morning session reached over 374 million units, with a trading value of over 9 trillion dong. HNX-Index recorded a trading volume of nearly 30 million units, with a trading value of over 581 billion dong.

The banking sector contributed most positively to the index growth at the end of this morning’s session. Specifically, most of the stocks were in green, such as CTG (+2.1%), TCB (+3.23%), VPB (+1.38%), MBB (+3.23), ACB (+2.05%), VIB (+4.98%), NVB (+1.9%), TPB (1.65%), LPB (+2.79%),…

On the other hand, the securities sector also recorded good growth in this morning’s session as most of the stocks were in green, such as SSI, VCI, VIX, FTS, BSI, MBS, CTS, AGR, BVS, TCI,…

Conversely, the rubber products sector, after a period of positive growth, decreased right from the beginning of the session. Stocks like DRC, CSM, SRC all had significant negative decreases.

At the end of the morning session, the banking, securities, retail, electrical equipment, and utilities sectors all had good growth in this morning’s session. The rest of the sectors, such as rubber products, real estate, seafood, and food and beverages saw subdued trading.

10:35: Selling pressure still persists

The trading volume continued to remain low and the main indices fluctuated around the reference level, showing the cautious sentiment of investors. As of 10:30, VN-Index decreased by 3.99 points, trading around the 1,246 level. HNX-Index decreased by 0.35 points, trading around the 235 level.

The large-cap stocks like VIC, FPT, VHM, and HDB are negatively affecting VN30-Index as they took away 0.66 points, 0.63 points, 0.31 points, and 0.31 points from the overall index, respectively. On the contrary, the banking group stocks like TCB, MBB, VPB, and VIB are supporting VN30 with a contribution of more than 5 points.

Source: VietstockFinance

|

The banking industry is maintaining the green color and is the most prominent in the group of leading stocks, with VCB increasing by 1.19%, BID by 0.39%, CTG by 1.8% and VPB by 1.38%…. As of 10:30, over 1.411 trillion dong poured into this group of industries and the trading volume reached over 62 million units.

Meanwhile, the real estate industry continues to face many ups and downs as the majority of stocks are in the red. Specifically, VHM decreased by 1.05%, VIC decreased by 1.38%, VRE decreased by 1.87%, and NVL decreased by 0.3%…

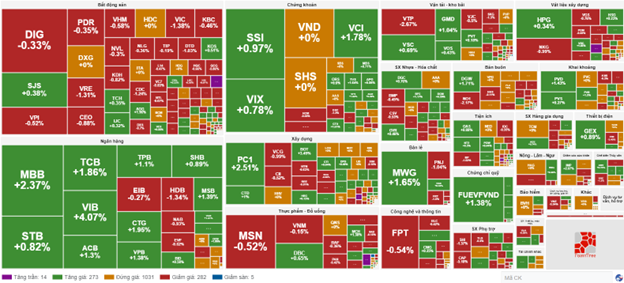

Compared to the opening, the market breadth with a significant number of stocks standing still with over 1,000 stocks. The number of advancing stocks was 287 (14 stocks reaching the ceiling price) and the number of declining stocks was 287 (5 stocks hitting the floor price), showing a relatively balanced breadth. The total trading volume on all 3 exchanges reached over 252 million units, equivalent to over 6.1 trillion dong.

Source: VietstockFinance

|

Opening: Cautious start of the session

A slight red color appeared at the beginning of the trading session. It indicates the cautiousness of investors that is still present in the market, as the main indices all showed a slight decrease and fluctuated around the reference level.

VN-Index slightly decreased and traded around the 1,240 level; HNX-Index reached the 236 level.

Temporary red dominated the VN30 basket with 18 decliners, 8 gainers, and 4 stocks standing still. Among them, GVR, VIC, CTG were the stocks with the strongest decrease. On the contrary, VIB, TCB, VRE were the stocks with the strongest increase.

The oil and gas sector stood out in the market with widespread green color. Stocks like BSR increased by 0.53%, PVD increased by 0.79%, PVC increased by 0.69%.

The banking sector is one of the reasons for the market’s point decrease. Stocks like BID decreased by 1.36%, SSB decreased by 0.45%, HDB decreased by 1.57%.

The real estate sector sank in red right from the beginning of the trading session. Stocks like VHM decreased by 0.58%, DIG decreased by 0.50%, PDR decreased by 0.52%.

Lý Hỏa