|

Changes in the portfolio of VNM ETF from 11-18/03/2024

|

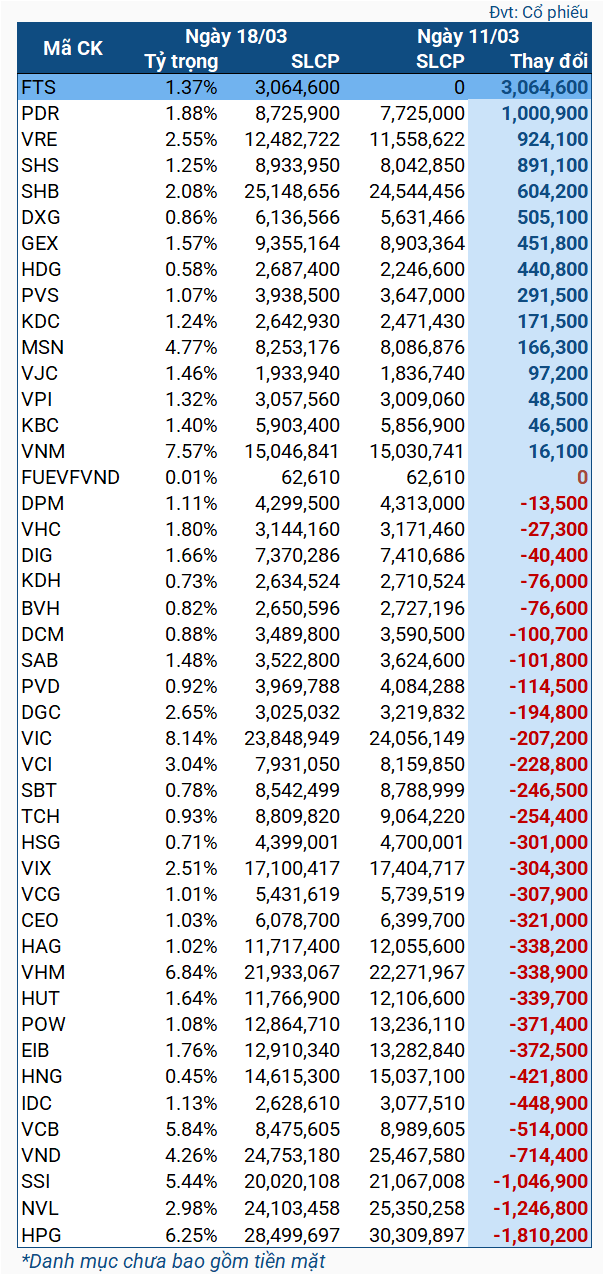

Specifically, during this period, FTS was added to the portfolio, with more than 3 million shares – also the highest buying volume. In second place is PDR, with over 1 million shares. In addition, VRE and SHS were also bought heavily, with a volume of around 900 thousand shares.

On the other hand, HPG was sold more than 1.8 million shares. NVL and SSI followed, with over 1.2 million shares and over 1 million shares respectively.

It is known that FTS is a new addition to the portfolio of MarketVector Vietnam Local Index by MarketVector Indexes – the benchmark index of VNM ETF – in the Q1/2024 review (announced in the early morning of 09/03, effective from 18/03/2024). According to forecasts, the Fund will buy about 3.2 million FTS shares. In addition, PDR and VRE are also expected to buy about 1 million shares, while selling about 1.6 million HPG shares, corresponding to what actually happened.

* Will the FTSE ETF, VNM ETF, and Fubon ETF trade millions of FTS, HPG, EIB shares?

* FTS to be included in VNM ETF, expected to buy over 3.2 million shares

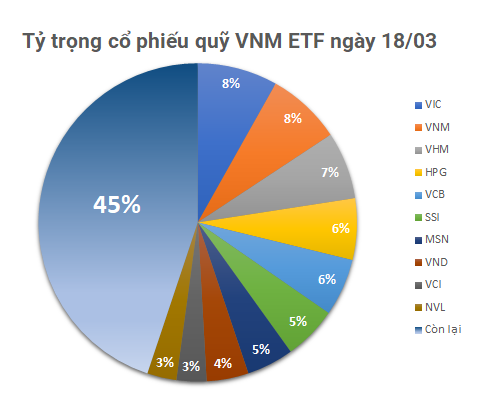

As of March 18th, the total asset value of VNM ETF was $546 million, an increase from $540 million on March 11th, consisting of Vietnamese stocks and a small amount of cash. The top holdings belong to VIC (8.14%), VNM (7.57%), VHM (6.84%), HPG (6.25%), and VCB (5.84%).