|

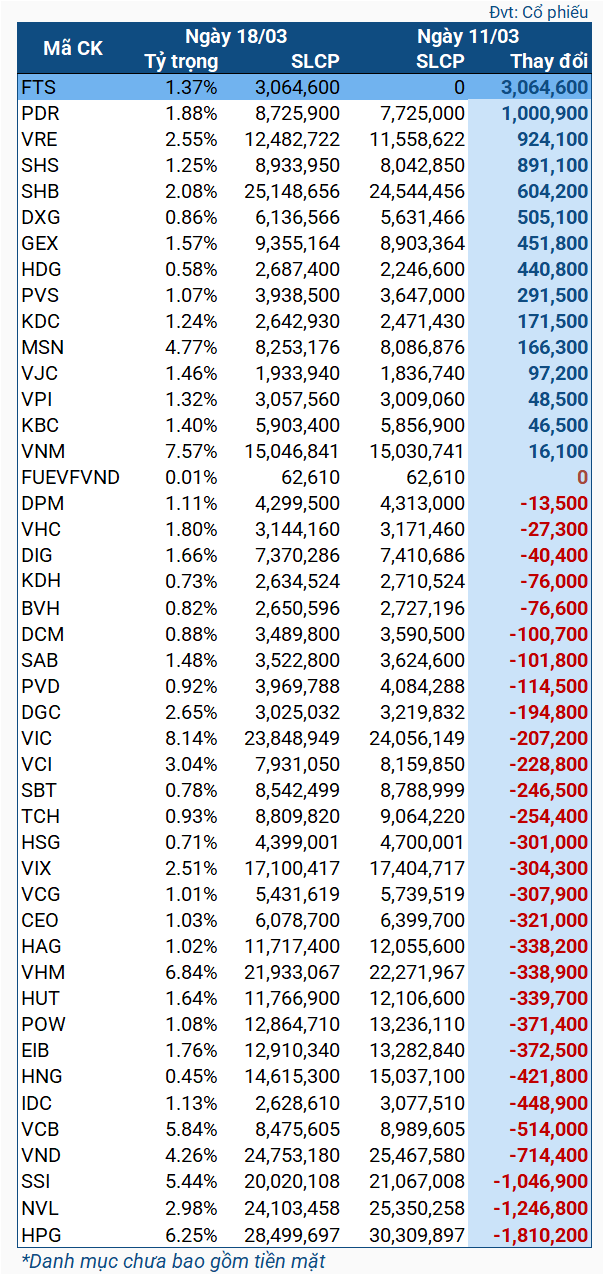

Changes in the portfolio of VNM ETF from 11-18/03/2024

|

Specifically, during this period, FTS was added to the portfolio, with more than 3 million shares – also the highest buying volume. In second place is PDR, with over 1 million shares. In addition, VRE and SHS were also bought heavily, with a volume of around 900 thousand shares.

On the other hand, HPG was sold more than 1.8 million shares. NVL and SSI followed, with over 1.2 million shares and over 1 million shares respectively.

It is known that FTS is a new addition to the portfolio of MarketVector Vietnam Local Index by MarketVector Indexes – the benchmark index of VNM ETF – in the Q1/2024 review (announced in the early morning of 09/03, effective from 18/03/2024). According to forecasts, the Fund will buy about 3.2 million FTS shares. In addition, PDR and VRE are also expected to buy about 1 million shares, while selling about 1.6 million HPG shares, corresponding to what actually happened.

Will the FTSE ETF, VNM ETF, and Fubon ETF trade millions of FTS, HPG, EIB shares?

FTS to be included in VNM ETF, expected to buy over 3.2 million shares

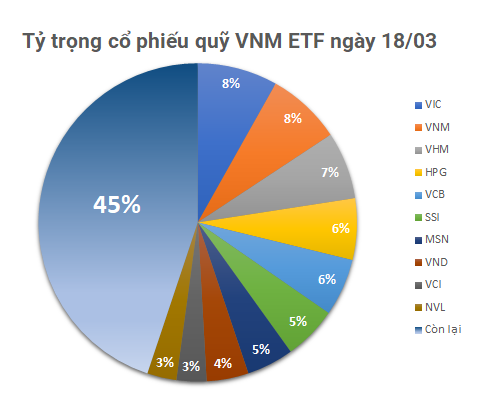

As of March 18th, the total asset value of VNM ETF was $546 million, an increase from $540 million on March 11th, consisting of Vietnamese stocks and a small amount of cash. The top holdings belong to VIC (8.14%), VNM (7.57%), VHM (6.84%), HPG (6.25%), and VCB (5.84%).