The average steel consumption per capita in Vietnam is currently estimated at about 240 kg, lower than the Asia average of 309 kg. The Vietnam Steel Association (VSA) projects that the steel demand in Vietnam could increase by an average of 5%-7% per year over the next 5 years, compared to a growth rate of 4.5% over the past 6 years, to achieve an average steel consumption per capita of 290 kg by 2030 with an expected population of 104 million.

This is driven by a stable GDP growth of about 6.5% per year, as well as increasing urbanization, stable FDI inflows, and the Vietnamese government’s target to disburse $123 billion in public investment in 2021-2025 (a 43.5% increase compared to 2016-2020), as well as a growing export market.

Vietnam’s main steel export markets are Southeast Asia, the EU and the US, Hong Kong, Taiwan, Japan, and South Korea, while the main import markets are China, South Korea, and Japan.

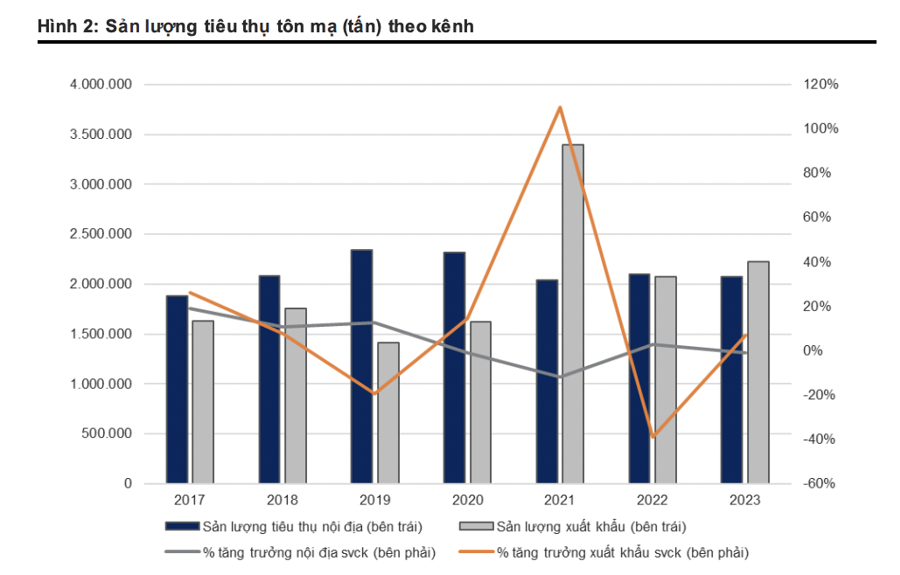

For the galvanized steel segment, the demand has seen stable growth from 2016-2023, with consumption volume growing at a compound annual growth rate of 6%. Of this, domestic steel consumption in Vietnam has grown at a compound annual growth rate of 4%, while exports have grown at a compound annual growth rate of 8%. The galvanized steel segment is expected to continue growing at a compound annual growth rate of at least 6% in the period 2024-2026, equivalent to the growth rate of the previous 8 years.

According to Fitch-ratings, steel demand will continue to grow in most regions by 2024, with global consumption expected to increase by 20-30 million tons compared to 2023. The growth in demand is supported by a vibrant Southeast Asian market, a strong recovery in Turkey, and modest growth in Europe, the US, and Brazil, while China’s demand is expected to decline.

VnDirect believes that the real estate market will start to grow significantly by the end of 2024 due to the following factors: Declining mortgage interest rates: Floating mortgage interest rates are currently around 10-11% in the second half of 2023, and are expected to decrease to 8-9% in 2024, stimulating demand for home purchases and real estate investments.

Boosting public investment: The government’s public investment target will drive Vietnam’s urbanization rate, leading to a high demand for housing in the coming years.

Provincial/city planning: Most provincial/city plans have been approved by 2023, providing the foundation for the implementation of detailed projects (at the scale of 1/2000 and 1/500).

The revised land law was approved in January and will expedite the legal licensing process once the guiding decrees are issued. Therefore, it is expected that the housing supply will gradually increase, helping increase the steel consumption for HPG, HSG, NKG.

HRC price differentials between regions: North American spot HRC prices have remained high for the past three months at $1,100 per ton, double the price of Vietnam’s HRC due to the strike by the United Auto Workers (UAW) while freight rates have remained relatively stable. Price differentials between regions create favorable conditions for Vietnam’s steel exports to the US and the EU.

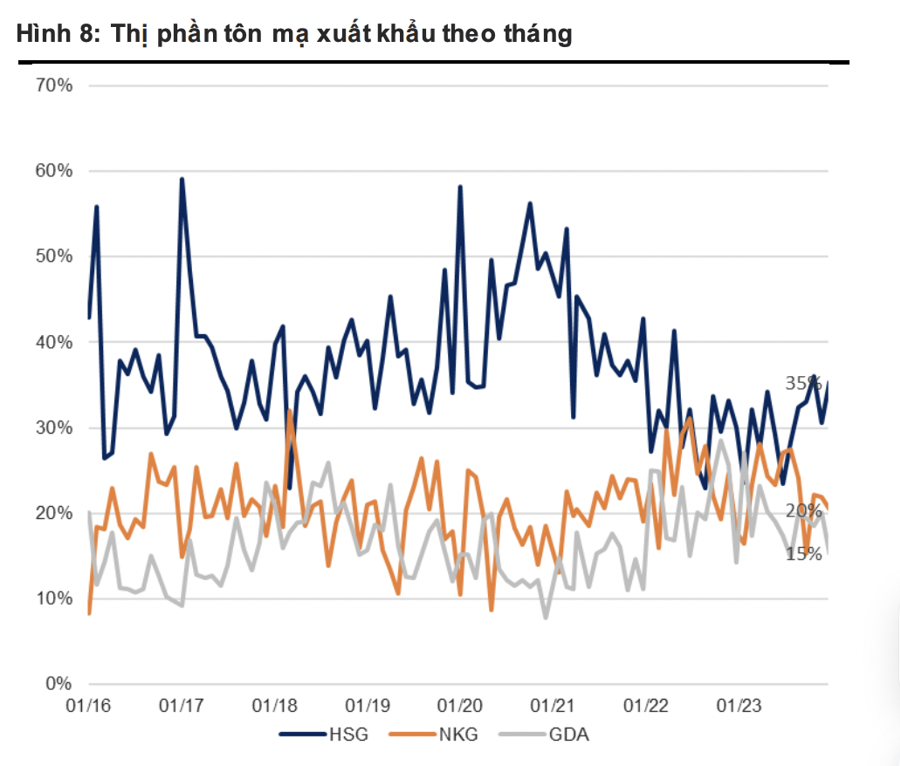

Currently, HSG holds the largest market share among galvanized steel producers with a domestic market share of 25.5%, followed by GDA and NKG with 16% and 10% respectively. In terms of exports, HSG has the advantage with a 30.5% market share, followed by NKG with 23% and GDA with 19.4% by the end of 2023.

HSG dominates the galvanized steel market in the northern region with a stable market share of 30% and 27% in the central region. However, fiercer competition occurs in the southern region, where both GDA and HSG hold a 23% market share by the end of 2023.

In terms of stocks, VnDirect recommends a positive outlook and a potential price increase of 52% with a target price of VND 34,000 for HSG. Net profit of HSG is expected to double in 2024 to VND 1,615 billion and increase by 66% compared to the same period in 2025 after a sharp decline in 2023. With an ROE of 15% and 21% in 2024-25 and a good leverage ratio, HSG should be traded at a P/B ratio of 1.5 times instead of the current P/B ratio of 1.1 times.

At the same time, a positive recommendation is made for NKG with a potential price increase of 46% corresponding to a target price of VND 35,000 per share. NKG’s profit is expected to increase significantly to VND 853 billion ($35 million) in 2024 from a low base in 2023. With an ROE of 16% and 19% in 2024-25, but with a relatively high leverage ratio, NKG should be traded at a target P/B ratio of 1.2x instead of 1.1x in 2024.