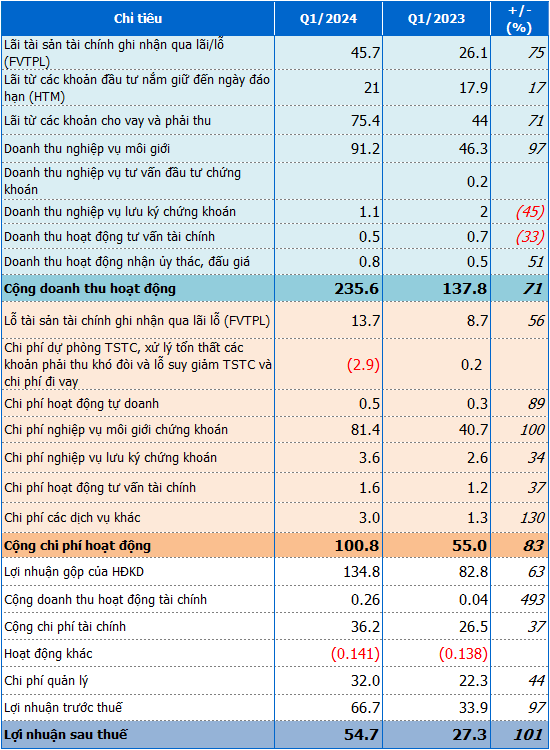

According to the Q1 2024 financial statement, BVS recorded operating revenue of over 235 billion VND, an increase of 71% compared to the same period last year, with revenue from core activities growing strongly. Of which, brokerage services brought in more than 91 billion VND, up 97%; interest from financial assets recorded through profit/loss (FVTPL) increased by 75% to 46 billion VND; and interest from loans and receivables was over 75 billion VND, up 71%.

Operating expenses recorded 101 billion VND, a rise of 83%. The largest expense was brokerage services, which increased by 100%.

With the above changes in revenue and expenses, BVS had a post-tax profit of 55 billion VND, more than double the same period last year. The post-tax profit implemented was over 49 billion VND, nearly 5 times higher. In 2024, BVS set a target of post-tax profit to decrease by nearly 8%, to 181 billion VND. However, the target post-tax profit implemented increased by nearly 5%, to 165 billion VND. After the first 3 months of the year, the company achieved about 30% of both post-tax profit targets.

BVS sets post-tax profit target for 2024 to decrease by nearly 8%

Margin lending increased by 15% compared to the beginning of the year

At the end of the first quarter, BVS‘s total assets were over 6,721 billion VND, an increase of 12% compared to the beginning of the year. Of which, margin lending outstanding was nearly 3,111 billion VND, accounting for 46% of total assets and an increase of 15%.

Financial assets available for sale (AFS) were at 160 billion VND, up nearly 7%. The total HTM portfolio consisted of bonds (104 billion VND) and other HTM assets (1,499 billion VND), down 6%.

In addition, the value of financial assets FVTPL recorded nearly 615 billion VND, down 16%. This portfolio is balanced between stocks and bonds, 237 billion VND and 307 billion VND respectively, at fair value. The equity investment provisionally gained 14%, compared to the original price of 208 billion VND. In addition, this portfolio also has listed fund certificates, over 71 billion VND.

On the other side of the balance sheet, BVS‘s liabilities were nearly 4,331 billion VND, of which short-term borrowings accounted for the majority (4,084 billion VND, up 22%).