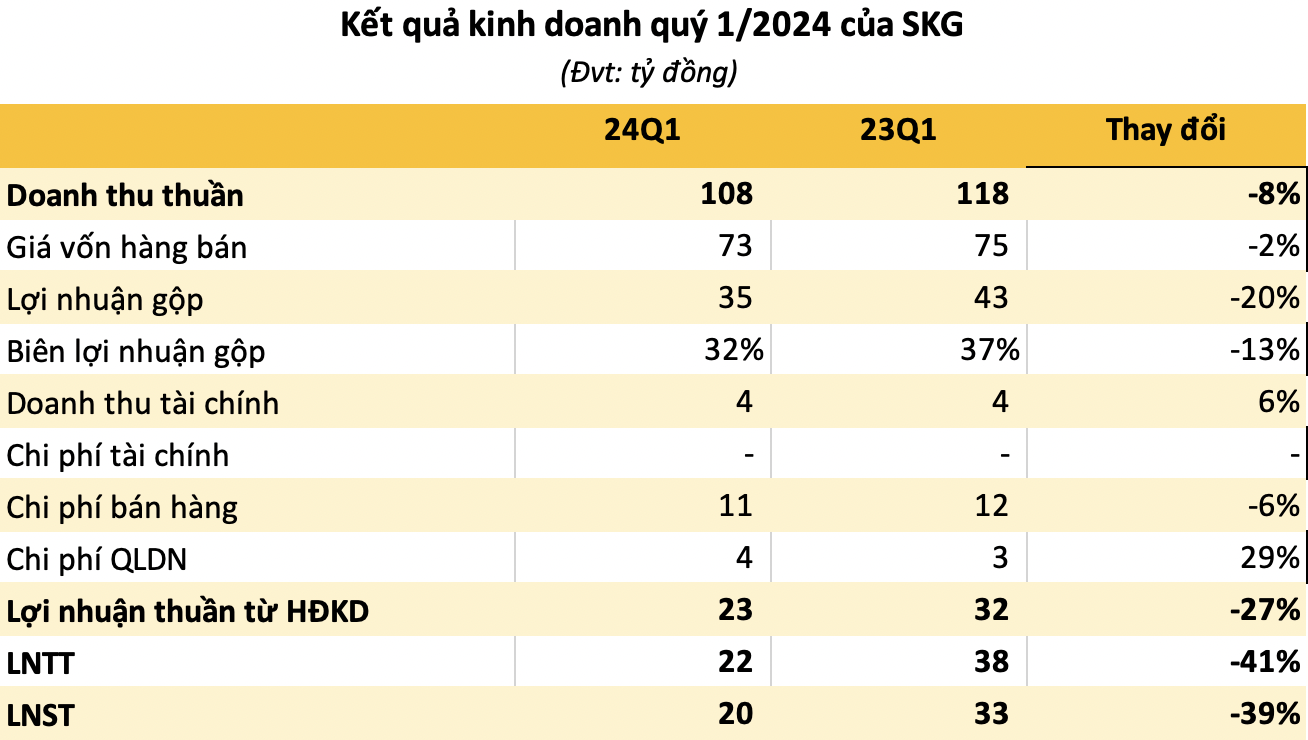

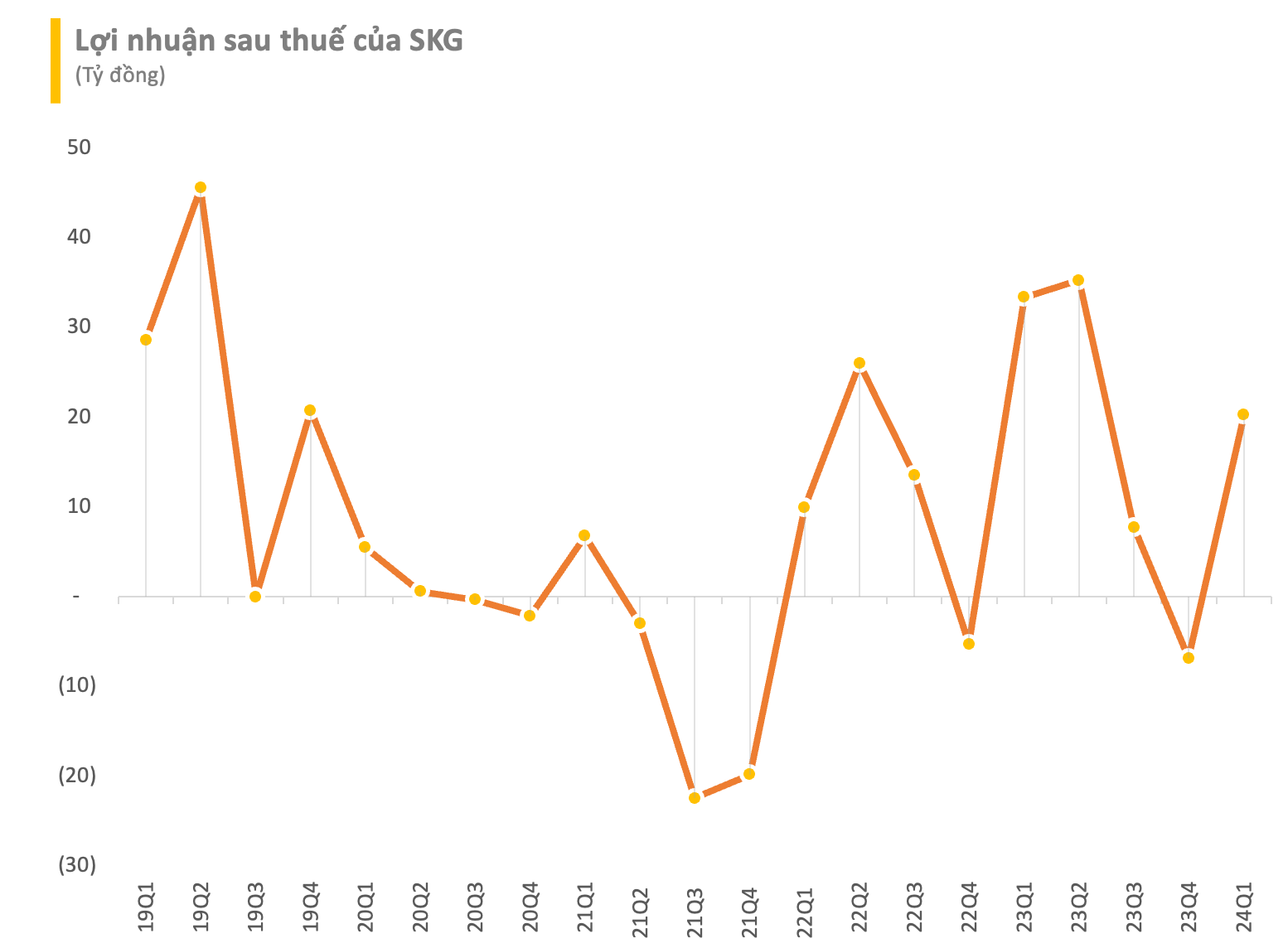

Superdong – Kien Giang High-Speed Ferry Joint Stock Company (stock code SKG) has just announced its Q1/2024 financial report with net revenue reaching 108 billion VND, a decrease of about 8% compared to the same period last year. After deducting the cost of goods sold and expenses, the company recorded pre-tax profit of 22 billion VND and after-tax profit of 20 billion VND, down by about 40% year-on-year.

According to the company’s explanation, the revenue in the first quarter decreased amidst a context where the revenue of the Rach Gia – Lai Son, Soc Trang – Con Dao, Phan Thiet – Phu Quy routes increased, but the revenue of the Ha Tien – Phu Quoc and Rach Gia – Phu Quoc routes decreased due to competitive pressure on price.

In addition, other profits decreased by 98% to over 138 million because in the same period of 2023, the company had income from the sale of 2 ferries.

As of March 31, 2024, SKG’s total assets reached 918 billion, an increase of 21 billion, equivalent to about 2% compared to the beginning of the year, including 205 billion VND in cash, cash equivalents, and deposits. In addition, short-term advances to suppliers were recorded at nearly 225 billion.

On the other side of the balance sheet, SKG recorded no loans, and equity reached 902 billion, up by 2% compared to the beginning of the year, in which more than 249 billion VND was undistributed post-tax profit.

Superdong – Kien Giang is a company that operates 16 high-speed ferries and two ferries specializing in transporting passengers, vehicles, and goods from the mainland to Phu Quoc, Nam Du, Con Dao, and Phu Quy. This is one of the shipping companies holding a large market share in sea transportation to famous tourist islands.

On April 26, Superdong – Kien Giang is scheduled to hold its 2024 annual general meeting of shareholders, submitting to shareholders a business plan with a net revenue target of 431 billion VND and post-tax profit of over 73 billion VND, a respective increase of approximately 5% compared to the 2023 target. The dividend forecast is 5%. Thus, after the first quarter, the company achieved 25% of its revenue target and 28% of its profit target.

In 2024, SKG assesses that the demand for high-speed ferry travel and tourism is increasing, especially for sea and island tourism. This trend provides the company with an opportunity to expand its market, increase its revenue, and boost its profits. However, this also requires the company to improve the quality of its services, innovate its technology, and seek new solutions to enhance its competitiveness, such as developing new services, improving customer experience, and building its brand. SKG will study the growth of tourism in the destinations it currently serves and the travel demand of passengers to arrange appropriate operating plans that meet customer needs and avoid wasting resources.

On the other hand, the company’s business activities in the next few years, especially in 2024, are still expected to face many difficulties that will put pressure on both business efficiency and profit growth. SKG believes it will have to compete with many different rivals in terms of price, service, and quality. Factors such as weather, fuel prices, and government policies remain volatile and subject to change; therefore, the company needs to focus on investing capital in improving/building new vehicles, adding more professional staff/crew members, and building an effective management system to compete in a highly competitive environment.

In the stock market, at the close of trading on April 17, the price of SKG shares reached 15,300 VND/share.