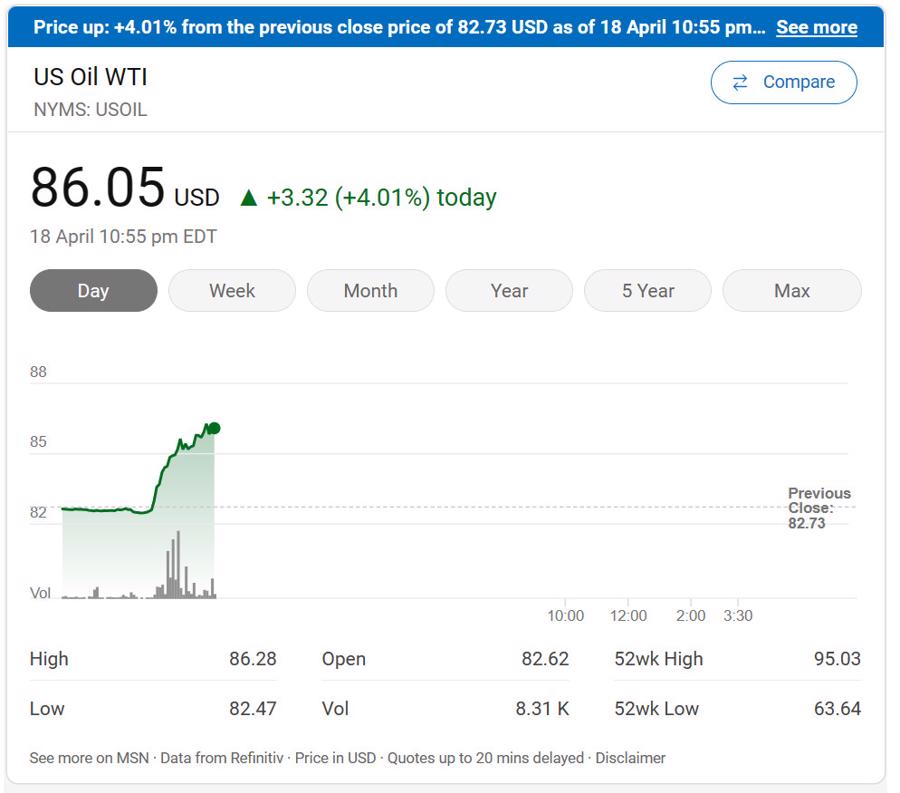

Oil prices rose sharply on Tuesday after ABC News reported that Israel may have conducted retaliatory strikes on Iranian territory, sparking concerns of escalating tensions in the Middle East that could disrupt oil supplies.

As of 10 am EST on Tuesday, the price of West Texas Intermediate (WTI) crude in New York rose by more than 4% at one point to over $86 per barrel. Prices later eased slightly and are currently trading around $85 per barrel, a gain of over 3% from Monday’s close. Brent crude in London gained over 3% to more than $90 per barrel.

ABC News cited an unnamed U.S. official saying that Israel had launched missile strikes on Iran in response to Tehran’s strikes on Israeli territory on April 13.

Several news outlets, including Iran’s Fars News Agency, reported earlier on Tuesday that there were three loud explosions near a military base housing fighter jets in the northwestern city of Isfahan in central Iran. The cause and extent of the damage are not immediately clear.

The reported explosions came hours after Iranian Foreign Minister Hossein Amir-Abdollahian told CNN that if Israel took further military actions against Iran, Tehran would respond “immediately and to the full extent.”

“Should the attack be confirmed as being perpetrated by Israel, it would further escalate the already fraught situation in the Middle East. The market fears that the situation could deteriorate to a point where the risk of supply disruptions materializes into actual supply disruptions,” Warren Patterson, head of commodities strategy at ING, said in a note.

Last week, Iran launched more than 300 drones and missiles at Israel in retaliation for the Israeli airstrikes on Iranian facilities in Syria earlier this month. Most of them were intercepted before reaching Israeli territory, and damage and casualties were reportedly minimal.

The reports of Tuesday’s attack on Iranian territory also sent gold prices higher, pushing them above the $2,400 level, which has been seen as a major resistance point amid pressure from the prospect of higher interest rates for longer in the U.S.

Spot gold in Asia climbed to $2,417.79 per ounce, while June gold futures rose to $2,433 an ounce. Spot prices are nearing their record high of $2,430.96 set last week.

Concerns about escalating conflict in the Middle East have kept demand for safe-haven gold high despite recent hawkish signals from the U.S. Federal Reserve.

With Tuesday’s gains, gold is on track for a fourth consecutive weekly rise. Spot gold has gained around 3% in the past seven days.

Other precious metals also rose after the news of the attack. Platinum gained 0.9% to $958.10 an ounce, while silver rose 1.1% to $28.70 an ounce.