The stock market recorded a not very positive trading session on April 19 with the VN-Index dipping in the red the entire time. The main index at one point lost up to 27 points, then narrowed the decline significantly, however, selling pressure once again caused the VN-Index to have another session down more than 1%. At the end of the session, the VN-Index decreased by 18.16 points to 1,174.85 points. Foreign block transactions became a bright spot when they suddenly reversed to a net buy of VND656 billion in the whole market.

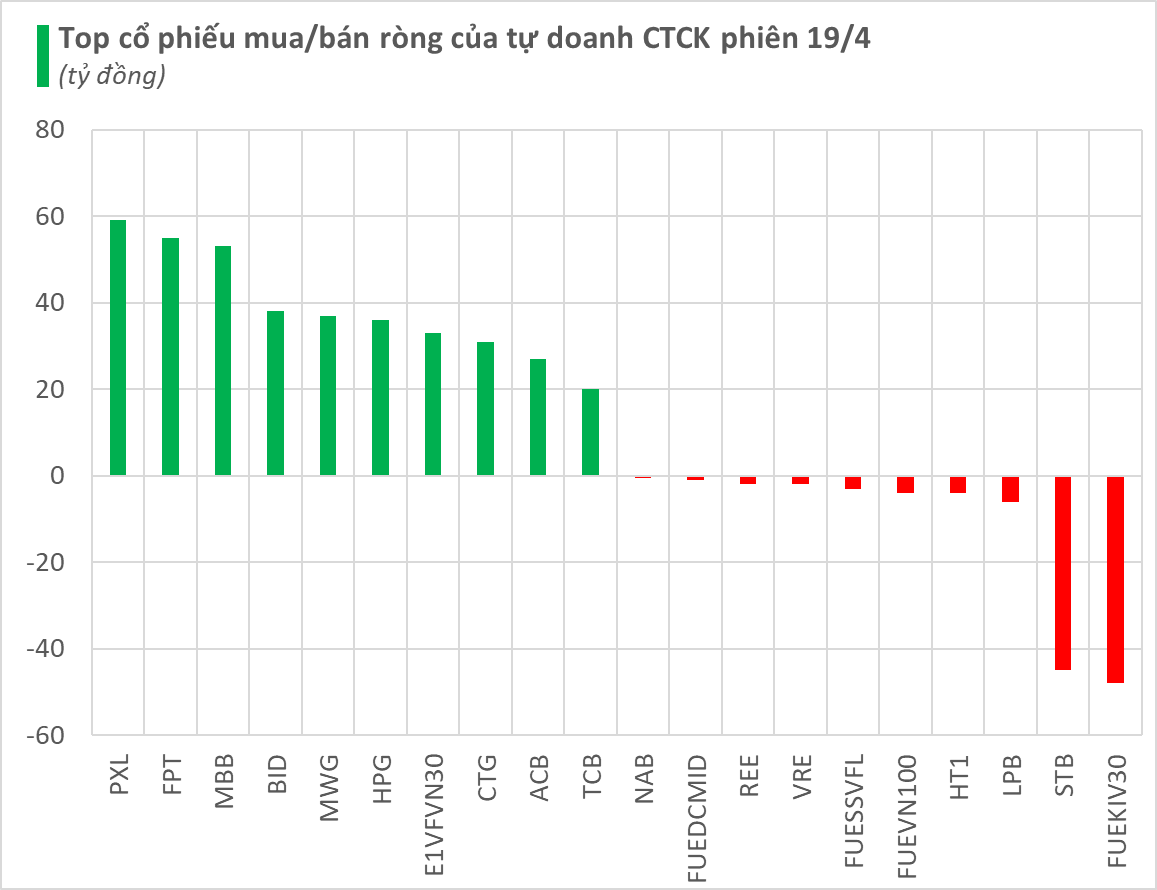

In that context, brokerage firms’ proprietary trading returned to net buying of VND697 billion on all three exchanges.

On the HoSE exchange, brokerage firms’ proprietary trading bought a net VND592 billion, of which VND527 billion was bought through the order-matching channel and VND65 billion more was bought through the negotiation channel.

Specifically, the group of brokerage firms that bought the most strongly at FPT with VND55 billion, MBB was also bought by VND53 billion. The two codes BID and MWG were respectively net bought for about VND38 billion and VND37 billion. Besides, codes such as HPG, E1VFVN30, CTG, ACB… were also bought net in the session on April 19.

Conversely, the transaction of brokerage firms sold the most strongly at FUEKIV30 fund certificate with VND48 billion, STB and LPB were also sold with VND45 billion, and VND6 billion, respectively at each code, followed by HT1 which was sold by VND4 billion. Other stocks that were net sold during the session today include codes such as FUEVN100, FUESSVFL, VRE, REE…

On the HNX, brokerage firms’ proprietary trading bought a net VND41 billion, of which more than VND17 billion was bought at PVS and VND14 billion at MBS. IDC was also bought by about VND10 billion.

On UPCoM, brokerage firms’ proprietary trading bought a net VND64 billion, of which the focus was on PXL when it was net bought by VND59 billion, followed by BSR and MCH being net bought by VND3 billion and VND1 billion, respectively.