Market Liquidity and Major Movers

Market liquidity improved compared to the previous trading session, with the trading volume of **VN-Index** reaching nearly 1 billion shares, equivalent to a value of over 24.3 trillion VND; **HNX-Index** reached over 127 million shares, equivalent to a value of nearly 2.7 trillion VND.

VN-Index opened the afternoon session in a state of indecision below the reference level until near the end of the session, after which selling pressure dominated, pushing the index down and closing near its lowest level of the day.

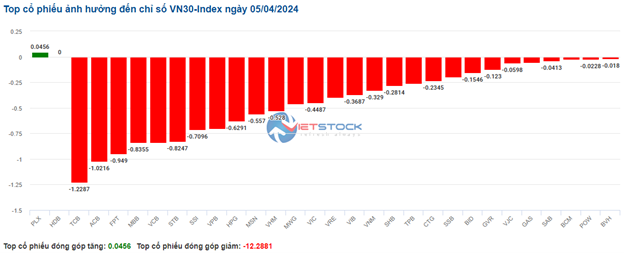

In terms of impact, **VCB**, **GVR**, **BID**, and **TCB** were the stocks with the most negative impact, taking over 4.8 points away from the index. On the other hand, **HVN**, **NVL**, **VPB**, and **MWG** were the stocks with the most positive impact on the **VN-Index** with an increase of nearly 1.4 points.

| Top stocks with the greatest impact on the **VN-Index** on April 05, 2024 |

The **HNX-Index** also experienced similar developments, in which the index was negatively impacted by stocks such as **TAR** (-7.32%), **DDG** (-6.52%), **L18** (-4.58%), and **NRC** (-3.85%), among others.

|

Source: VietstockFinance

|

The consulting and support services sector experienced the sharpest decline in the market with -5.25%, mainly due to **TV2** (-6.98%) and **KPF** (-5.82%). This was followed by the rubber products sector and the plastics and chemicals manufacturing sector, which declined by 4.41% and 3.51%, respectively.

On the other hand, the agriculture, forestry, and fishery sector was the industry with the strongest recovery, with 1.49%, mainly due to **HAG** (+1.98%) and **HNG** (+0.49%).

Regarding foreign transactions, foreign investors returned to net selling by nearly 44 billion VND on the **HOSE** floor, concentrated in **VHM** (218.68 billion), **PVD** (106.08 billion), **DIG** (43.37 billion) and **HCM** (42.83 billion). On the **HNX** floor, foreign investors net sold over 30 billion VND, concentrated in **SHS** (15.89 billion), **PVS** (13.08 billion), **CEO** (9.04 billion) and **IVS** (8.23 billion).

| Net buying/selling by foreign investors |

Morning Session: Mining Stocks Recover, Preventing Index from Deeper Decline

At the end of the morning session, the market had declined quite significantly, with the VN-Index一度 dropping nearly 15 points. However, the VN-Index narrowed its decline to close at 1,259.4 points (-8.85; -0.7%). The HNX-Index dropped 0.22 points (-0.09%) to close at 242.22 points.

Many large groups on the **HOSE** floor were in the red, dragging down the index. Among them, the large-cap stocks belonging to the **VN30** were the main reason for the negative market sentiment in the morning session. The indices of the two exchanges **HNX** and UPCoM also declined as a result.

The securities sector continued its negative trend. The entire sector declined by 1.38%, with 20 stocks losing value, 2 stocks remaining flat, and only 4 stocks gaining. This was the result recorded at the end of the morning session for the securities sector.

The mining sector was the market’s support today with a 2.14% increase, despite facing some pressure at times. There were 13 stocks that increased in value and 10 stocks that decreased in value. Due to the strong increase in the value of the stocks that gained, as well as the large weight of these stocks, the index for the entire sector increased. Notably, **PVS** (+3.26%), **PVD** (+1.79%), **TMB** (+6.96%), **PVC** (+8.33%), **PVB** (+5.47%), **TVD** (+1.38%), **NBC** (+2.14%), **TNT** (+6.72%), **HMR** (+10%), etc.

Foreign investors continued to net sell over 308 billion on the two exchanges during the market matching hours. **VHM** and **PVD** were the two stocks that were sold off heavily, accounting for a much larger proportion compared to the stocks below them, such as **DIG**, **SSI**, **GEX**, **HCM**, **MSN**, etc.

A fiery Friday, but fortunately the market did not decline further.

10:45: Selling Pressure Evident

Market sentiment is cautious, causing the benchmark indices to fluctuate below the reference level. As of 10:40, the VN-Index had declined by 11.23 points, trading around 1,257 points. The HNX-Index had declined by 1.22 points, trading around 241 points.

The breadth of the **VN30-Index** was dominated by a pessimistic red hue, with 28/30 stocks facing strong selling pressure. Among them, negative sentiment was concentrated in the four banking stocks **TCB**, **ACB**, **MBB**, and **VCB**, which took away 1.23 points, 1.02 points, 0.84 points, and 0.84 points from the general index, respectively. Only the stock **PLX** retained its green hue, contributing a paltry 0.05 points to the index.

Source: VietstockFinance

|

The real estate sector continued to face many “storms” as most stocks recorded negative values. Specifically, **VHM** decreased by 1.28%, **VIC** decreased by 0.73%, **VRE** decreased by 1.78%, and **BCM** decreased by 0.79%. Only less than 10 stocks remained in the green, and these were mainly stocks with market capitalizations that were not too large. As of 10:40, more than 1.631 billion VND had been poured into this industry group, and the matching volume exceeded 77 million units.

The banking and securities sectors also shared the same “fate,” with a significant decline in large-cap stocks such as