Market Outlook: Negative Sentiment Dampens Tuesday Trading

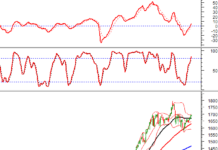

Market liquidity declined from the previous trading session, with the trading volume of the VN-Index reaching over 766 million shares, equivalent to a value of over 17 trillion VND. The HNX-Index recorded nearly 80 million shares, equivalent to a value of nearly 1.6 trillion VND.

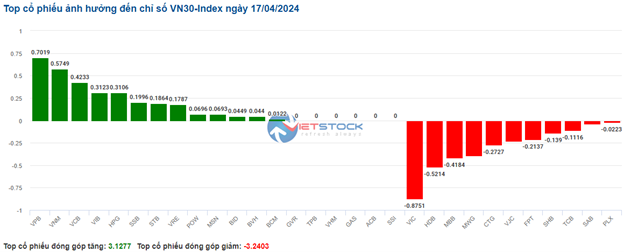

The VN-Index opened the afternoon session with investor pessimism, as the index remained in the red. Towards the end of the session, sellers dominated, causing the index to plummet and close at its lowest level of the day. In terms of influence, BID, CTG, GVR, and VIC were the stocks with the most negative impact, subtracting over 7.6 points from the index. Conversely, LPB, MSN, and GMD were the stocks with the most positive influence on the VN-Index, contributing over 0.8 points.

| Top Stocks Impacting the VN-Index on April 17, 2024 |

The HNX-Index also exhibited a similar trend, with the index negatively impacted by PVC (-6.58%), BVS (-6.32%), MBS (-5.26%), CEO (-4.04%), and others.

|

Source: VietstockFinance

|

At the close, red dominated most industry groups. The securities sector recorded the sharpest decline in the market with -3.98%, largely due to SSI (-2.27%), VND (-3.73%), VCI (-5.65%), and others. This was followed by the plastics and chemicals manufacturing sector and the mining sector with declines of 3.51% and 2.35%, respectively.

Conversely, the consulting and support services sector exhibited the strongest recovery with 0.43%, primarily driven by TV2 (+1.49%), TV4 (+2.22%), and TV3 (+4.17%).

In terms of foreign trading, foreign investors continued net selling nearly 1,047 billion VND on the HOSE, concentrated on VHM (140.8 billion), SHB (88.75 billion), MSN (67.4 billion), and VIC (66.01 billion). On the HNX, foreign investors sold a net of over 27 billion VND, focusing on TIG (9.97 billion), PVS (8.15 billion), SHS (7.8 billion), and MBS (5 billion).

| Foreign Trading Activity |

Morning Session: Sellers Prevail

The VN-Index retreated after oscillating above the reference point throughout the first half of the morning session. At the end of the morning session, the VN-Index closed at 1,211.6, a decrease of 4.08 points.

After failing to push the index above the 1,220-point mark in the first half of the morning session, buyers retreated to near the reference point. However, sellers were strong enough to turn the index negative, closing at 1,211 points.

Despite the intense struggle between buyers and sellers, liquidity on the HOSE today was only a little over 5 trillion VND, a very low proportion compared to recent sessions.

Among the stocks negatively affecting the market, VIC contributed the most with a decline of over 1 point. CTG was the second largest negatively influential stock on the market, followed by GVR, HDB, MBB, and others. In contrast, stocks such as VCB, MSN, VNM, and GMD continued to increase in value, providing support for the market.

The food and beverage sector was one of the most positive performers during the morning session. Leading stocks in the sector performed well, with VNM gaining 1.09% and MSN rising 1.66%. Conversely, SAB declined slightly by 0.98%.

OGC stock in the financial sector maintained its high growth, reaching its ceiling at the start of the session with a gain of 6.95%. In contrast, IPA and TVC stocks fell significantly, with declines of 2.84% and 1.19%, respectively.

On the foreign investor front, selling pressure continued to intensify, with net selling value at the end of the morning session exceeding 495 billion VND for the HOSE and net selling value for the HNX reaching over 22 billion VND.

10:40 AM: Cautious Trading Amidst Indecision

Investor indecision led to narrow fluctuations of the main indices around the reference point. As of 10:30 AM, the VN-Index had slightly decreased by 1.53 points, trading at around 1,214 points. The HNX-Index declined by 0.1 points, trading around 228 points.

Divergent trading resulted in mixed gains and losses across the VN30 index, with relatively balanced pressure. However, green dominated with notable stocks such as VPB down 0.7 points, VNM down 0.57 points, VCB down 0.42 points, and VIB down 0.31 points. On the other hand, VIC, HDB, MBB, and MWG continued to face strong selling pressure, subtracting over 1 point from the index.

Source: VietstockFinance

|

In line with this trend, the breadth of industry groups exhibited significant variation, with 12 out of 25 industry groups gaining points. The banking sector, with stocks such as VCB, BID, VPB, and ACB, maintained green but with gains below 1%.

Additionally, red was still visible in stocks like MBB, HDB, and SHB, although declines were not significant. However, CTG is notable with a drop of 1.32% after announcing that VietinBank plans to issue stock dividends and that the bank has not set a specific pre-tax profit target for 2024 but will comply with approvals from relevant government agencies.

On the other hand, the real estate sector was a notable drag on the overall market, with declining stocks including VHM (-0.82%), VIC (-2.26%), KDH (-0.73%), and PDR (-1.89%). Conversely, stocks maintaining green included BCM, VRE, and NVL, but gains did not exceed 1%.

Compared to the start of the morning session, the market breadth continued to be dominated by flat stocks, with over 960 stocks. Additionally, the number of stocks in green still outnumbered those in red, with 326 (including