Market liquidity remains stagnant compared to earlier sessions. The matched trading volume of the VN-Index exceeded 633 million shares, equivalent to a value of over VND 15,000 billion; the HNX-Index reached nearly 57 million shares, equivalent to a value of over VND 1.2 billion.

The VN-Index entered the afternoon session on a rather negative note, with selling pressure emerging from the outset, dragging the index into the red and closing near its daily low. In terms of impact, BID, CTG, and GVR were the most detrimental stocks, shaving off nearly 2.4 points from the index. Conversely, VHM, VIC, and HVN positively influenced the VN-Index the most, contributing approximately 2.2 points to its rise.

The stock market reacted negatively to the recent surge in gold prices, as this factor exerts pressure on interest rates. In the past two months, the international gold price has climbed by nearly 19%, repeatedly setting new record highs.

| Top 10 stocks impacting the VN-Index on April 10, 2024 |

The HNX-Index followed a similar trend, with the index negatively impacted by stocks such as DDG (-5.13%), PVC (-3.66%), NDN (-2.65%), and PLC (-2.43%), among others.

|

Source: VietstockFinance

|

The mining sector witnessed the sharpest decline in the market, dropping by 2.41%, primarily driven by PVS (-2.12%), PVD (-4.22%), and KSB (-1.59%). This was followed by the electrical equipment and rubber products sectors, with declines of 2.04% and 1.59%, respectively. On the contrary, the consulting and support services sector exhibited the most significant recovery, surging by 2.44%, mainly due to gains in TV2 (+3.58%) and KPF (+0.88%).

Regarding foreign transactions, foreign investors turned net sellers, offloading over VND 660 billion on the HOSE exchange, focusing on VHM (VND 210.68 billion), NVL (VND 167.86 billion), VNM (VND 65.22 billion), and PVD (VND 62.45 billion). On the HNX exchange, foreign investors bought a net value of over VND 1 billion, primarily investing in DTD (VND 6.83 billion), PVS (VND 5.31 billion), and PVI (VND 3.31 billion).

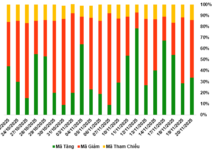

| Foreign Trading Activity |

Morning Session: The market fluctuates throughout the morning session, with the uptrend narrowing

The VN-Index ended the morning session with a modest gain of 1.51 points, closing at 1,264.33 points. The increase narrowed compared to the beginning of the morning session. Moreover, there are signs of weakening cash flow, indicating investor caution.

Numerous major banking stocks led the index higher today. VPB, TCB, SHB, STB, MBB, and ACB were notable stocks among the top 10 VN30 stocks that positively influenced the index.

Securities stocks continued to decline in the morning session. The industry’s overall index fell by almost 1%, with 18 out of 26 stocks in the group losing value. Major stocks such as SSI, VND, VCI, HCM, and SHS all turned red, dragging the overall index down.

The divergence affected the construction and healthcare sectors. Nevertheless, buyers remained dominant, helping both sectors maintain their green status.

The stock MWG experienced a slight decline of 1% at the end of the morning session, following a significant rise yesterday after the announcement of CDH Investments acquiring a 5% stake in Bach Hoa Xanh. Despite this transaction, MWG will retain its position as the controlling shareholder of BHX Investments, with CDH Investments and the company’s management team participating as well.

Sector performance by the end of the morning session on April 10. Source: VietstockFinance

|

At the close of the morning session, red prevailed when looking at the overall industry. Major industry groups such as retail, plastic chemicals, rubber products, electrical equipment, etc., delved further into the red. Conversely, industry groups such as consulting and support services, information technology, real estate, and seafood remained in positive territory, indicating that investors are focusing on these sectors.

10:40 AM: Indecisiveness persists

Although the market has shed its pessimistic sentiment from previous bearish sessions, investors remain hesitant, causing the key indices to hover around the reference point. As of 10:30 AM, the VN-Index had gained a modest 2.94 points, trading around 1,265 points. The HNX-Index rose by 0.14 points, trading around 240 points.