SERVICES

Specifically, new customers opening SHB Visa Platinum/ SHB Visa Platinum Star cards with a cumulative spending turnover of at least VND 8 million within 45 days from the date of card issuance will receive a refund of VND 1,000,000. Customers with a cumulative spending of VND 5 million to 8 million will receive a refund of VND 500,000.

In addition, cardholders will receive an additional 5% refund (maximum VND 600,000) for transactions of VND 500,000/billing cycle at stores registered with the POS code for the culinary sector on weekends (Saturday and Sunday) such as Golden Gate, King BBQ, Thai Express…

Various cashback offers await customers spending with SHB international credit cards

|

Similarly, for the SHB Mastercard Cashback/ SHB – FCB Mastercard credit card line, new customers spending VND 5 million or more will receive a refund of VND 500,000, while those spending VND 3 million to 5 million will receive a refund of VND 300,000.

SHB also provides a refund of VND 300,000 for customers with a total spending turnover of at least VND 5 million/billing cycle on weekends. This offer applies depending on the spending category of each card, such as SHB Mastercard Cashback for the supermarket sector and SHB – FCB Mastercard for fashion, sports, and online payments.

Notably, SHB will refund up to VND 3 million for cardholders with the highest installment turnover in the entire program (total installment turnover of VND 50 million/program) as well as offer 0% interest-free installment payment for a term of 3 months and a 20% reduction in installment fees for terms of 6 months and 12 months at all payment locations.

Mr. Dang Cong Hoan – Director of the SHB Retail Banking Group said that, given the increasingly popular trend of cashless payment, SHB international credit cards are a suitable choice for customers who need to be proactive and flexible in their spending and shopping, while also wanting to save costs effectively. All thanks to the policy of accumulating points to exchange for gifts, cashback on purchases, and a wide range of “free” services such as: No card issuance fee, no annual fee for the first year, no installment conversion fee….

“We want customers to make the most of the offers of the “powerful” cards they own in each program, so that they can not only spend freely but also receive attractive cashback rewards“, emphasized Mr. Dang Cong Hoan.

SHB international credit cards are increasingly chosen by customers

|

In recent times, SHB international credit cards have been outstanding products with many attractive utilities and offers. Depending on the type of card, customers will enjoy exclusive privileges such as: Airport business lounges, global travel insurance, high-end resort – dining – spa vouchers,… Customers also enjoy interest-free periods of up to 55 days; quick card opening process; contactless payment….

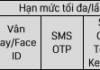

In addition, SHB credit cards apply the most advanced security technologies to help customers easily manage their cards anytime, anywhere through the Electronic Banking application. This allows cardholders to proactively lock their cards in case of emergencies and quickly redeem reward points right on their mobile phones with just 30 seconds of manipulation without having to contact the call center or go directly to the transaction points. In the future, SHB will continue to expand and develop new card lines that integrate modern technology, specialized offers, bring convenience and enhance the experience for each customer segment, contributing to promoting cashless payment and universal financial inclusion, towards the Government’s goal of a cashless society.